Seagate thinks it will gain a HAMR-based competitive advantage over Western Digital – because its arch-rival is delaying a move to the HDD technology. It also thinks Toshiba will lose out on sales because it lacks in-house HAMR drive manufacturing.

Given Seagate’s roadmap, evidence of any such competitive advantage could emerge in 2022.

Disk drives using conventional magnetic storage technologies are approaching capacity limits. HAMR (heat-assisted magnetic recording) enables much higher disk drive capacities by using smaller recording bits. However, the disk drive makers have had to overcome many technological development barriers to get HAMR disks into production.

Microwave-assisted magnetic recording (MAMR) is an alternative method to push up disk drive capacity. The disk drive makers are able to do this with relatively incremental advances but capacities are lower than can be achieved by HAMR. Accordingly, MAMR may be considered as a intervening magnetic storage technology

Seagate CFO Gianluca Romano pointed to WD’s emphasis on MAMR, in a recent conference call hosted by Wells Fargo. He thinks this could result in one to two years of lost HAMR development time for WD, giving Seagate potential advantages in cost per TB and areal density.

WD told Blocks & Files in December that it probably will move to HAMR as it increases capacity per drive beyond 24TB. (Read our article discussing WD’s disk drive roadmap.)

A glimpse of Seagate roadmap

Rakers told his subscribers that Romano expressed confidence in its HAMR positioning and also in demand for public cloud-driven nearline, high-capacity HDDs.

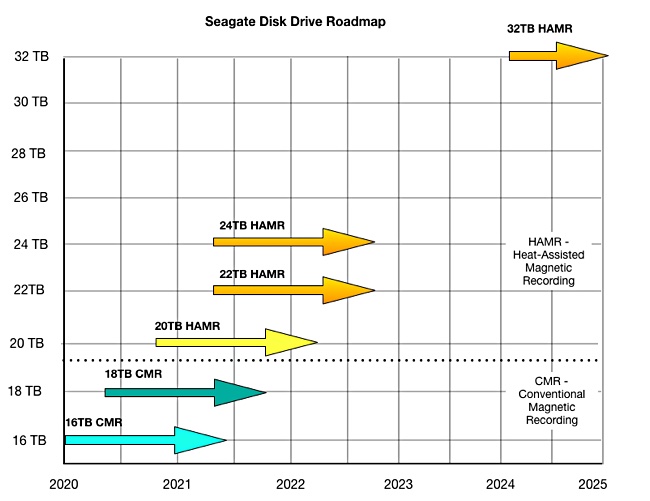

During the conference call, Romano discussed Seagate’s near-term HDD roadmap and said the current 16TB conventional magnetic recording (CMR) drive is selling well. An 18TB CMR drive released by mid-2020 is the next step up the capacity ladder, and this drive will use 9 platters and 18 heads, in common with the 16TB HDD.

The qualification period for the 18TB drive means Seagate’s 16B model will be its most popular drive in 2020. Rakers notes that WD expects revenue this quarter from its recently announced 16TB/18TB CMR-based and 20TB SMR-based drives. (SMR, or shingled magnetic recording to give it its full name, gets more read tracks on a drive by partially overlapping the write tracks, leaving the narrower read tracks unaffected.)

At this point in Seagate’s roadmap there is a transition to HAMR tech, with a 20TB HAMR drive released before the end of 2020 and revenue also anticipated by the end of the year. This is expected to be a non-shingled drive and will also use 9 platter and 18 heads.

Next up are 22TB and 24TB capacities, using a second generation HAMR technology. The schedule outlined by Romano has enabled Blocks & Files to craft a Seagate HDD roadmap chart.

HAMR time

We have positioned Seagate’s 22TB-24TB drives on the above chart about six months after the 20TB HAMR drive, because Romano said Seagate will focus on transitioning quickly to the 2nd-generation as a more cost-optimised platform at those capacities. In our view, ‘quickly’ means less than a year.

The 32TB HAMR drive positioning is derived from a Seagate cost-reduction chart shown below. We envisage 26TB, 28TB and 30TB drives will be on Seagate’s roadmap in 2022-202 .

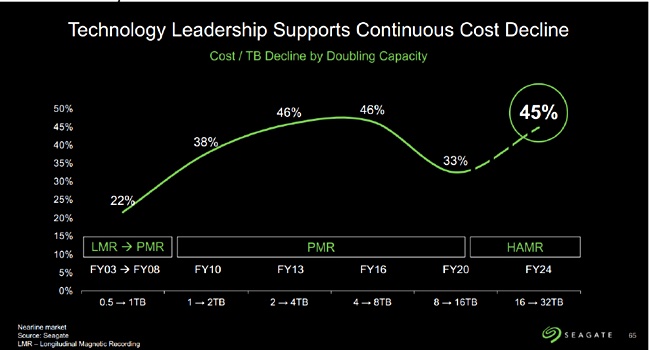

The second-generation HAMR drives will still use 18 heads and 9 platters, meaning an effective lowering of the cost per TB. Seagate provided a chart to show this:

This shows 32TB HAMR tech drives with a 45 per cent cost advantage over 16TB CMR drives, in Seagate’s fiscal 2024.