GigaOm’s latest HCI report for enterprises shows Nutanix ahead of VMware, Cisco falling behind and two new challengers. The analyst house has also posted new SMB and Edge HCI Radar reports.

HCI (hyperconverged infrastructure) appliances are servers operated via a hypervisor with network links and storage included. The systems operate in clusters, adding nodes to scale out resources as needed. The market leading VxRail systems from Dell have a PowerEdge server with VMware’s vSphere hypervisor and vSAN storage. GigaOm’s Radar reports set market presence aside and evaluate systems based on their technical merits.

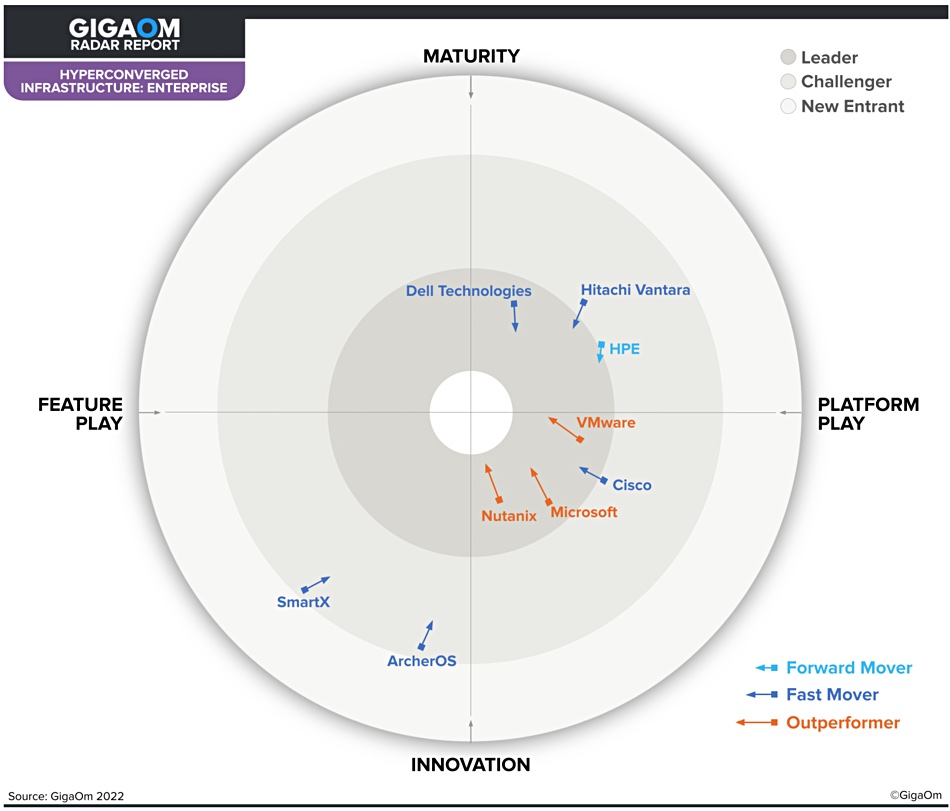

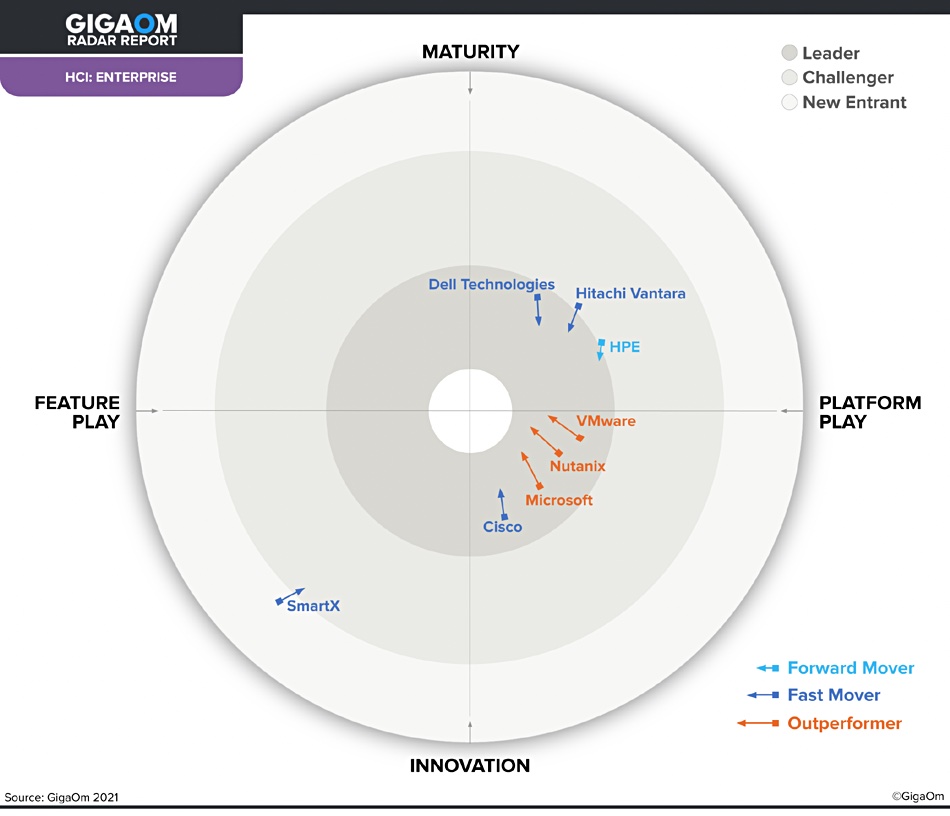

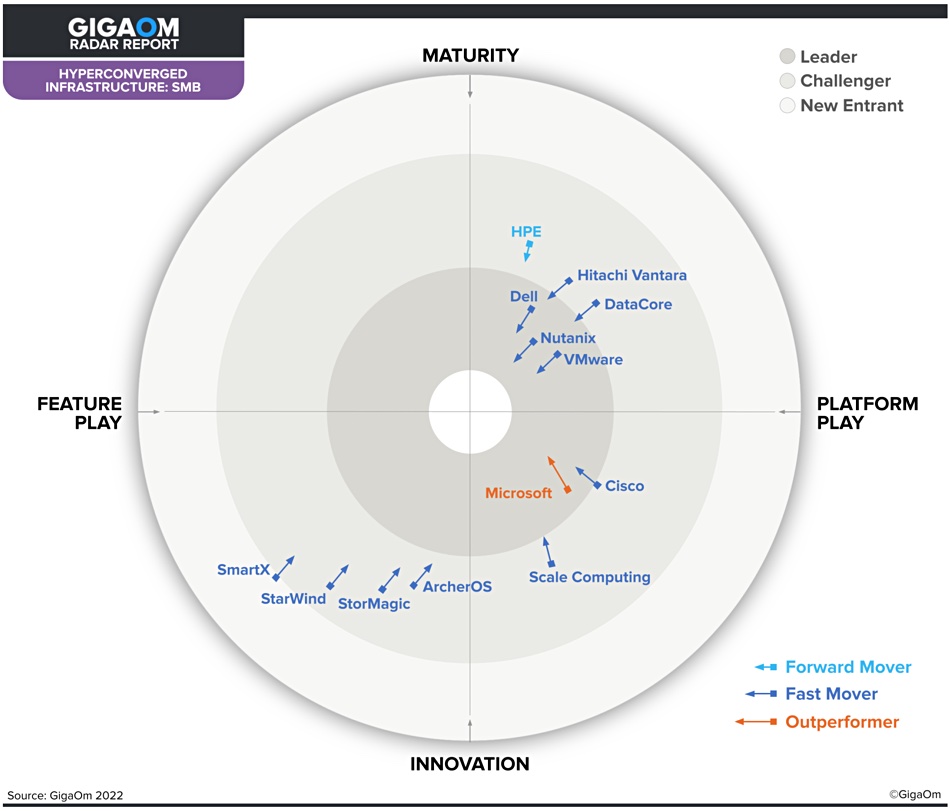

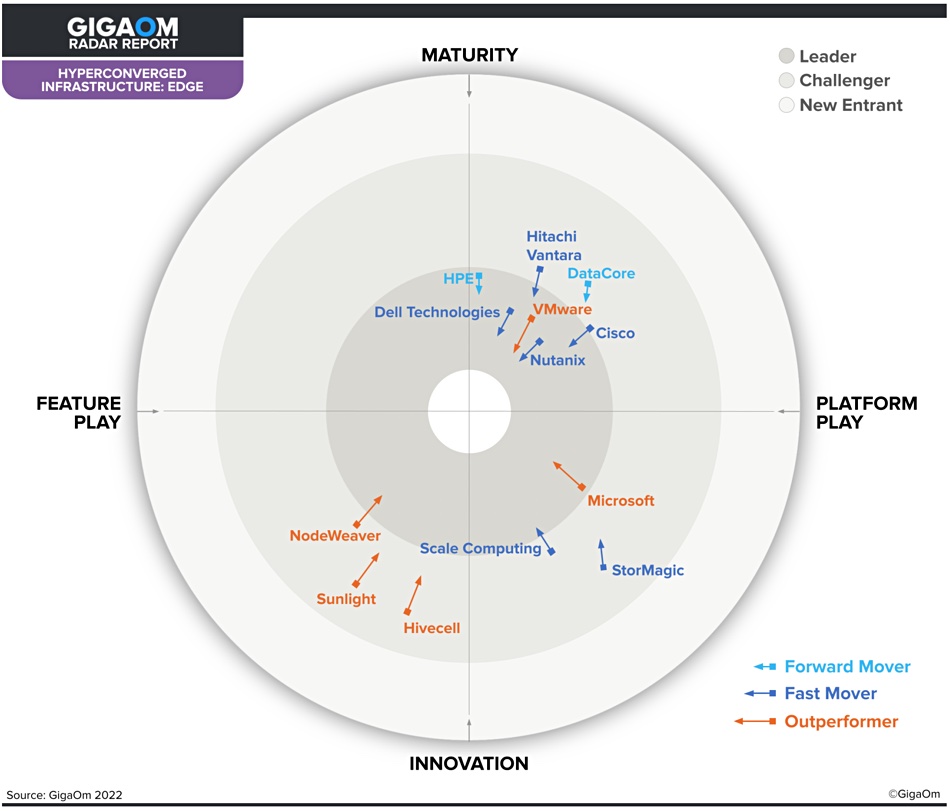

GigaOm decided there are two distinct HCI markets, Enterprise and SME/Edge, in its January 2021 Radar reports. It updated the Enterprise HCI Radar report with a new edition in January 2022. This year it has created three separate HCI reports: Enterprise, SMB (Small/Medium Business), and Edge.

Comparing this year’s enterprise HCI Radar (above) to last year’s (below), we can see that Nutanix is now ahead of Microsoft, VMware and Dell in the leader’s ring, and that Cisco has gone backwards from being a leader in 2022 to a challenger this year. SmartX has moved from the new entrant’s ring into the challenger’s ring where newcomer ArcherOS is placed as well.

Alistair Cooke, GigaOm HCI analyst, thinks “Nutanix has one of the most compelling HCI solutions in the market.” The company has an established and strong partner ecosystem, and a consistent user experience across different environments.

He says about Cisco, its HyperFlex HCI product and Intersight cloud operations offering: “The effort spent building, and then discontinuing, a kernel-based virtual machine (KVM) solution and a Kubernetes platform would have been better spent on extending Intersight’s capabilities – Cisco needs to regain momentum in this area.”

ArcherOS is a new-to-us Chinese supplier selling into its local Chinese market, with Cooke suggesting that expansion outside China could be difficult.

The SMB HCI Radar report evaluates more suppliers with one new entrant (SmartX), eight challengers, and four leaders, with Nutanix, again, in front, closely followed by VMware:

The Edge report has three suppliers completely new to us: NodeWeaver, Sunlight and Hivecell.

Cooke says Edge HCI is an emerging category with multiple approaches to solving problems, varying from slimmed-down remote office HCI for the near edge from mainstream vendors like Nutanix and VMware, to newer companies offering both virtual machines and containers for running app software in far edge devices. He counts NodeWeaver, Sunlight and Hivecell in this category, and expects to see more as these three, and future newcomers, use HCI to remedy Kubernetes limitations for far edge deployments.

Bootnote

GigaOm’s Radar report diagram places suppliers in one of three concentric rings, with those set closer to the center judged to be of higher overall value. The chart characterizes each vendor on two axes – balancing Maturity versus Innovation and Feature Play versus Platform Play – while providing an arrow that projects each product’s evolution over the coming 12 to 18 months. The arrow color indicates a forward moving company (light blue), faster mover (dark blue) and out-performer (orange).