Rubrik grew quarterly revenues by 35 percent in Q2 of its fiscal 2025 to $204.9 million, and reported a $176.9 million net loss.

The Palo Alto-based biz sells a combination of backup-based data protection and data security, positioning itself as a zero trust data security provider with a mission to secure data and a focus on post-attack recovery. In the latest quarter ended July 31, Rubrik beat its own $196 million forecast for the quarter by quite some margin.

Rubrik CEO Bipul Sinha said on the earnings call: “We outperformed across all guided top line and profitability metrics and are raising our annual guidance … Our all-important profitability measure, subscription ARR contribution margin improved by over 1,300 basis points year-over-year.”

The results were driven by new customer wins and expansions in existing customers, the classic land-and-expand strategy. This expansion has three factors: growth of data, additional customer applications protected by Rubrik, and the sale of new data security services.

Sinha added: “Our subscription ARR, up 40 percent year-over-year in Q2 to $919 million, showcases the value we provide to enterprises in delivering complete cyber resilience, which combines cyber recovery and data security posture management.

“Rubrik is winning in the cyber resilience market. As more and more organizations realize that cyberattacks and breaches are inevitable, cyber resilience is becoming the number one topic in cyber security.

“Cloud resilience is top of mind for every organization around the world because what folks have realized is they have invested millions of dollars in cyber prevention tools and they still are not sure whether they can continue operating the business in an event of cyber breach or successful cyber-attack.”

The Crowdstrike incident raised a lot of CxO and board-level awareness about these risks. Sinha said: “What we saw was a small human error can really take a global digital economy down in such a rapid pace and with such significant scale. So we believe that it will be one of the many factors that will only propel this market going forward.”

Rubrik now has 1,969 customers with more than $100,000 in subscription ARR, up from 1,463 a year ago. CFO Kiran Choudary said: “These larger customers now contribute 81 percent of our subscription ARR, up from 78 percent in the year-ago period.”

Financial summary

- Gross margin: 76 percent vs 75 percent last quarter

- Operating cash flow: -$27.1 million vs -$6.7 million a year ago

- Free cash flow: -$32 million vs -$13 million a year ago

- Cash, cash equivalents & short-term investments: $601.3 million

- Debt: $306.8 million vs $297.1 million last quarter

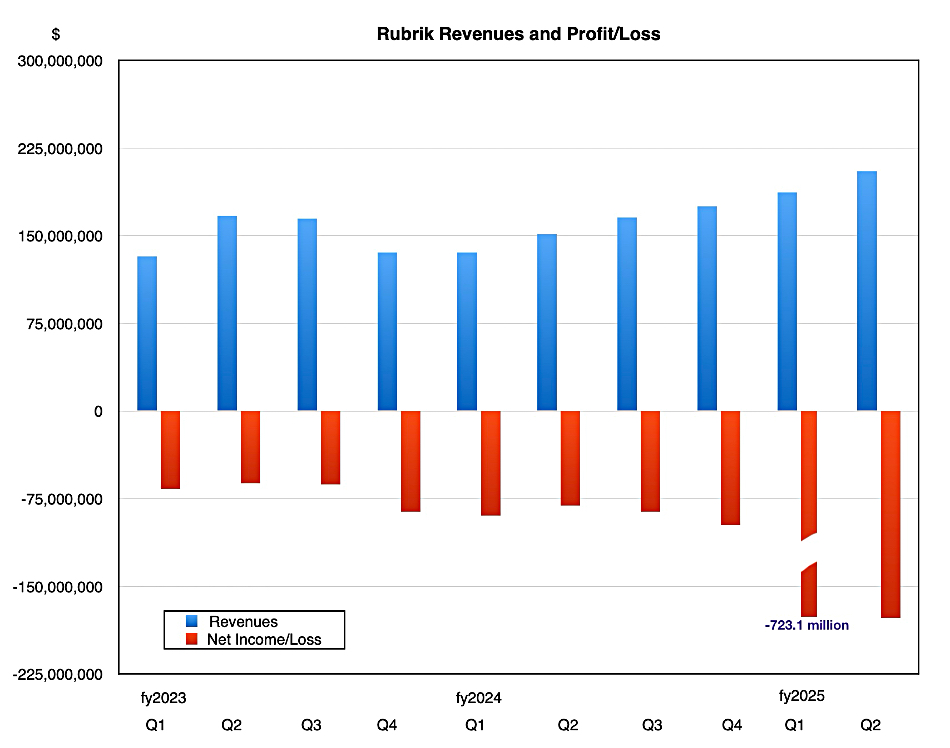

The revenue and profit/loss history chart below shows a revenue fall from fiscal 2023’s Q2 for a couple of quarters before revenue started growing again. This was due to a switch from perpetual license sales of its Cloud Data Management product to Rubrik Security Cloud (RSC) subscription-based revenues. Subscription revenue is now 86 percent of total revenues. It was 64 percent a year ago and 51 percent in the twelve months before that.

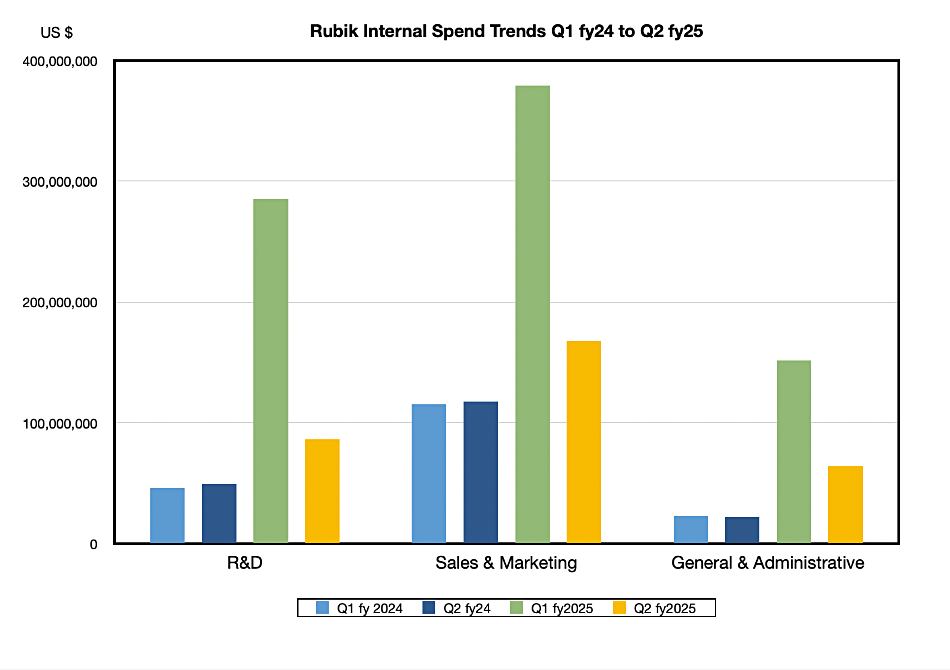

Internal spending has been reined back from the last quarter’s high point:

- R&D: $86.2 million

- S&M: $167.9 million and still the largest item

- G&A: $63.9 million

- Total: $318 million vs $816 million in the prior quarter.

Choudary said: “As our renewal base continues to scale and becomes a bigger part of the revenue, we expect to see further improvements in sales and marketing expenses as a percentage of sales.”

Rubrik believes GenAI is a significant catalyst for its growth, with Sinha saying: “GenAI trust, GenAI security, GenAI responsibility depends upon the data that gets fed into it.”

Rubrik has set an ambition on becoming profitable. Sinha said: “In addition to growth at scale, we believe our path to profitability is clear.” Choudary commented: “We plan to continue to invest into this enormous opportunity ahead of us while delivering efficient growth at scale.” He sees “positive free cash flow in the second half of the fiscal year.”

Sinha was asked about the impact of SaaS app supplier Salesforce buying data protection supplier Own Company, with Rubrik offering a Salesforce SaaS protection service.

He replied: “The Salesforce acquisition of Own actually validates our strategy. We are telling customers and organizations and governments around the world that SaaS data is important to protect. SaaS is becoming mission-critical. And a SaaS vendor buying a SaaS data security, SaaS cyber resilience company validates our whole strategy, but we are focused on all the applications across enterprise cloud and SaaS landscape.

“Salesforce is one of the 20-plus applications [to whom] we actually provide cyber resilience, and businesses want a single policy engine, a single security control across all of their application landscape. Otherwise, they are turning 30, 40 knobs to make sure that the business is running.”

Protecting SaaS apps is a focus. “As these SaaS platforms become more and more critical in the enterprise, we will continue to expand our platform to cover more and more SaaS apps,” Sinha said.

Rubrik’s strategy is to be a single point for data protection, meaning backup and cyber resilience. As Sinha explained: “Our strategy… is the consolidation of cyber resilience across all apps, all the apps that are in their data center, all the apps that are across AWS, Azure, GCP as native cloud app, as well as all the apps in their SaaS landscape, and a single policy engine, a single security control across all apps.”

The next quarter outlook is for revenues of $217.5 million +/- $1 million, a 31.3 percent uplift on the year-ago quarter. The full fiscal 2025 revenue outlook is for $834 million +/- $4 million, a 32.8 percent rise at the midpoint.

This has been revised upward since the last quarter when the full year outlook was for $817 million +/- $7 million, a 30.1 percent increase annually at the midpoint.

Sinha is looking forward to Rubrik becoming a $1 billion/year company in fiscal 2026 with $3 billion a year the next major event after that.