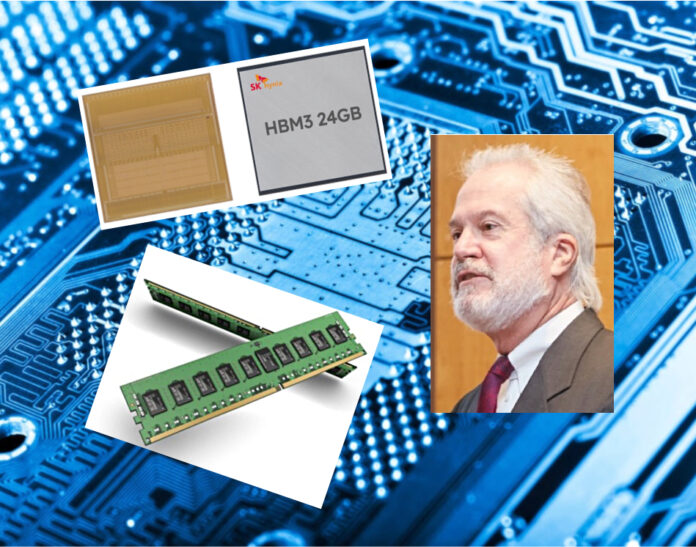

Analyst Jim Handy thinks the memory market is being artificially buoyed by AI server demand, with oversupply and a price correction coming.

Handy is a senior analyst at Objective Analysis. In a post titled How Long Will Memory Growth Continue? he writes: “The memory business is currently faring pretty well [but] the business is definitely off-trend.”

He says that the memory market is characterized by capacity-driven cycles. As market demand rises, suppliers build more fabs, but the market can’t often absorb their output, prices fall due to over-supply, and the market slumps.

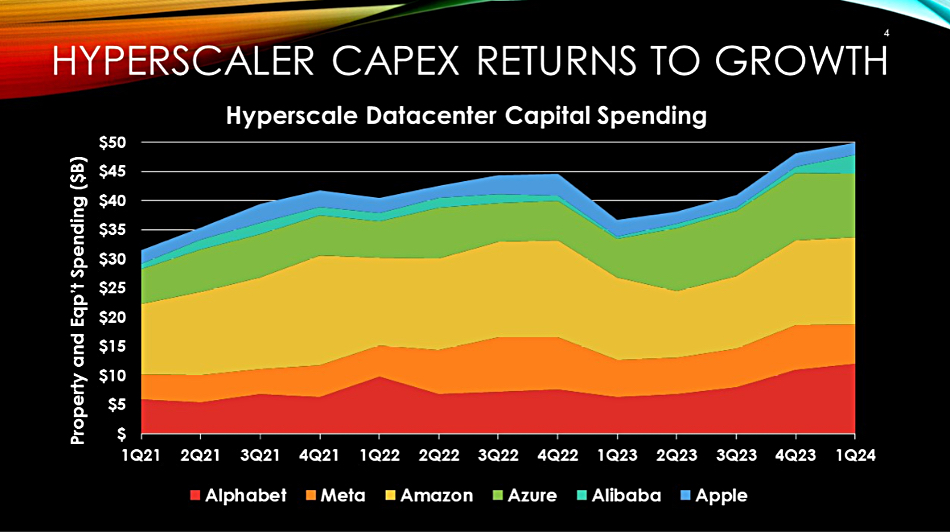

The current memory market is demand-driven with a lot “coming from massive AI purchases in hyperscale datacenters.” Forecasting the duration of this cycle is tricky as “demand-driven cycles tend to be caused by factors that are very hard to predict.”

At the FMS event in Santa Clara in August, Handy “presented a chart showing the history of hyperscaler capital expenditures … It’s unusually high at the moment, but it’s not clear how long these companies will continue their high expenditures. They haven’t had a matching revenue surge, so they can’t fund accelerated spending forever.”

He superimposes the current memory market revenue history on a second chart showing two previous demand cycles, “normalized to the market’s underlying trend, so they are all expressed in a percentage relating to how far off-trend they are, rather than in absolute revenues.”

Also, all three curves start from the same point, month 1, and then rise and fall over time. A 2017 cycle is shown by the red line and a 2021 cycle by a black line. Their duration, rise, and fall are identical within a two-month window.

The green line shows the current cycle, with the dashed extension being “a projection of where it might head if it performs as did the prior two cycles. Today we appear to be in Month 18.” If the projection is correct, this suggests the current cycle will peak in month 21, by the end of 2024, with the demand declining as 2025 progresses through to the fall.

Handy says this isn’t as scientific a forecast as those Objective Analysis usually produces for its clients, but adds: ”Today’s heavy AI spending can’t last forever, and when it does end, there will undoubtedly be an oversupply with a subsequent price correction, if not a collapse like those seen in 2018 and 2022.”

This line of analysis suggests that the high-bandwidth memory (HBM) boom being enjoyed by SK hynix and Micron, and pursued by Samsung, could be relatively short-lived.