Western Digital reported flat results for its second fiscal quarter ended January 3, 2020 today, with a small uptick in data centre segment and a large dip in flash sales.

Revenues were $4.234bn, compared to $4.233bn 12 months previously, and it reported a loss of $139m, down from a $487m loss a year ago.

CEO Steve Milligan said: “The December quarter results reflect strong execution in our product roadmap, success in increasing our hard drive gross margin, and an improving flash market. We expect an accelerated recovery in our flash gross margins, which coupled with ongoing strength in demand for both hard drives and flash, positions us well for continued profitable growth in calendar year 2020.”

WD generated $257m cash from operations, and ended the quarter with $3.1bn of total cash and cash equivalents. Free cash flow was $97m, compared to the $21m reported a year ago.

Its three component businesses reported revenues of:

- Data Centre Devices and Solutions – $1.49bn compared to $1.07bn a year ago,

- Client Solutions – $948m compared to $945m a year ago,

- Client Devices – $1.8bn compared to $2.2bn 12 months prior.

Disk

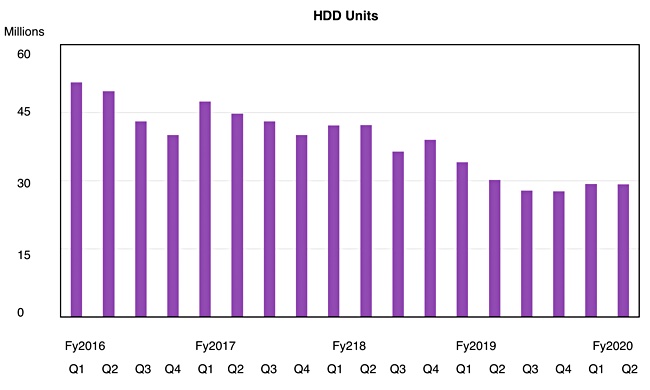

WD shipped 29.2 million disk drives, slightly less than the year-ago 30.2 million, but disk revenues of $2.4bn were higher than the $2.1bn recorded. That’s because HDD capacity shipped at about 119EB was up 56 per cent y/y.

A chart shows a levelling out after a prolonged disk drive unit ship reduction trend:

Enterprises and hyperscalers want more and more enterprise capacity drives; that’s where the unit ship growth is to be found.

Flash

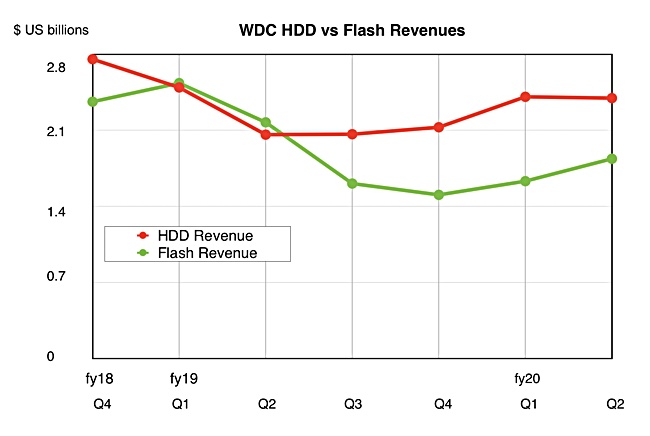

Flash revenues of $1.4bn were well down on last year’s $2.2bn; that’s due to lowered NAND prices from a supply glut which is now winding down. COO Mike Cordano said: “Inventory in the flash supply chain has returned to normal levels.”

Milligan said: “Demand is going to exceed supply this year. … Prices are improving. Right now that tightness is it’s kind of in pockets. It’s not necessarily across the board. So we’re seeing pockets of tightness in the market and as we move through the balance of the year, we expect that that tightness will increase.“

Both points indicate an end to the NAND glut.

Back to the flash revenue decline. CFO Bob Eulau pointed out: “On a sequential basis growth in enterprise SSD was offset by a decline in capacity enterprise drive and the impact of our exit from the storage-system business.”

NVMe SSD revenue rose more than 50 per cent quarter on quarter, as hyperscalers and OEMs adopted the products.

Aaron Rakers, a senior Wells Fargo analyst, told his subscribers that WD expects to see a 2x increase in its enterprise SSD revenue in calendar 2020, with a 20 per cent market share position target.

WD expects an accelerated recovery in its flash gross margins in the fist half of 2020 with more improvement in the second half.

Comparing HDD and SSD revenues in a chart shows a slight trend for flash to be catching up with spinning rust:

COO Mike Cordano said: “Starting in the June quarter, we expect to begin shipments into a new gaming platform. The gaming console market is expected to be a multi-exabyte opportunity this calendar year.”

We think this refers to Sony’s PlayStation 5 and WD could see a flash revenue bump if gamers take to Sony’s new console.

WD’s outlook for the next quarter is for revenues between $4.1bn and $4.3bn. At the $4.2bn mid-point that represents 14.3 per cent annual growth.