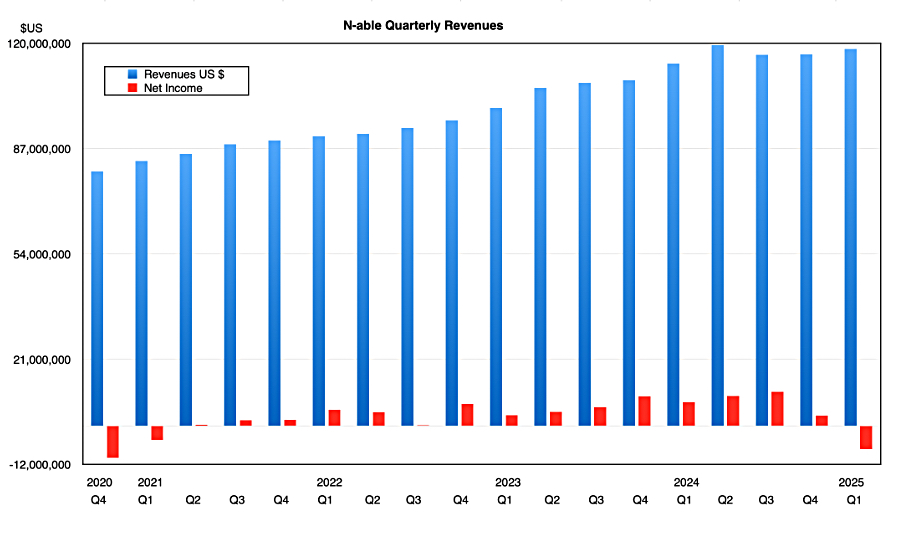

Data protection vendor N-able reported a loss and lower growth in its first 2025 quarter.

The company supplies data protection and security software to more than 25,000 managed service providers (MSPs) who supply services to small and mid-market businesses in turn. It also sells to distributors, SIs, and VARs. Revenues in the initial 2025 quarter were $118.2 million, up 3.9 percent year-on-year and above its guidance range, with a GAAP loss of $7.2 million. Subscription revenues grew 4.8 percent to $116.8 million and its gross margin was 76.6 percent.

N-able president and CEO John Pagliuca stated: “Our earnings reflect continued progress advancing cyber-resiliency for businesses worldwide. The launch of new security capabilities, strong addition of channel partners in our Partner Program, and our largest new bookings deal ever showcase that N-able is innovating and growing. We look forward to building on this progress throughout the year.”

The loss was due to increased cost of revenue, operating expenses, and acquisition costs.

Pagliuca said in the earnings call that N-able had signed “our largest new bookings deal ever.”

A revenue history chart shows N-able’s growth rate has been declining:

N-able’s net retention rate (NRR) is 101 percent, which indicates some customer revenue growth and low customer churn. It was 103 percent in 2024, 110 percent in 2023, and 108 percent in 2022. The higher the NRR, the higher a company’s growth rate. A 100 percent NRR indicates any lost revenue from customer churn is offset by increased revenue from new customers, upsells, and cross-sells. A less than 100 percent NRR suggests a business is keeping most of its customers but not growing its revenue as much as it could. N-able’s NRR is not in this category but not much above it either.

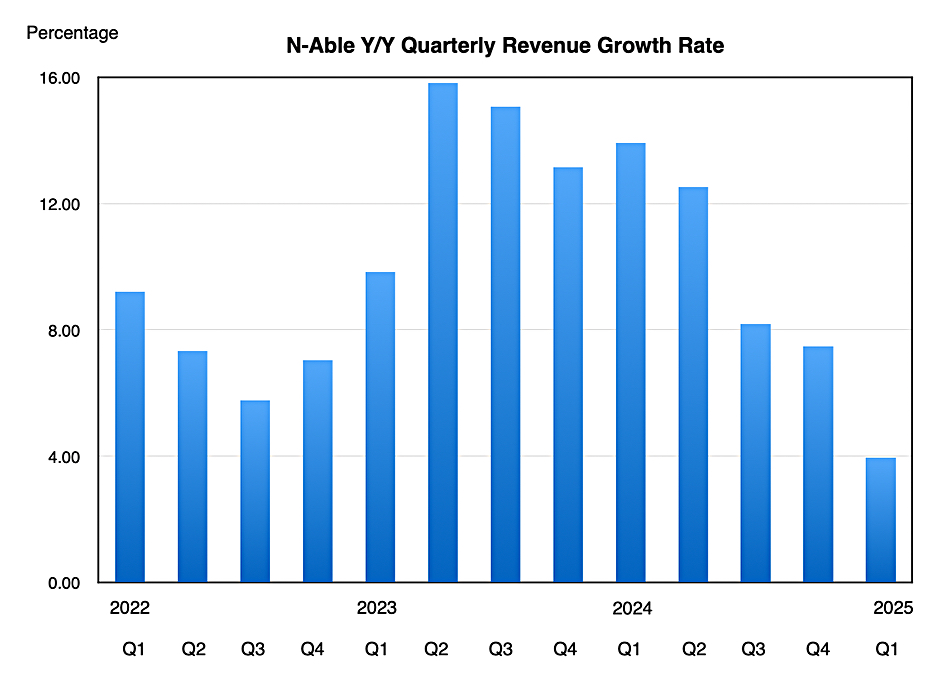

The issue is that N-able’s quarterly revenue growth rate has been slowing, with seven declining quarters since a high point in 2023’s second quarter, as a second chart indicates:

Delivering cyber-resiliency services through MSPs is akin to a franchise model. Its revenues should increase as existing MSP partners bring on new clients and grow revenue from existing clients, and also from recruiting new MSP partners. As the chart above shows, N-able’s franchisees are growing its revenues at a declining rate.

The cybersecurity-focused acquisition of Adlumin last November was intended to scale its security portfolio, giving MSP partners new services to sell to their clients and channel. The Adlumin deal brings in distributors, VARs, and SIs, giving N-able access to more channel partners and cross-selling scope.

Pagliuca expects the NRR percentage to grow, saying: “The improvements we’re looking to drive will be driven mostly through the cross-sell opportunity that we have within the customer base.”

N-able’s second quarter outlook is $126 million ± $500,000, a 5.5 percent year-on-year increase at the midpoint. Its full 2025 outlook is $494.5 million ± $2.5 million, a 6 percent year-on-year increase at the midpoint, which suggests that it sees its revenue growth rate staying above 5 percent in the second, third, and fourth quarters.

Analyst Jason Ader said: ”While the company is going through multiple simultaneous transitions this year (channel expansion, investments in security products, and cross-sell/platformization motions), which are pressuring profitability and creating some execution risk, we like management’s aggressive posture and believe it holds the promise of a larger TAM, faster growth, and greater operating leverage in the future.”

N-able has instituted a $75 million share buyback program.