Michael Dell is the king of US computer hardware-based system companies, brushing past Cisco, HPE, IBM and everyone else to assume the throne. But what next for his eponymous company?

It’s approaching $100bn in annual revenues. Does it want to become a $150bn business and how might it accomplish this?

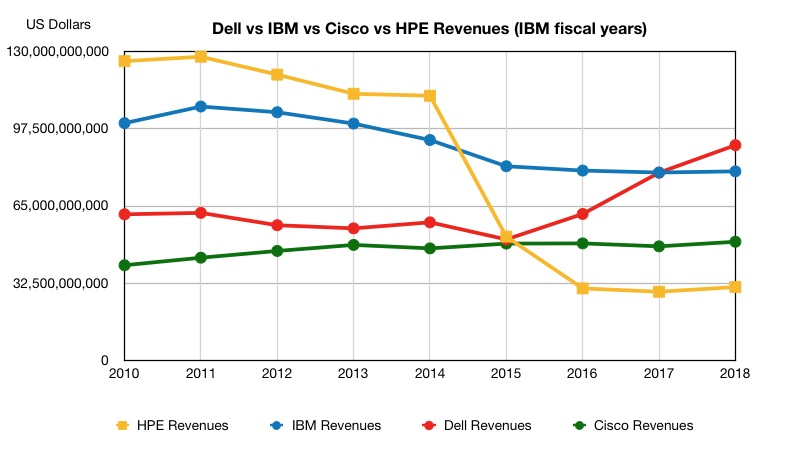

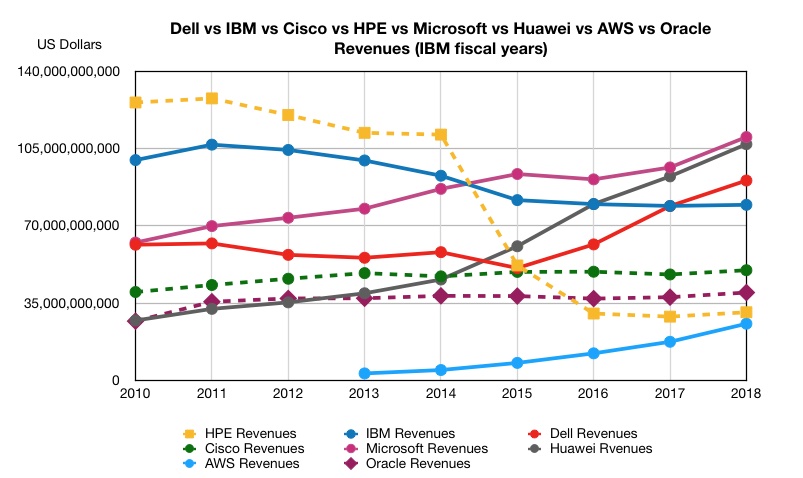

Let’s start the conversation with this chart.

It shows annual revenues for Cisco, Dell, HPE and IBM, using IBM financial years, starting from 2010, when HPE ruled the IT markets, with IBM in second place. But HPE choked on its own structure and decided commodity hardware, namely PCs and printers, were not its thing and divested them into a separate company in November 2015.

At a stroke revenues fell below its three great rivals and HPE is still trying to recover its mojo.

Cisco grew steadily until the end of 2015 when it looked poised to overtake a declining Dell. But then it had a wobble and started level-pegging as the Chambers era came to a close. His replacement Chuck Robbins is re-igniting growth but in revenue terms Cisco is way below Dell’s league.

And IBM. Oh dear. A $98bn revenue company has become an $80bn company due to many mis-steps, including a failure to capitalise on commodity hardware.

Dell though has grown and grown. It is now at $91bn and climbing, with $100bn revenues in its sights. Founder Michael Dell still holds the reins and masterminded Dell’s path to the top of the heap by embracing hardware commoditisation, and buying EMC for $67bn, with its VMware crown jewels.

The company also went through a public-to-private and back to public ownership in a financial engineering sequence, starting with going private in 2013 and returning to public ownership in December 2018.

All this has enabled it to overtake the declining Big Blue, surpass HPE and leave Cisco behind.

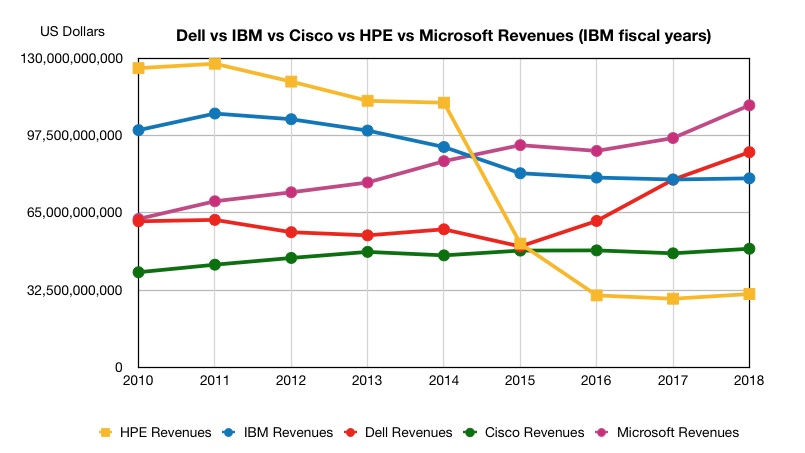

Bigger IT companies include Microsoft, Huawei, and Amazon and Google in overall terms. Let’s add Microsoft revenues to the chart and see how they stack up.

As you can see, it is bigger than Dell. For Microsoft, 2015 was a crossover revenue year in which it surpassed falling HPE and shrinking Big Blue. The Windows and server system software company has become a $100bn plus turnover business after Satya Nadella restructured it following the end of Steve Ballmer’s run as CEO in 2014. It entered the public cloud with Azure, gaining revenues as it built up its Office 365 business.

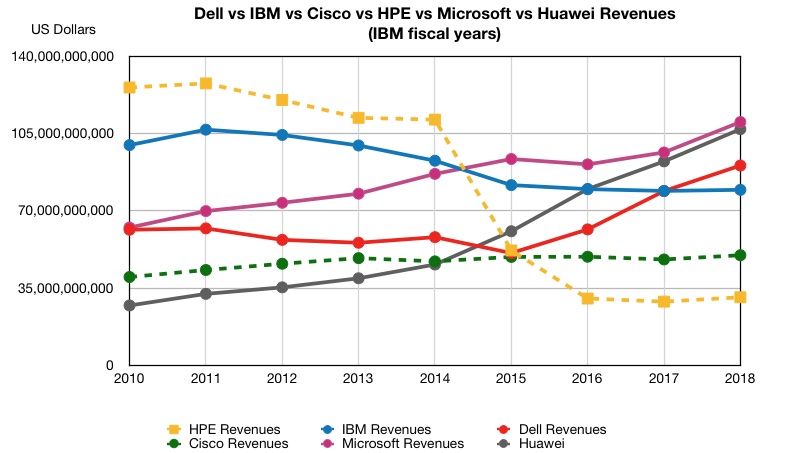

Let’s add Huawei to see how the picture changes.

Huawei overtook Dell in revenue terms in 2014. It has grown faster than Microsoft, although not passing it, to become a $100bn plus revenue business, despite problems with the US and recent security concerns.

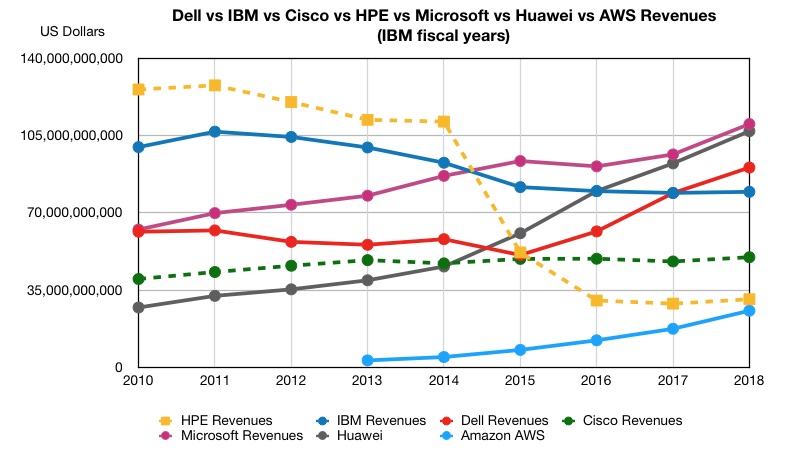

Dell, Microsoft and Huawei form a triumvirate, leaving old US hardware system-based IT companies behind. Now, let’s add the AWS part of Amazon to the chart:

AWS is a $26bn revenue business on its own. Amazon in total of course is much bigger but the AWS component is the appropriate comparison with Dell.

Similarly with Google, which is looking to become a $150bn-plus revenue company overall. GCP, its Cloud Platform, is what we would compare with Dell’s revenues and that is not split out from the overall Google number.

Google said it was a $4 bn run rate business at the end of 2017, which would place it well below AWS and also Azure.

These growth curves on the chart represent the new IT, with the old IT behemoths shrinking or lost with no place to go: HPE, IBM, Cisco, Oracle – yesterday’s IT giants becoming today’s also-rans. Yes, they are multi-billion turnover companies but they are not growing at anything like the rate of Dell, Microsoft and Huawei which are each two to three times their size in revenue terms.

At Oracle, which is paralleling Cisco at the $30bn – 40bn/year level, founder Larry Ellison is now CTOing the ship and annual revenues have been stuck at $35bn-$40bn since 2011.

The only old school, hardware system-based supplier with growth fuel left in its tanks, according to these charts, is Dell. Cisco could buy Ericsson or HPE buy Arista or Juniper to bump up their revenues to a higher level, but neither has shown an ability or inclination to make acquisitions at the level of a Dell-EMC.

But all we have looked at is the annual revenue number so far. What about profit and market capitalisation?

Profit and Market Capitalisation

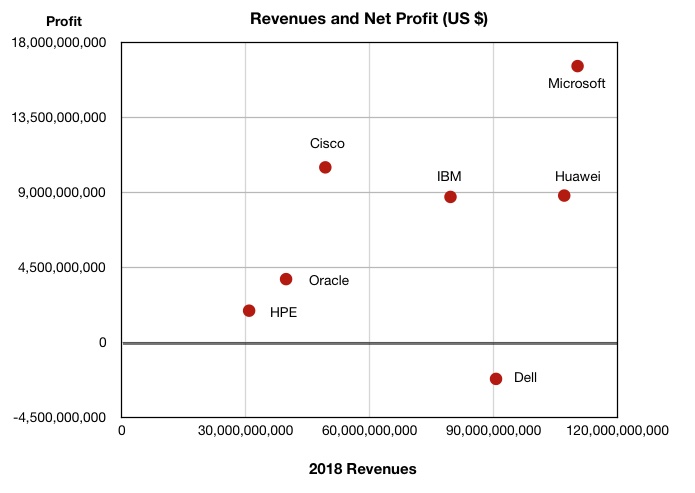

As we’re chart happy we’ll continue, and chart revenues versus net income for Cisco, Dell, HPE, Huawei, IBM, Oracle and Microsoft for the 2018 year:

Dell is in bottom place as its paying off debt from the EMC acquisition and recording losses. HPE has the lowest profit/revenue combination and there is a rough correlation (lower left to upper right diagonal) between increased revenues and higher profit numbers.

Cisco makes more profit from a dollar of revenue than the other suppliers, while Huawei makes less. Microsoft stands tall as the joint revenue and profit king.

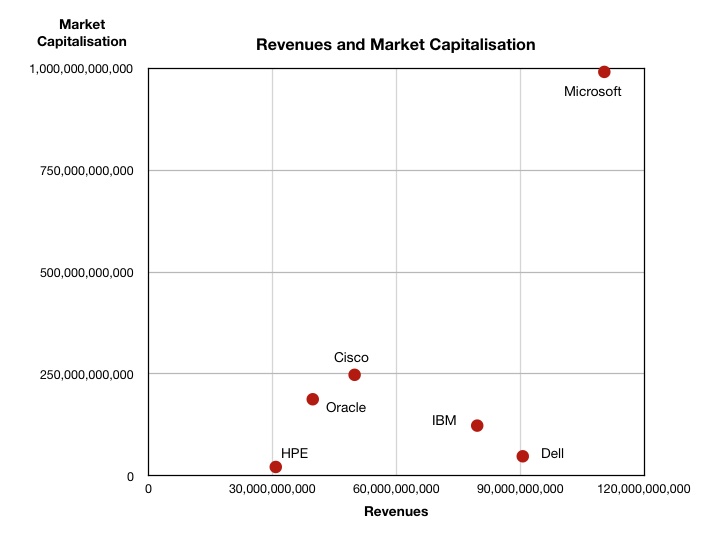

Are these profit-revenue relationships correlated with the companies’ market capitalisation?

If we assume that the natural order of things should be that companies with greater revenues and profits have a higher market capitalisation, then suppliers should be clustered around the lower left to upper right diagonal .

HPE, Oracle, Cisco and Microsoft are roughly in that position and in that order. Outside this group, IBM has a lower market capitalisation than its revenues and profitability on their own would suggest.

Dell is capitalised at a lower value than IBM, despite higher revenues, and has a higher market capitalisation than HPE, even though it makes losses.

Microsoft’s market capitalisation is very much higher than the other suppliers.

We can generally assume that, the higher a company’s profits and market capitalisation are, the better position it is in should it want to make significant acquisitions as a way of growing its business.

What’s next for Dell?

Looking at these charts gets Blocks & Files wondering what is next for Dell? Does it want to become a $150bn company? Or will it run out of steam?

Is Michael Dell, sitting there in Round Rock, content with what he’s got? Surely not. He’s not reached 55: the man is in his prime.

We think three dominating trends in IT are affecting Dell.

First, the public cloud has strong growth potential as do SaaS companies like SalesForce, Workday, ServiceNow, Splunk and Atlassian. The three main public cloud suppliers are increasing revenues at a fast clip.

Secondly, the Internet of Things will vastly increase the number of intelligent devices and the data they produce will need processing.

We see the rise of AI and machine learning as part of the IoT and public cloud. It’s not a dominating trend on its own.

Thirdly, China represents a huge market and also a whole bunch of relatively new world-stage companies such as Huawei and Alibaba. No US IT supplier is making it big in China. For Dell to think its next growth surge could come from China is unlikely.

But Dell should be able to organically grow into being an IoT supplier. However, is that enough? Does that represent a route to becoming a $150 billion company?

Can Michael Dell, will Michael Dell, pull another rabbit out his hat – and say, buy a SaaS company? Buying a public cloud supplier to get into that great game looks impracticable, but buying a SaaS company? That looks hard but not impossible, not to someone who pulled off the EMC acquisition.

Blocks & Files is convinced Michael Dell isn’t done yet. There’s more to come.