Dell EMC is ramping up performance for its high-end PowerMax arrays by adding support for FC-NVMe and Optane storage-class memory (SCM). Customers will get up to 50 per cent more read IOPS, lower latency and doubled throughput. PowerMax is also getting VMware, Ansible and Kubernetes integrations.

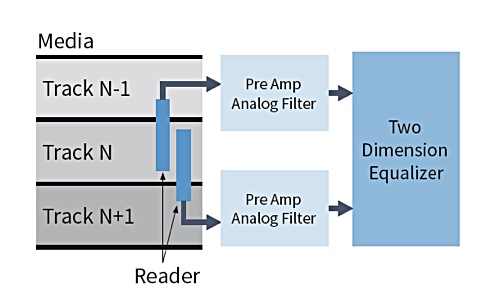

PowerMax already supports NVMe SSDs and this upgrade provides end-to-end NVMe support. FC-NVMe is the NVMe fabric protocol for storage array access implemented using Fibre Channel cabling -running at 32Gbit/s in this case. It delivers sub-200 μs latency with NVMe flash SSDs.

The updated systems support 750GB and 1.5TB dual-port Optane DC 4800X SSDs which have an NVMe interface. Dell heralded Optane support in December 2018 and PowerMax is the first system to ship with these drives.

The PowerMax’s machine learning sub-system looks at IO profiles and uses predictive analytics and pattern recognition to automatically place data on the SCM and NVMe flash SSDs.

PowerMax iterations

The first generation PowerMax array was announced in May 2018, with two models; the 4U 2000 and the rack-level 8000:

- PowerMax 2000 – to 1.7m random read IOPS, 300μs latency, and 1PB effective capacity.

- PowerMax 8000 – to 10m IOPS, 300μs latency, to 175GB/sec and 4PB effective capacity.

They scale up by adding PowerBrick controller/storage units; one to two for the 2000 and one to eight for the 8000. A brick includes a controller with two PowerMax directors, packaged software, cache, and 24-slot Drive Array Enclosures. The engines use Xeon CPUs; E5-2650 v4 for the 2000 and E5-2697-v4 for the 8000

The updated PowerMax specs are:

- PowerMax 2000 – to 7.5m IOPS, sub-100μs read latency and 1PB effective capacity.

- PowerMax 8000 – to 15m IOPS, sub-100μs read latency, 350GB/sec and 4PB effective capacity.

This is a performance upgrade, not a capacity boost.

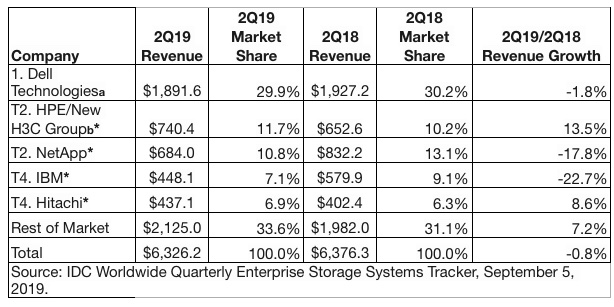

PowerMax Competition

Infinidat claims its arrays are faster than PowerMax. A May 2019 update to its F6000 array provided up to 2m IOPS and 25GB/sec throughput. Infinidat claimed latency is typically less than 1 msec, down to under 50μs as measured from the host, in one example. PowerMax with SCM and NVMe-FC has more IOPS and equivalent latency.

HPE’s Primera array puts out 2.3m IOPS and 75GB/sec of data with sub-millisecond latency. NVMe-oF support is baked into the Primera OS but is not yet available.

Primera is also said to be ready to support dual-port Optane drives and the system can handle the IO load of NVMe-oF and SCM.

PowerMax Operations

Pre-built modules for RedHat Ansible, available on GitHub, enable customers to create Playbooks for storage provisioning, snapshots and data management workflows for automated operations.

Also available on GitHub, a Container Storage Interface (CSI) plug-in for PowerMax provisions and manages storage for Kubernetes workloads.

A VMware vRealize Orchestrator (vRO) plug-in enables customers to develop end-to-end automation routines for provisioning, data protection and host operations. These routines can be offered as self-service catalogue items on the vRealize Automation platform.

Dell EMC Cloud Storage services provide disaster recovery as a service using AWS, Azure or the the Google Cloud Platform. This supports PowerMax.

There is a Dell Technologies validated design for PowerMax; and PowerMax is validated for VMware’s Cloud Foundation through Fibre Channel as primary storage. The hardware updates (NVMe, SCM) will be available on September 16 but everything else is available now.