Disk drive maker Seagate has announced flat revenues and lower profits in its second fiscal 2020 quarter ended 3 January 2020, but as a bright spot, 3.5-inch drives accounted for about half of its revenues.

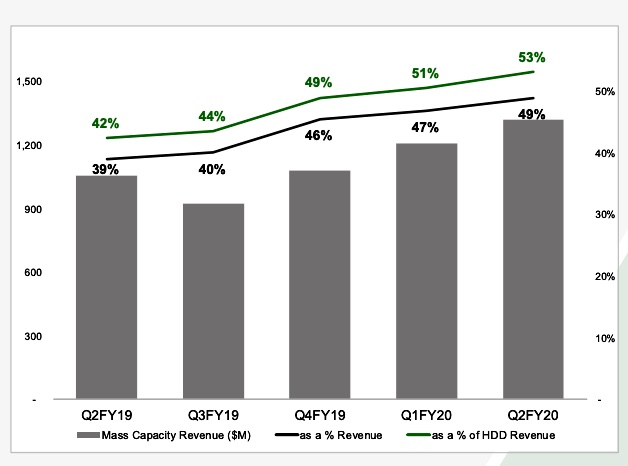

CFO Gianluca Romano told an earnings call: “Mass capacity storage which include nearline, video and image application and NAS drives represented 49 per cent of total December quarter revenue, up from 47 per cent in the prior quarter and 39 per cent in the prior year.”

Competitor Western Digital also reported anaemic revenues for the quarter.

Seagate’s revenues of $2.696bn were a sliver down on the year-ago $2.715bn while $318m net income fell 17.2 per cent. The company did not quite meet consensus analyst estimates of $2.72bn revenues but adjusted profit was $1.35 a share, beating the consensus $1.31 estimate.

It posted $480m cash flow from operations; it was $288m a year ago. Free cash flow a year ago was $161m; it’s now $286m.

CEO Dave Mosley said in a canned quote: “Seagate expanded non-GAAP operating margin by nearly 300 basis points and delivered non-GAAP EOS growth of more than 30 per cent Q-on-Q while driving strong operational cash flow in an improving demand environment.” He said Seagate had executed the company’s fastest-ever product ramp with its 16TB drive.

Western Digital is poised to deliver 18 and 20TB drives. Both companies will soon discover where the market’s sweet spot lies – either at the 16TB point (in Seagate’s favour) or higher capacity (with WD winning).

Seagate shipped 106.9EB of capacity overall, averaging 3.3TB/drive. A year ago it delivered 87.4EB with a 2.4TB/drive average.

The company has changed its reporting to focus on mass capacity 3.5-inch and legacy 2.5-inch drives. It no longer providing segment revenue numbers for enterprise mission-critical, nearline, edge non-compute, edge compute, edge/client CE, consumer and desktop notebook category drives. So comparison on these counts with prior quarters comes to an end.

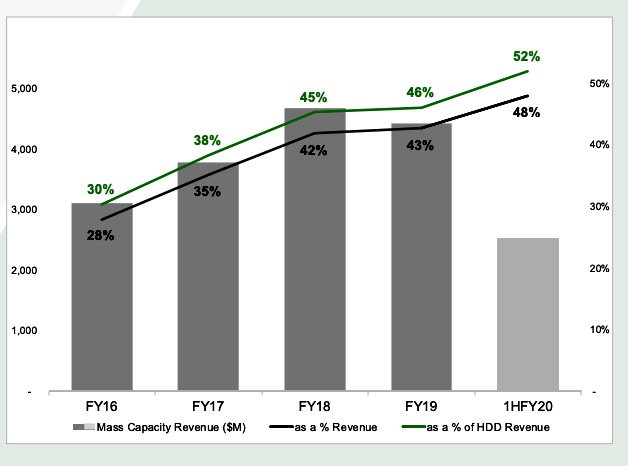

It is instead providing mass capacity drive growth trends by quarter and by year:

This way all the lines go up, whereas with the previous segmentation, many lines went down, as 2.5-inch drives were cannibalised by SSDs.

Seagate’s next quarter outlook is for revenues of $2.7bn plus or minus 7 per cent. At the mid-point that represents 16.7 per cent growth y-o-y.

Mosley said the company is “poised to benefit from ongoing demand for mass capacity storage which we expect to offset typical seasonal declines in the legacy (2.5-inch) markets in the first half of the calendar year.”