A look at storage systems’ progress in IBM’s third quarter shows continuing long-term decline but expect a mainframe-led pickup next quarter.

IBM’s overall results were examined by our sister publication The Register. We look at the storage side in more detail here.

Storage is part of IBM’s Systems segment which produced revenues of $1.5bn. Hardware revenues fell 16 per cent to $1.1bn, as the z14 sales cycle ended and the new generation z15 cycle starts. IBM Z revenue was down 20 per cent and. Power server system revenues fell 27 per cent, while storage revenues declined 4 per cent to $433.7m.

IBM CFO Jim Kavanaugh said in prepared remarks: “This is an improvement in the year-to-year performance compared to recent quarters, driven by our high-end and growth in all-flash arrays.”

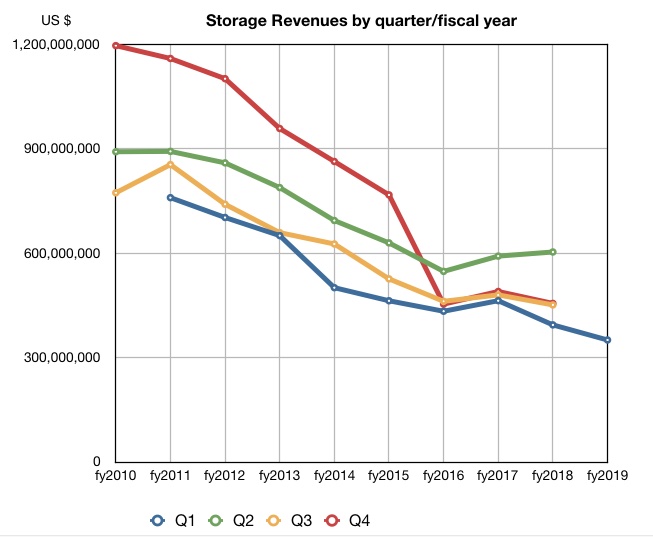

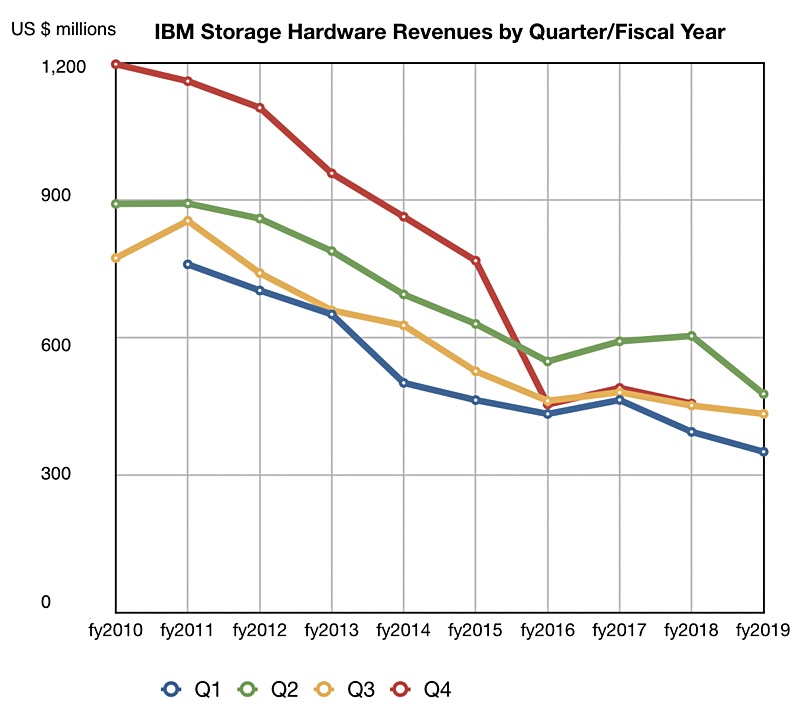

We have charted IBM’s storage quarterly hardware revenues by fiscal year to show a pronounced pattern of declining revenues;

Each quarter has its own line and colour so we can see how the results have trended since fiscal 2010. Fiscal 2017 was a growth year, and fiscal 2018’s first quarter showed y-on-y growth, but all other fiscal years show consistent quarterly revenue declines.

For comparison:

- Dell EMC net storage revenues were $4.2bn in its latest quarter

- NetApp recorded $1.2bn in its latest quarter

- HPE reported $844m

- Pure’s last quarter saw $396.3 revenues and is guiding $440m for the current quarter.

Big Blue is not so big now.

NetApp and, to an extent, HPE, saw an enterprise buying slowdown in their latest results. They attributed the fall to concerns about trade wars and the macroeconomic situation. And IBM’s revenue decline? Kavanaugh answered this question in the earnings call, saying: “I would not say per se this is a macro related thing.”

The high-end DS8900 was announced in the quarter and sales should be boosted next quarter as z15 sales attract attached DS8900 storage in their wake.

Kavanaugh more or less said outright that new storage arrays were coming: “Pre-tax profit was down, reflecting mix headwinds and the investments we’re making to bring new [sic] hardware innovation to market.”

With the high-end already refreshed Blocks & Files expects new mid-range arrays in the Storwize and FlashSystem 900 lines.

IBM’s fourth quarter is traditionally its strongest, and this one will coincide with the first full quarter of z15 and DS8900 availability. Expect a bumper close to the year and an uplift in storage revenues as the DS8900 orders roll in.