IDC’s converged systems tracker for Q1 2020 shows resilient demand despite the early effects of the pandemic.

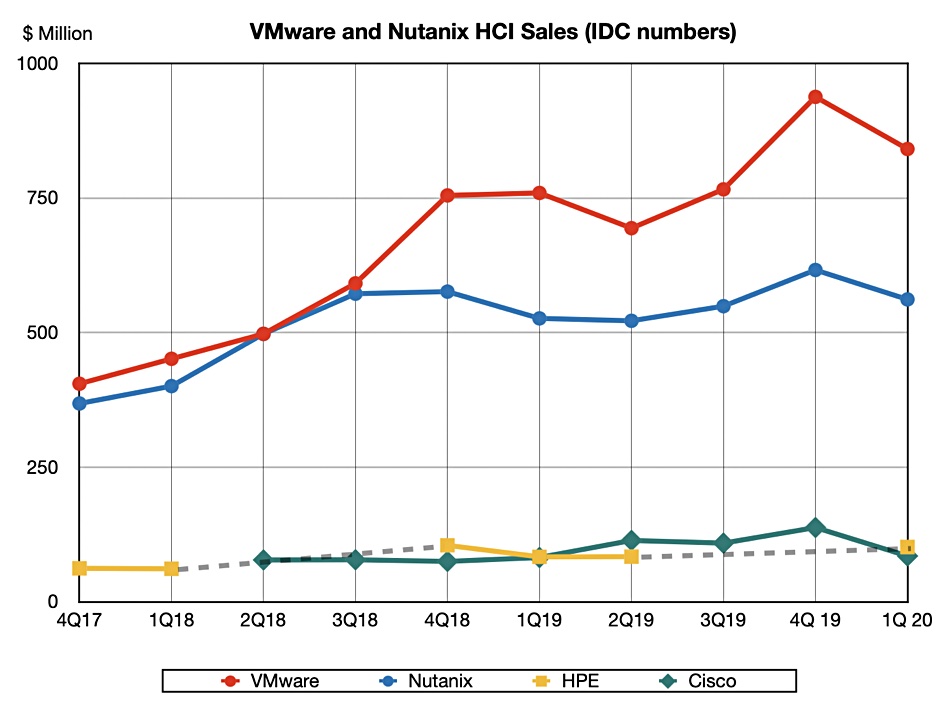

The status quo remained the status quo, with VMware leading Nutanix, and HP and Cisco duking it out a long way behind.

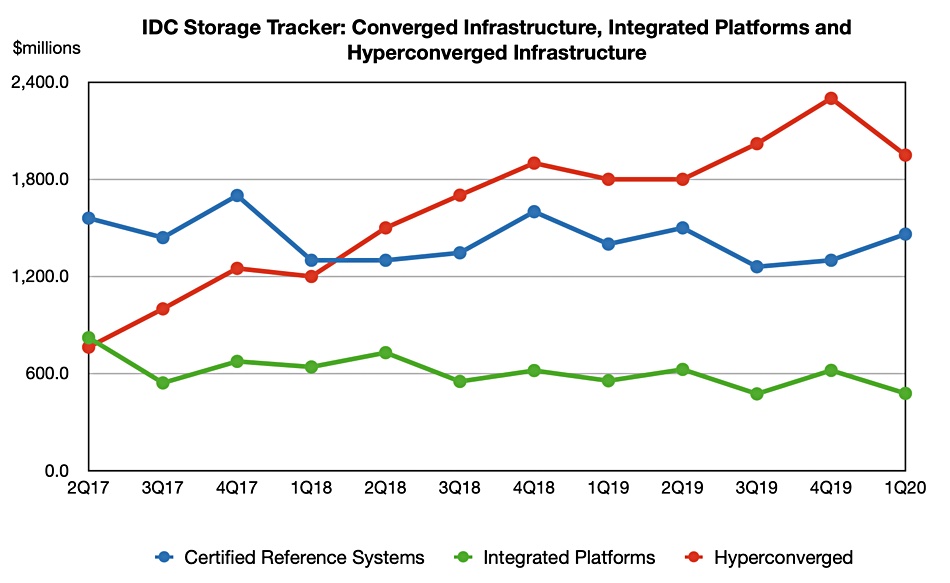

The market segment revenue splits were:

- HCI – $1.95bn revenues, 8.3 per cent growth Y/Y, 50.9 per cent revenue market share

- Certified Reference Systems & Integrated Infrastructure – $1.46bn revenues, 4.4 per cent growth, 36.8 per cent market share

- Integrated Platforms – $478m, -8.7 per cent decline, 12.3 per cent share.

Sebastian Lagana, IDC research manager, said in a statement: “While the hyperconverged system market continued to expand as enterprises seek to take advantage of software-defined infrastructure, the Certified Reference Systems and Integrated Infrastructure segment posted its best quarter of growth since 2Q19 on the strength of richly configured platform sales related to demanding workloads in industries such as healthcare and telecoms.”

Let’s look at the trends with this chart of the converged systems market.

The Certified Reference Systems boost is accompanied by an HCI drop but this is only a quarter-on-quarter change and may not be significant.

A closer look at the top three HCI vendors reveals a quarter-on-quarter revenue drop by the two leaders and also by Cisco. HPE’s Q/Q change is unclear because IDC is not revealing all its numbers as HPE weaves in and out of a top three spot where it ties for third place with Cisco.

We have charted the revenues of these suppliers over the past few quarters using revenue attributed to the owner of the HCI software rather than IDC’s measure of revenue by HCI brand.

Basically, apart from the first 2020 quarter pandemic hit causing revenues to fall, there’s little or no change in the vendors’ relative positions. (Revenues from other contenders such as those from Pivot3 and Scale Computing, are too low to show in IDC’s public tables.)

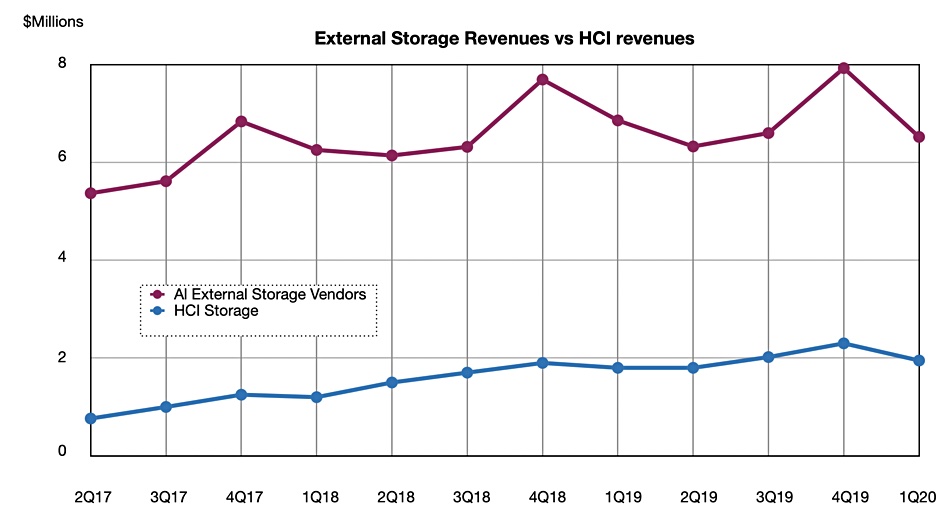

Let’s check if HCI is taking more revenue from the overall external storage market. The Q1 IDC numbers for both storage categories are:

- HCI – $1.95bn revenue; 8.3 per cent change Y/Y.

- External storage – $6.52bn revenue, -8.2 per cent change Y/Y.

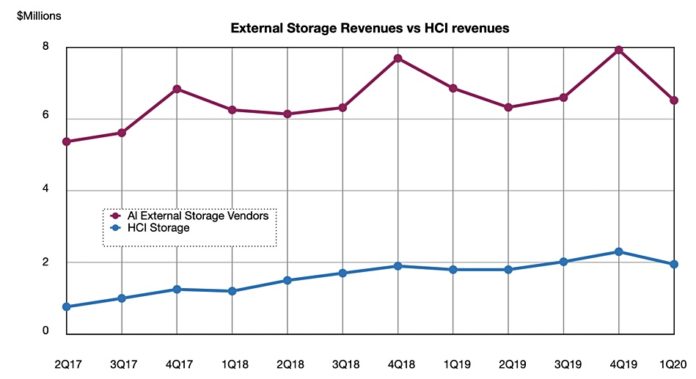

Charting the trends to see the longer term picture shows a pretty consistent gap between the two.

External storage sales are much more seasonal than HCI sales. Note the Q4 peaks on external storage sales, but there is no general sign yet of HCI sales eating into external storage sales.