Data intelligence supplier Alation has achieved Federal Risk and Authorization Management Program (FedRAMP) “In Process” status and gained a listing on FedRAMP Marketplace at a Moderate impact level. Alation’s partnership with Constellation GovCloud and Merlin Cyber allows government agencies to search for and discover secure, FedRAMP-compliant data. Constellation GovCloud de-risks the FedRAMP authorization process for Alation by handling most compliance tasks and reducing costs.

…

Cloud backup and general S3 storage vault provider Backblaze has won SaaS-based legal biz Centerbase as a customer. Back in Dec 2023 Veeam using Centerbase chose Object First’s Ootbi appliance as its on-prem backup store for its Veeam backups. It has also decided to use Backblaze’s B2 service as a cloud-based offsite disaster recovery facility. The scheme has Veeam Backup and Replication tiering infrastructure to Backblaze B2 as well as sending it to the Ootbi appliance. If Centerbase’s primary site is affected by ransomware or natural disaster, it can turn to its B2 backups to restore data and meet recovery time objective (RTO) requirements.

…

Supercomputer, HPC and enterprise/AI storage supplier DDN has won Qatar’s telecommunications operator and information and communications technology (ICT) provider Ooredoo as a customer. It will adopt DDN’s AI infrastructure across its networks.

…

HPE Storage bloke Dimitris Krekoukias, blogging as Recovery Monkey, has posted a blog about resiliency aspects of HPE’s Alletra MP scale-out block storage system’s DASE (disaggregated, shared everything) architecture – like VAST Data. Alletra MP has no concept of dual controllers. He writes: “all the write cache resiliency has been moved out of the controllers. It goes hand-in-hand with not having a concept of HA pairs of controllers. Ergo, losing a controller doesn’t reduce write cache integrity. Which is unlike most other storage systems.” Also: “all controllers see all disks and shelves, all the time.” Users can add new controller nodes (compute) without having to add capacity (storage). The system rebalances itself.

If a controller goes down, the system rebalances itself. Extra capacity can be added at will. If a component disk shelf is lost, the system recovers. Controller resilience is high – (N/2)-1 nodes can be lost at the same time for Alletra MP Block. So in a six-node cluster, any two nodes can be lost simultaneously. “Conceptually, the architecture allows arbitrary node counts – so if in the future we do, say, eight-node clusters, (8/2)-1=3 so any three nodes could be truly simultaneously lost without issues, and so on and so forth, as cluster size increases.”

He notes: “We now allow N/2 rolling failures in R4, and later may potentially allow more.”

…

Seagate’s HAMR drive qualification at customers has been hindered, Wedbush analyst Matt Bryson suggests, by mechanical components being stored in a non-climate-controlled environment. This resulted in a material reaction to the environment and, when the components were used in the HAMR process, media contamination followed. Bryson argues this is basically a logistics problem and relatively easily fixed – much more easily than fixing a physics or chemistry problem. The delayed HAMR take-up will benefit WD, with its 24/28 TB PMR/SMR HDDs. He thinks that, overall, the HAMR situation will improve for Seagate from now on, with the next HAMTR iteration due in H2 2025 with a 40TB-class product launch providing a Seagate revenue boost.

…

Storage Newsletter reports Trendfocus SSD shipment stats for calendar Q1, 2024, showed capacity shipped rose 6.5 percent quarter on quarter to 90.87EB with units dropping 5.1 percent to 83.79 million. But these low-level changes hid dramatic market sector differences.

- Client units decreased 9.5 percent to 65.65 million and EB shipped went down 11.5 percent to 43.67EB;

- SAS SSD units dropped 19.9 percent to 751,000 and EB shipped went down 5.6 percent to 3.03EB;

- Enterprise SATA units rose 2.1 percent to 3.64 million, with 5.12EB shipped, up 3.7 percent;

- Enterprise PCIe units shipped soared 50 percent to 8.08 million, and EB shipped went up 45.5 percent to 33.71EB.

Supplier capacity market shares:

- Samsung – 36.8 percent

- WD – 15.1 percent

- Kioxia – 7.8 percent

- Combined WDC + Kioxia – 22.9 percent

- Solidigm – 14.8 percent

- SK hynix – 6.9 percent

- Combined SK hynix & Solidigm – 21.7 percent

- Micron – 8.2 percent

- Kingston – 4.5 percent

- SSSTC – 0.6 percent

- Others – 5.3 percent

Units shipped supplier market shares:

- Samsung – 31.3 percent

- WD – 18.5 percent

- Kioxia – 9.3 percent

- Combined WDC + Kioxia – 27.8 percent

- Solidigm – 5.4 percent

- SK hynix – 10.3 percent

- Combined SK hynix & Solidigm – 25.7 percent

- Micron – 9.8 percent

- Kingston – 6.7 percent

- SSSTC – 1.6 percent

- Others – 7.2 percent

SK hynix is benefitting greatly from Solidigm’s high-capacity SSDs.

…

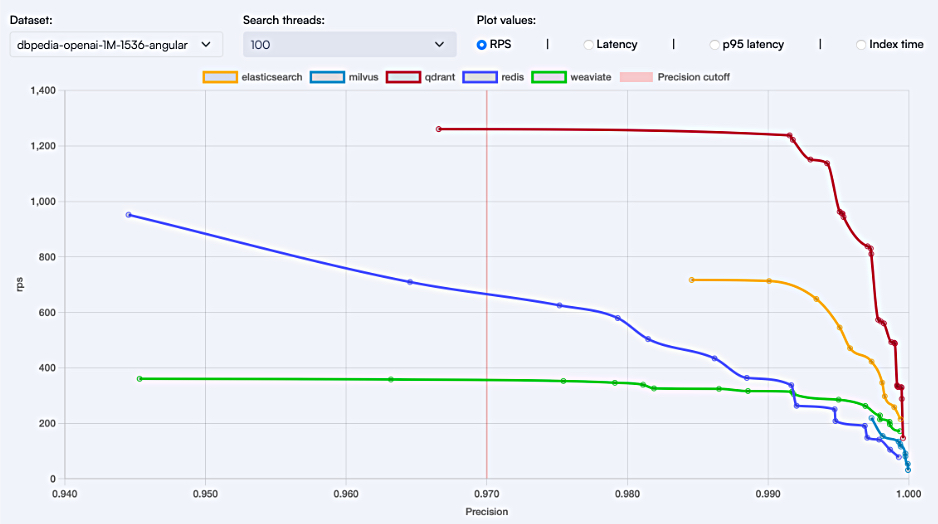

Vector database supplier Qdrant claims its dedicated vector database is faster than other databases with vector extensions added in, and also other dedicated Vector databases such as Pinecone. It claims Qdrant enhances both speed and accuracy by ingesting additional context, enabling LLMs to deliver quicker and more precise results. Qdrant delivers higher retrieval capabilities in Requests Per Second (RPS). Qdrant is designed for high-capacity workloads, making it ideal for large-scale deployments like in the global medical industry, where patient data is continuously updated. For smaller applications, such as a startup’s chatbot, the performance and accuracy benefits may be less noticeable between Qdrant and other products. For extensive datasets, Qdrant’s optimization and scalability offer significant advantages.

Qdrant benchmarked its performance against named vector databases – Elastic Search, Milvus, Redis, and Weaviate, but not Pinecone – using various configurations of them on different datasets. You can reference the parameters and results, summarized in tables and charts here.

…

ReRAM developer Weebit Nano has partnered with Efabless to allow quick and easy access to prototyping of new designs using Weebit ReRAM. Key points:

- This will enable a broad range of designers (startups, government agencies, product companies, research centers and academia) to prototype their unique designs with limited quantities, before they decide to proceed to full production.

- The manufacturing will be done at SkyWater, where Weebit is already proven and qualified up to 125 degrees C.

- Efabless has thousands of users and customers and it has a unique value proposition: allowing anyone to design their own SoCs for a fraction of the price of a full-mask production, for limited quantities only.

…

Veeam announced new technical training and certification programs through Veeam University, which delivers Veeam technical training to IT professionals on-demand anytime, anywhere. The online offering is the result of a global partnership with Tsunati, a Veeam Accredited Service Partner, revolutionizing on-demand technical certification training for partners and customers worldwide. Veeam University offers maximum flexibility and an immersive, engaging learning experience in a self-paced format. This innovative approach includes clickable labs that can be accessed 24x7x365, video-based demos, and technical deep dives allowing students to effectively absorb concepts and prepare for real-world cyber security and disaster recovery scenarios. Completion of on-demand courses offered through Veeam University qualifies learners for Veeam certification exams – including Veeam Certified Engineer (VMCE).