Veeam has the largest market share in the data replication and protection market by revenue, according to IDC.

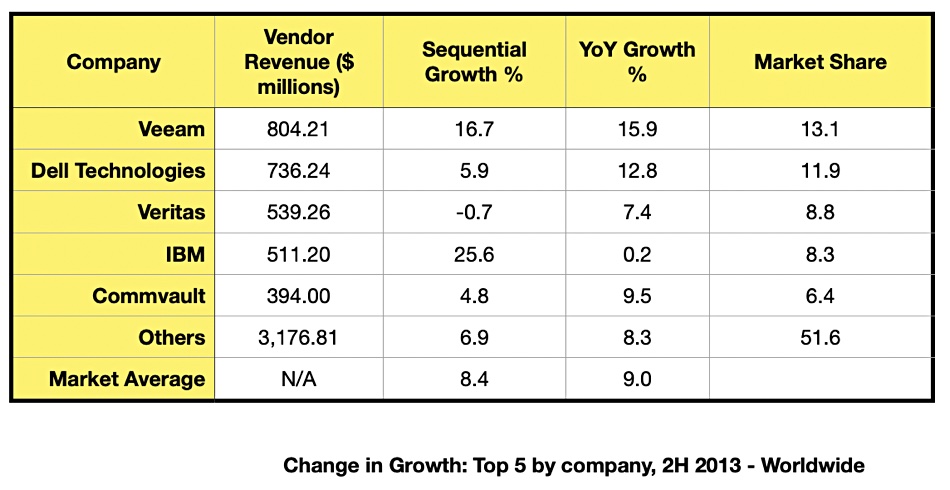

The analyst house gave its clients a Semi-Annual Software Tracker/Data Replication & Protection – 2H 2023 report, and Veeam shared the numbers for the change in growth by the top five companies worldwide for the second half of 2023. It had the highest revenue, the fastest growth rate and the largest market share. Here is the table it presented at a briefing in London today:

The IDC analysts say this tracker covers the data protection and recovery software, data-replication services and public cloud services market sectors.

An initial observation is that the market is highly fragmented. Veeam, the leader, has just over one eighth of the market. Because backup processes and file formats are proprietary and very “sticky” this is a market that’s enormously resistant to consolidation. Veeam has a 1.2 percent market share lead over second-placed Dell, and is growing faster than any other top five supplier on a year-on-year basis – but not a sequential half year by half year basis. By that measure IBM leads, with 25.6 percent growth. However, IBM’s year-on-year growth rate is a derisory 0.2 percent.

By buying the major part of Veritas’s data protection business, but not all of it, Cohesity will likely jump into a top five position at the end of 2024 when the acquisition is slated to complete. The Veeamsters at the presentation didn’t think Cohesity plus the majority share of Veritas would topple it from the number one slot.

We have charted the vendor revenues from the table:

It is also obvious from this chart that no one vendor has a commanding lead. We also charted market shares and year-on-year growth rates:

The top two, Veeam and Dell, and also Commvault, have growth rates higher than their market shares, whereas Veritas’s growth rate is slightly less than its market share and IBM is hardly growing at all. The leading two are growing their market share the fastest and are set to enlarge their lead over IBM and Commvault next year. We don’t know the growth rate of the combined Veritas-Cohesity business and so can’t predict what will happen there.

B&F thinks there is a likelihood that there will be another acquisition or merger in the data protection/cyber security market between now and the end of 2025. A legacy vendor could join with a thrusting upstart – one like HYCU, Clumio or Druva say – to bolster its market share, move more quickly into a growing market area, and offer broader coverage, of the on-premises and public cloud SaaS areas, to its enterprise customers. Imagine what might happen if an incumbent vendor like IBM and Commvault combined with a newcomer such as HYCU or Clumio, OwnBackup or Keepit.

In an era of constant and pervasive ransomware attacks, enterprises would surely like to deal with large data protection + security suppliers who could offer broader coverage of their at-risk data assets. That would be opposed to relying on several artisanal suppliers with little or no coordinated data protection and security coverage and unknown gaps in coverage.