Rubrik has filed S-1 initial public offering documentation with the US Securities and Exchange Commission.

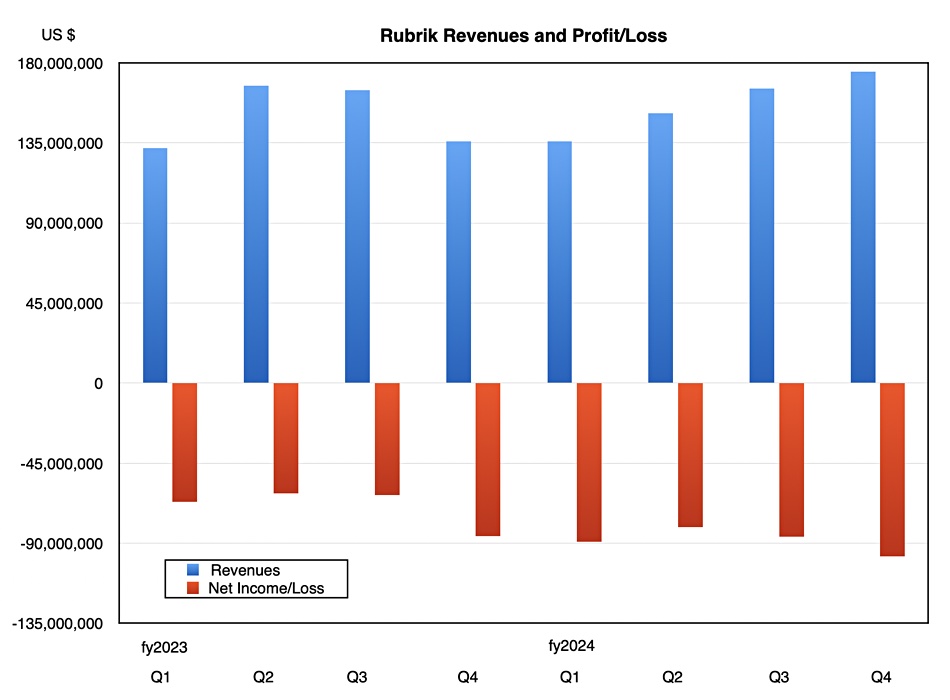

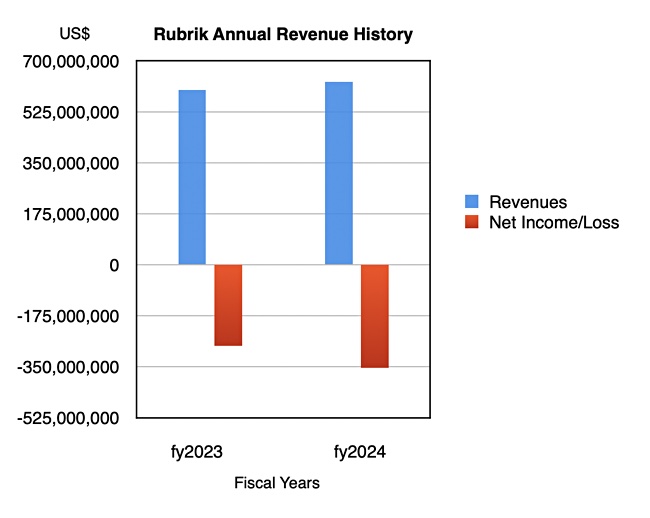

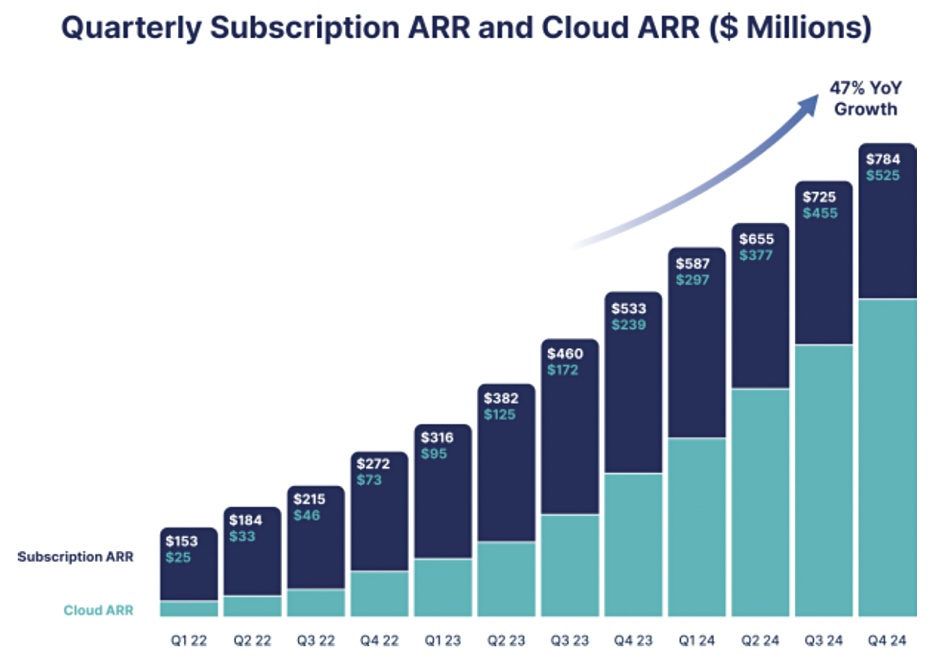

The filing reveals details of the cybersecurity and data protection business’s growth since it was founded in 2014. With the help of six funding rounds, Rubrik has raised more than $552 million to this end. Rubrik has more than 6,100 customers, up 22 percent year-on-year, and $784 million of subscription annual recurring revenue (ARR), which has risen 47 percent year-on-year. Total revenue in the year ending January 31, 2024, was $627.9 million, an increase of just 4.7 percent year-on-year. There was a net loss of $354.2 million compared to a loss of $277.7 million the year before. Rubrik is still spending heavily to grow its customer base and expand its business.

In an introductory letter, Rubrik CEO and co-founder Bipul Sinha writes: “When market transitions occur, opportunity arises to transform and massively expand existing markets. These disruptions allow new products to gain market relevance quickly and set the agenda of the new market order. This is precisely why I left my venture partnership to start Rubrik. The legacy backup and recovery market was ripe for such a transformation into data security based on cloud and cybersecurity trends.”

In its fiscal 2024, Rubrik’s operating cash flow was -$4.5 million, compared to $19.3 million in 2023. The free cash flow numbers were -$15 million in fiscal 2023 and -$24.5 million in 2024.

Rubrik believes its total addressable market (TAM) will be approximately $36.3 billion by the end of calendar 2024 and approximately $52.9 billion by the end of 2027, based on Gartner research, representing an average 13 percent compound annual growth rate (CAGR).

The company’s revenue growth rate has shrank due to a switch from perpetual license sales of its Cloud Data Management product to Rubrik Security Cloud (RSC) subscription-based revenues. This transition started around fiscal 2022 and makes Rubrik’s recent revenue history chart resemble that of a low-growth business:

Rubrik notes: “We expect new and existing customers to increasingly purchase subscriptions of RSC, which is recognized ratably over the term of the subscription. Our revenue will fluctuate based on the timing for transitioning our existing customers to RSC and when qualified customers choose to exercise or forfeit their customer options … The combination of both of these factors will limit and cause fluctuations in our subscription revenue growth through fiscal 2027, depending in part on the timing of our existing customers’ transition to RSC.”

As classic revenue growth has slowed, Rubrik has concentrated on measuring its ARR growth rate as that, it says, is a better indicator of its actual expansion:

The S-1 doc says of Rubrik profitability: “While we have experienced rapid revenue growth in recent periods, we are not certain whether or when we will obtain a high enough volume of sales to achieve or maintain profitability in the future.”

This market has several large and strongly competing players such as Veeam, Cohesity (which is buying most of Veritas’s data protection business), Commvault, Dell, Druva, IBM, and myriad smaller players. Rubrik’s S-1 points out: “Many of our current and potential competitors have longer operating histories and have substantially greater financial, technical, sales, marketing, and other resources than we do, as well as larger installed customer bases, greater name recognition, lower labor and development costs, and broader product solutions, including servers … We expect that competition will increase as a result of future software industry consolidation.”

The S-1 form does not specify the price range for Rubrik’s Class A common stock shares, nor the number that will be offered to the public. Earlier reports estimate the cash raised will be between $500 million to $700 million.

The bankers identified in the filing are Goldman Sachs, Barclays, Citigroup, Wells Fargo Securities, Guggenheim Securities, Mizuho Securities, Truist Securities, BMO Capital Markets, Deutsche Bank Securities, KeyBanc Capital Markets, Cantor CIBC Capital Markets, Capital One Securities, Wedbush Securities, SMBC, and Nikko.