Nutanix is investigating the impact of incorrectly using third-party software for customer proof of concepts and more, saying that working out the cost implications of this prevented it from filing audited profit and loss accounts for Q2 of its fiscal 2023.

“Company management discovered that certain evaluation software from one of its third-party providers was instead used for interoperability testing, validation and customer proofs of concept over a multi-year period,” Nutyanix said. “The Audit Committee commenced an investigation into this matter, which is still ongoing, with the assistance of outside counsel. The Company does not believe that this will have a significant impact on the fundamentals of its business and overall prospects.”

The organization is “assessing the financial reporting impact of this matter and it is likely that additional costs would be incurred to address the additional use of the software,” it added.

This perhaps took some of the shine off the 18 percent year-on-year revenue growth to $486.5 million that Nutanix recorded for the quarter ended January 31, beating guidance of $460 – $470 million. This revenue growth outpaced that of NetApp (-5 percent), HPE (12 percent), Pure Storage (14 percent) and Dell’s storage business (7 percent).

Nutanix CEO Rajiv Ramaswami said: ”Against an uncertain macro backdrop, we delivered a solid second quarter, with results that came in ahead of our guidance and saw continued strong performance in our renewables business. The value proposition of our platform is resonating with customers as they look to tightly manage their IT and cloud costs while modernizing their data centers and adopting hybrid multicloud operating models.”

Some customers are repatriating some workloads from the public clouds to their own data centers because the total cost of ownership of these workloads is lower on-premises, the company hinted.

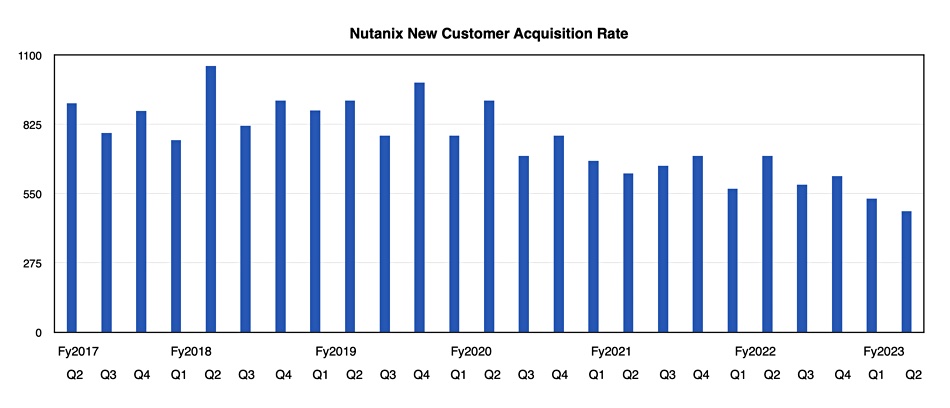

Annual Contract Value (ACV) billings rose 23 percent year-on-year top $267.6 million and annual recurring revenue grew 32 percent to $1.38 billion. Nutanix gained 480 new customers in the quarter, taking its total customer count to 23,620.

Although the new customer acquisition rate is trending lower (see chart above) customers are spending more money with Nutanix.

Life time bookings:

- 125 customers with >$10million – up 24 percent

- 196 customers with $5 – $10 million – up 21 percent

- 281 customers with $3 – $5 million – up 15 percent

- 1,411 customers with $1 – $3 million – up 22 percent

Ramaswami said: “We are focusing on higher quality, higher ASP new logos [customers],” more so than picking up as many new customers as possible.

The percentage of customers using Nutanix’ own AHV hypervisor rose to 63 percent, up from 55 percent a year ago and 61 percent in the previous quarter.

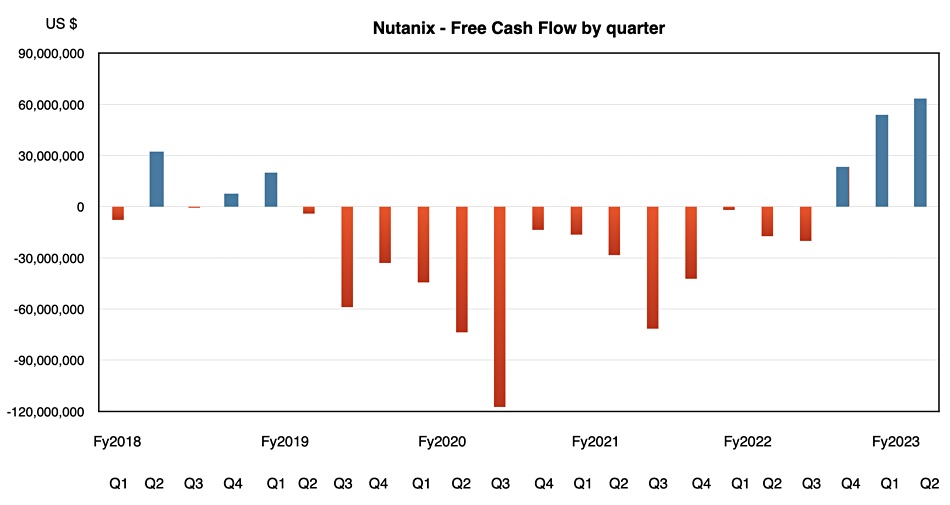

Operating cash flow went up 187 percent to $74.1 million, with $63.0 million of free cash flow equating to a rise of 266 percent. This, Ramaswami said, was due to good expense management. The company’s financial health is improving rapidly.

Ramaswami spoke about priorities in the earnings call: “Our overarching priority remains delivering sustainable profitable growth, through judicious investment in the business, execution on our growing base of renewables and diligent expense management. Our strong free cash flow along with solid top line growth in the second quarter reflects the progress we’ve made to date towards this objective.”

Supply chain constraints with several suppliers improved compared to the prior quarter, and the new worry coming into view is the general economic situation, with Ramaswami saying: “With respect to the macro backdrop, in the second quarter, we continue to see businesses prioritizing their digital transformations and datacenter modernization initiative, enabled by our platform.”

“However, we have seen some increased inspection of deals by customers, which we believe is likely related to the more uncertain macro backdrop. And this is driving a modest elongation in sales cycles.”

These have affected Nutanix’s outlook for the remainder of the fiscal year.

Outlook

Because of the ongoing evaluation software probe, Nutanix will file its formal SEC 10Q quarterly report late. It is possible that expenses will go up and profits will fall in the affected reporting years.

Nutanix said it is expecting between $430 million and $440 million in revenues for the next quarter; $435 million at the mid-point and 7.7 percent year-on-year growth. Full fy2023 guidance is for revenues between $1.80 billion to $1.81 billion, with year-on-year growth of 14 percent at the midpoint.

Broadcom’s VMware acquisition has prompted some VMware customers to look at Nutanix as an alternative but such deals, particularly with larger customers, can take a year to complete. These potential migrations have not been factored into the outlook.