All-flash array revenues fell in the second 2019 quarter and the total storage market slumped almost 10 per cent year-on-year, according to IDC

We should note IDC has altered how it calculates suppliers’ total enterprise storage systems sales in its Storage Tracker report for the second 2019 quarter.

William Blair analyst Jason Ader reports: “IDC has amended how it reports total storage numbers in August 2019 to include servers with fewer than three drives within the enterprise storage market, thus increasing the total size of the market on a historical basis.”

IDC’s number crunchers totted up total enterprise storage market revenues of $13.23bn in Q2 2018. Using the new calculation method, this more than doubles to $28.62bn. IDC’s Q2 2019 total is $25.9bn, down 9.5 per cent.

Ader says: “This compares to 4.1 per cent growth in the prior quarter and 35.9 per cent growth in the year-ago quarter.” There has been a pronounced fall in storage revenue growth, taking it into negative territory. This is attributed to cloud data centres buying fewer servers, which reduced internal/server-based storage revenue.

However this is expected to return to growth with cloud data centre storage buying from ODMs. IDC forecasts five-year CAGR of 8.9 per cent through 2023. IDC us seeing more growth in server SANs than external storage. Ader says: It expects growth in internal OEM storage systems to outpace external storage systems over the forecast period, generating CAGR of 8.5 per cent through 2023 (compared to 1.1 per cent CAGR for external storage).

Suppliers’ total storage revenue market shares in the quarter were;

- Dell Technologies – 21.6 per cent

- HPE (including H3C China JV) – 16.5 per cent

- IBM – 6.6 per cent

- Inspur – 5.7 per cent

- Lenovo 4.9 per cent

The calculation change has caused NetApp and Pure Storage to fall out of the top 5 supplier ranking, to be replaced by Inspur and Lenovo.

Worldwide all-flash array market revenue for the quarter was $2.09bn, down 0.7 per cent, on the back of reduced demand and lower NAND pricing. In contrast there was 18 per cent growth last quarter and 48 per cent growth a year ago.

All-flash array supplier shares were:

- Dell Technologies 28 per cent

- NetApp -17 per cent

- HPE/H3C -14 per cent

- Pure Storage – 12 per cent

- IBM – 10.1 per cent

- Others – 17.3 per cent

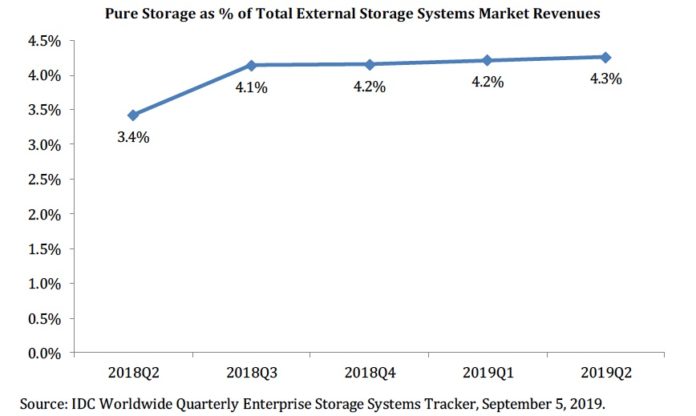

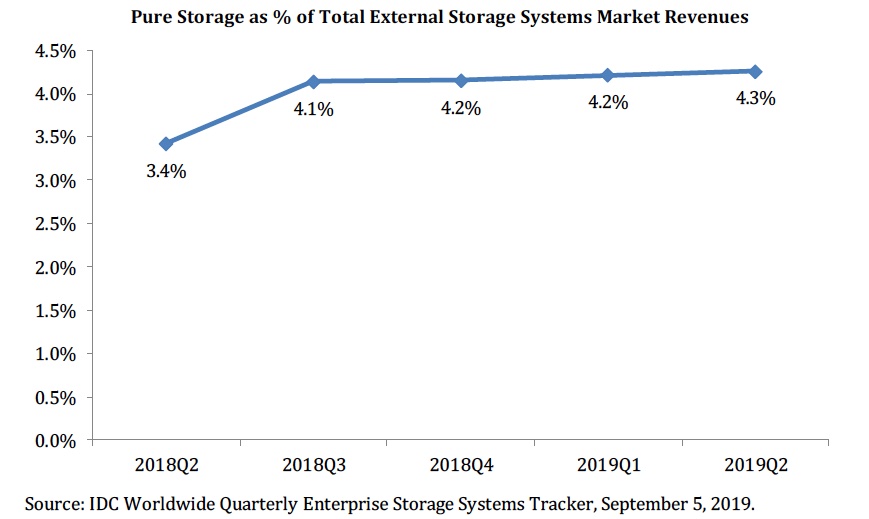

Pure Storage is slowly but steadily growing market share;

The all-flash arrays systems market is projected to grow at a compound annual rate of 10.8 per cent through 2023.