Cirata, the successor to crashed WANdisco, has reported decreased revenues and increased losses for 2023.

WANdisco supplied replication-based Data Integration (DI) and DevOps/Application Lifecycle Management (DevOps) software. According to WANdisco’s previous filings with the authorities, a senior sales rep falsified sales reports and an inadequate sales management and monitoring system did not prevent this. Management thought the company was growing at a high rate – until auditors burst that bubble in March 2023. Sweeping executive changes followed, as well as a temporary ejection from the UK’s AIM stock market, layoffs, equity-based fundraising, readmission to AIM, and a name change to Cirata.

CEO Stephen Kelly, who was brought in to find a way forward for the business, today issued 2023 profit and loss accounts which show a deterioration in trading performance. “The speed of the recovery is slower than we anticipated,” Kelly said.

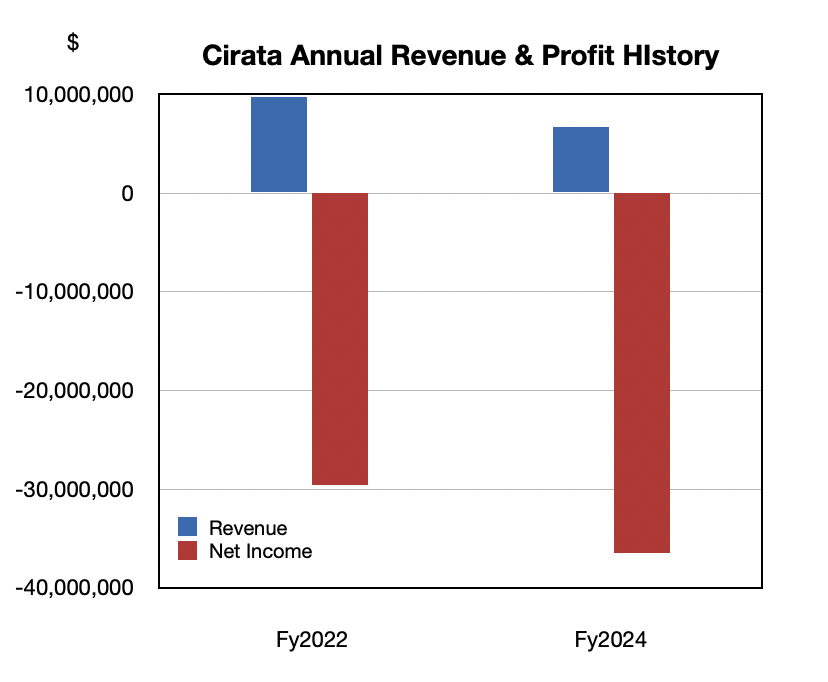

According to the update, 2023 revenues fell 30 percent year-on-year to $6.7 million and, the pre-tax loss widened to $36.5 million versus $29.6 million in 2022. Bookings of $7.2 million were down 37.5 percent.

Kelly said: “The first half of FY23 revealed a business at a standstill. Internally, the post 9 March 2023 announcement (the “Irregularities”) discovery period extending into late 2023 resembled the laborious task of Sisyphus. Reactive surprises, rear-guard activities and unexpected challenges occupied late nights and weekends. The situation demanded continuous firefighting. We were experiencing a seemingly endless series of ‘whack-a-mole’ challenges.”

“Soon after 9 March 2023, some customers and partners placed the Company on their ‘watchlist’, leading to a pause in activities and the then embryonic sales pipeline coming to a standstill. For a period, the only substantial executive interaction with certain customers and partners involved reassuring their compliance teams. It wasn’t until post-October 2023 that any semblance of normality returned, with Q4 2023 providing an opportunity for management to proactively plan for FY24.”

As Cirata’s annual results reveal, the sales management system was even more broken than the new management first thought. Kelly said: “The reality is that, since its IPO in 2012, the Company has raised $270 million but without delivering consistent sales momentum. Several fundamental elements of a scalable growth company seemed to be lacking.”

- “By mid Q2 FY23, there were no sales compensation plans, territory plans, or account reviews, which are key for a professional sales organisation.”

- Initial projections in March 2023 suggested a significant 12-month pipeline. “However, upon closer scrutiny the reality emerged. The reassessed pipeline was around 20 percent of the original figure and some of the ‘deal values’ overestimated. This reality within the GTM presented a scenario akin to starting from scratch.”

- “Sadly, over the preceding 12 months, a significant portion of the engineering schedule and product roadmap was anchored in customer requirements that did not exist.”

- “Company-wide, essential elements of governance, training and certification were missing.”

- “The working culture mainly characterised by a 4-day week, unlimited vacation, and working-from-home, failed to align with the operational reality of a loss-making business.”

- The new management team discovered that some customers and strategic partners had legacy contracts featuring uncapped licencing and partner agreements with unconsumed “pre-paids.”

An unanticipated $8 million cost for advisory fees resulted in pleas to the firms involved to reduce their fees. Some did. Some did not.

Kelly said management has struggled to deal with all these issues but the sales close cycle is still problematic. “Notably, although it is fair to represent that DI customers remain in the pipeline, the predictability of customer deal closure has been challenging, with a tendency for slippage from quarter to quarter. DI solutions are sold into large, complex enterprises and the sales cycle can be longer and unpredictable. A key focus of the new management team is to enhance the pipeline, improve predictability, and elevate overall sales performance.”

“Challenges and uncertainty remain. FY24 represents a transition year to growth and our path to cash-flow positive in FY25.”

Overall, Kelly said of 2023: “A necessary cost realignment, a capital raise and a ‘root and branch’ restructuring and refocusing of the Company sees the business exiting 2023 with its customers and partners re-engaging … FY24 needs to evidence a transition to growth.”

The 2024 bookings outlook is for revenues between $13 million and $15 million; 81 percent bookings growth at the low end and 108 percent at the high end. There is no revenue forecast. Cirata wants to exit 2024 at cash flow break-even.

Cirata will issue a trading update on the first 2024 quarter later this month and has noted that deal slippage is still a problem. It is hoping that sales booking and revenue momentum will pick up during the year to deliver the growth it needs in what is looking like a make-or-break year.