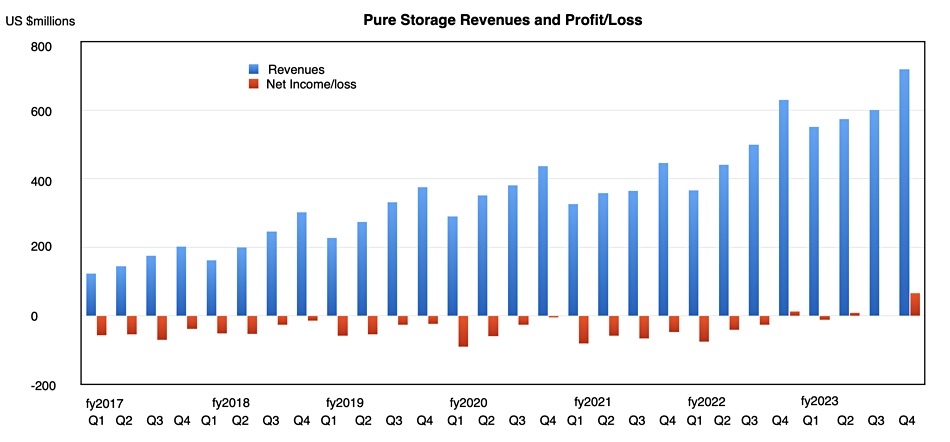

Pure Storage grew Q4 revenues by 14 percent year-on-year, reported its biggest ever profit, and overtook NetApp for all-flash array run rates. Yet Wall Street analysts expected higher revenues and a stronger outlook, so the stock price sank more than 10 percent in trading after the results were posted.

Revenues in the quarter ended February 5 were $810.2 million and net profit was $74.5 million, up from $15 million a year ago. Q4 subscription revenues of $1.1 billion were 30 percent higher.

Full year revenues totaled $2.75 billion, a 26 percent jump, with a profit of $73 million, Pure’s first ever annual profit recorded.

CEO Charlie Giancarlo said in his prepared remarks: “We were pleased with our Q4 year-over-year revenue growth of 14 percent and were very pleased with our annual revenue growth of 26 percent, and annual subscription ARR growth of 30 percent – especially considering the challenges of the steadily increasing global economic slowdown.”

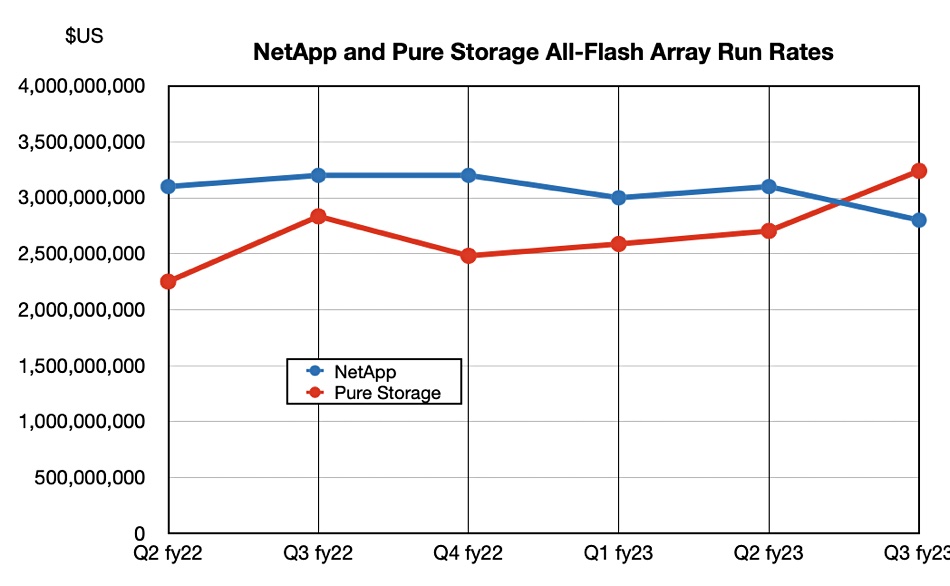

Pure’s revenues grew faster than the market and it also outpaced NetApp in all-flash array revenue run rate, with a 14 percent year-on-year increase to $3.24 billion versus NetApp’s $2.8 billion, down 12 percent annually:

The Pure AFA run rate number includes service revenues, as does NetApp’s. Strict product revenues were $545 million, a $2.2 billion annual run rate.

Pure gained more than 490 new customers in the quarter, taking its total past 11,000. International market revenues grew 39 percent to $258 million while the US could only manage 6 percent growth to $552 million, reflecting customer caution. There was no new business from Meta, which is about halfway through a 1EB Pure system deployment.

Q4 financial summary

- Gross margin: 69.3 percent

- Operating cash flow: $233 million; up 85 percent

- Free cash flow: $172.8 million

- Total cash, equivalents and marketable securities: $1.6 billion

- Headcount: 5,100

The general economic situation is affecting Pure and Giancarlo said: “We are … well aware of the challenges of the current economic environment and the strains that it places on our customers.”

Pure – like others – is seeing longer sales cycles and customers, particularly enterprise customers, being cautious about large purchases. These, described as near-term headwinds, have affected its growth outlook for the year, which also served to disappoint Wall Street.

To counter this, Giancarlo said: “We have already taken actions to reduce spending across the company and have reduced our spending and budgetary growth plans for FY 24 until we see improvements in the environment.”

Pure is emphasizing electricity and operational savings in its sales messages and suggesting customers could save cost by moving from disk or hybrid arrays to Pure’s flash gear. Giancarlo referred to this: “We’re … changing the way our sales teams go about working with the customer on evaluating our products [with] a much greater focus on near-term operational costs as a justification for making the choice to proceed forward with a project versus maybe other projects that they have in their consideration.

“Pure’s Flash-optimized systems generally use between two and five times less power than competitive SSD-based systems, and between five to ten times less power than the hard disk systems we replace. Simple math then shows that replacing that 80 percent of hard disk storage in data centers with Pure’s flash-based storage can reduce total data center power utilization by approximately 20 percent. ”

Step forward the new FlashBlade//E as Pure’s disk array-killing standard bearer, released this week. Giancarlo said: “While our development of FlashBlade//E was not done in anticipation of a recession, it couldn’t come at a better time. It’s operating costs [are] well below the operating cost of a hard disk environment that it will be replacing … FlashBlade//E, I think, is going to be a barn burner.”

Outlook

CFO Kevan Krysler said: “We expect that Q1 revenue this year will be flat at $560 million when compared to Q1 of last year.“ This bleak outlook surprised analysts and investors who had been expecting $681.4 million, according to Wells Fargo’s Aaron Rakers.

Giancarlo answered a question about this in the earnings call, saying there “was a slowing down of progression of the pipeline of the staged opportunities, meaning the progression that we had typically seen in earlier quarters of movement from early stage to later stage… That has slowed down since the beginning of the year. And we have to assume that, that will be true for at least a couple of quarters going forward. And so that’s changed the outlook … for the year as we go forward.”

Krysler expects things to improve later in the year and full FY 24 guidance is for mid to high single digit year-on-year percentage growth, with no Meta sales included. Wall Street analysts had expected 13-14 percent growth, hence the 10 percent stock price drop.