IDC has resumed putting out hyperconverged system supplier revenue and market share numbers after after a three-quarter gap and not much has changed since the end of 2020 and the latest third 2021 quarter numbers. As before, VMware leads in revenue and market share ($982.3 million, 41.5 percent) followed by Nutanix ($581.2 million, 24.6 percent) with Huawei, Cisco and HPE distantly behind.

Hyperconverged Infrastructure (HCI) systems, also known as servers with storage, combine compute, networking and storage hardware with hypervisor software, providing a scale out system such that customers can grow their systems by adding HCI nodes. The hypervisor software aggregates the storage across the individual nodes into a server or virtual SAN.

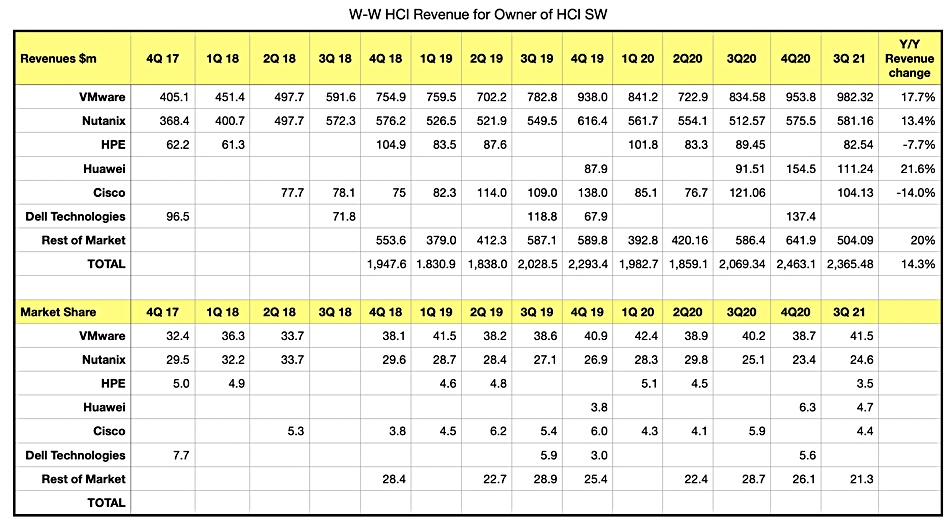

Here is our table of the IDC numbers:

Vendors dip in and out of the table as IDC only publishes numbers for the top five vendors in any quarter. You have to buy its reports to get the full picture.

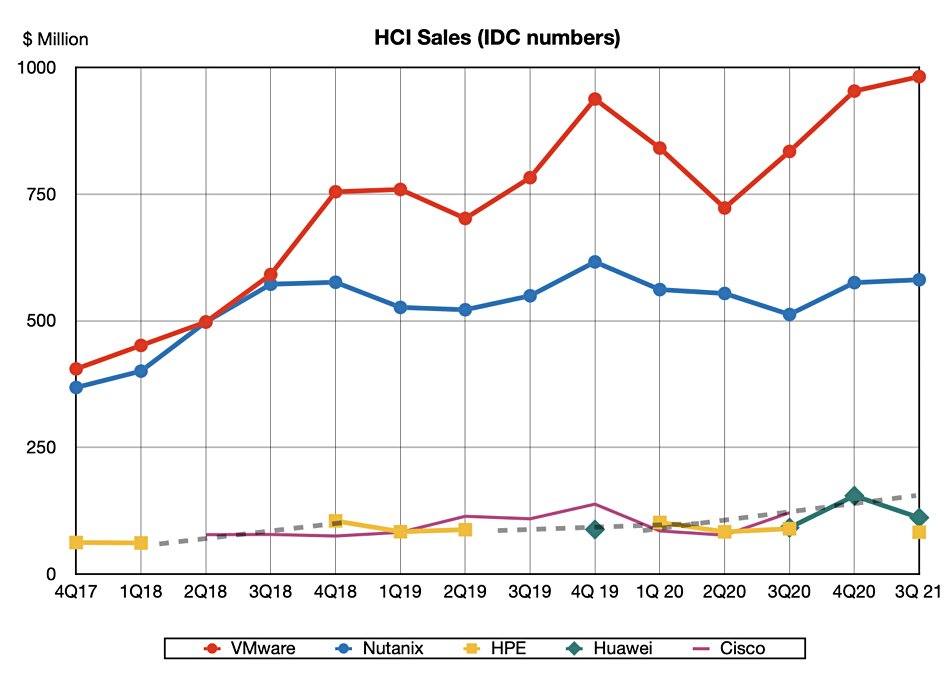

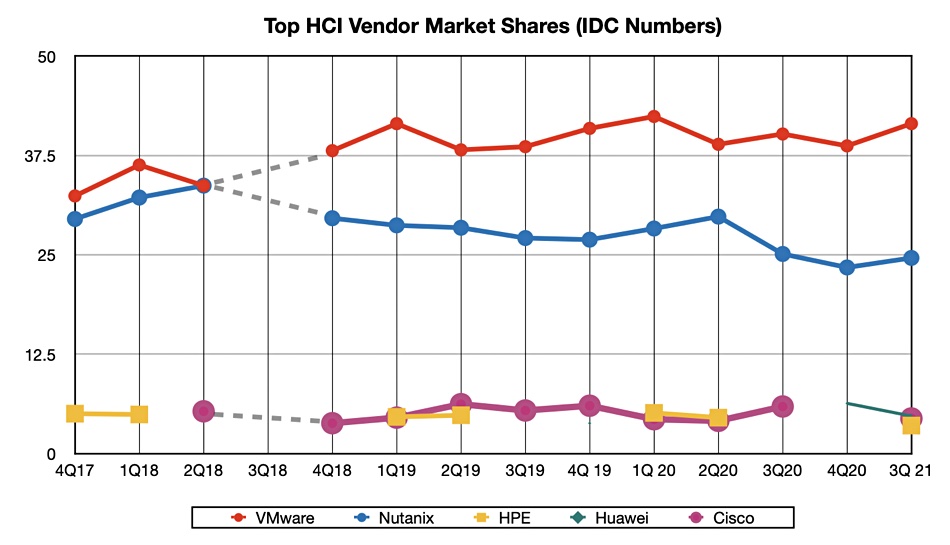

The numbers are more than a year old and we have no IDC visibility into what’s happened since the third 2021 quarter. We have charted both the revenue and market share numbers to show the trends:

Virtually nothing has changed over the gap since the fourth 2020 quarter. VMware still rules the roost with vSAN. While the overall HCI market grew at 14.3 percent in the year to 3Q 2021, VMware vSAN revenues rose 17.7 percent, with Nutanix having a 13.4 percent increase. Only Huawei beat VMware, with its 21.6 percent rise.

Cisco HCI sales declined 14 percent in the year to 3Q 2021 and there’s little reason to think they may have grown since then. HPE’s sales fell 7.7 percent in the same period and its market share went down from 4.5 percent in the second 2020 quarter to 3.5 percent in the third 2021 quarter.

Other suppliers accounted for 21.3 percent of the market in the third 2021 quarter almost as much as Nutanix.

The takeaway here is that this is a stable and mature market, with VMware’s vSAN solidly in the lead at just under the $billion/quarter revenue mark, Nutanix locked into second place at just over the $500 million revenue level, and three also-rans around the $100 million/quarter point. Expect little change as time goes by.

Bootnote.

IDC tells us itreplaced hyperconverged with cloud infrastructure spending around this time (late 2021). That’s why there’s been no hyperconverged infrastructure spending reports since then.