There are some strange goings on at startup Nebulon. For much of Tuesday, February 13, its website redirected to a page on Nvidia’s dotcom. And before the weekend, Nebulon CEO Siamak Nazari indicated on his LinkedIn page he had left to take up a role at the GPU giant.

Nebulon supplies the Medusa2 SPU – that’s services processing unit – which aims to unify enterprise data services, network and cybersecurity services, and remote server management on a single Nvidia BlueField 3 DPU. The biz was founded in 2018 by executive chairman David Scott, Nazari, and CTO Sean Etaati, all three with 3PAR experience on their resumes.

Their startup developed its SPU as a proprietary add-in server card to offload storage and other management tasks from the host processor. The SPU is cloud-managed, and tries to provide fleet management as well as a secure and ransomware-resistant enclave for the host server’s operating system files. It shifted to Nvidia’s BlueField hardware last year. Nebulon raised $18.3 million in seed and A-round funding in 2018, with an unknown amount, possibly $5 million, coming from a 2021 B-round.

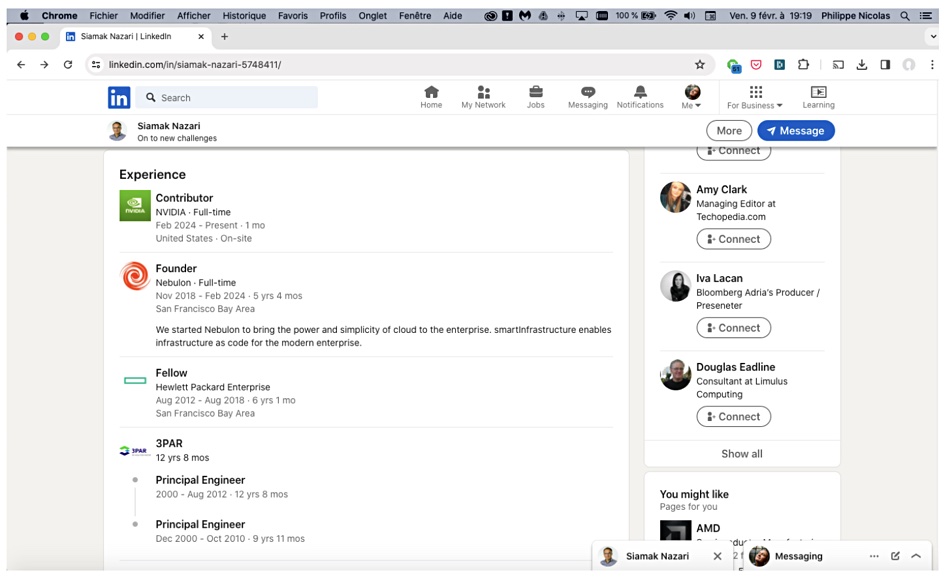

Nazari’s LinkedIn profile was updated to show he had switched to Nvidia as of this month. That update was later deleted but not before Storage Newsletter screengrabbed it, as shown below. Right now Nazari’s profile states he’s still at the company he co-founded and simultaneously “on to new challenges,” though where that may be is not specified.

The nebulon.com URL also redirected visitors to www.nvidia.com/en-us/data-center/dgx-cloud/ earlier today, as captured by the Internet Archive, though it now loads up Nebulon’s usual web home. That site’s team page still lists Nazari as chief exec.

A look around LinkedIn shows various Nebulon engineering staffers joining Nvidia:

- Technical director Phil Hooker became an Nvidia senior solutions architect in January.

- Dessie Roddy, a Nebulon technical support engineer, became an Nvidia technical engineer this month.

- Technical staff member David DeJong became an Nvidia senior software engineer in January.

- Senior tech support engineer Darren Carr joined Nvidia as an IT engineer in January.

- Michael Migal, Nebulon’s cloud team leader, joined Nvidia as a senior software engineer in January working on DGX Cloud.

- Tech staff member Leah Itagaki is now an Nvidia senior software engineer, joining in January.

- Martin Powderly, a Nebulon software engineer, joined Nvidia in same role this month.

This pattern of events could be indicative of Nvidia acquiring assets and some people from Nebulon or the whole company. One source told us Nebulon’s blueprints and engineering team was bought by Nvidia for $15 million, which would be less than Nebulon’s total funding if correct.

We have asked contacts at both Nebulon and Nvidia what is going on. Liz Archibald, a director of corporate communications and public relations at Nv, said: “Thanks for reaching out. We’ll decline comment.”

There has been no word from Nebulon. Something has happened, is happening, and neither Nebulon nor Nvidia want to talk about it.

Comment

The DPU market has proved to be a hard nut to crack as the routes to market are restricted. There are relatively few large suppliers of servers: Dell, HPE, Lenovo, Supermicro, and, some way behind, Cisco. If one or more of these adopts your DPU as a standard component, you stand a good chance of succeeding as a general market supplier. DPU startups Fungible and Pensando, to name two, found this did not happen.

Very large buyers of servers, such as the hyperscalers, could adopt a supplier’s DPU, if not acquire the business outright, which is what happened to Fungible. Microsoft snapped it up for $190 million at the end of 2020. When these sorts of businesses get bought, they become an internal system component supplier, not a general market supplier.

Processor suppliers can develop their own DPU – Intel with its IPU; Nvidia with BlueField – or buy a DPU startup, as happened with AMD buying Pensando for $1.9 billion in April 2022. This left Kalray and Nebulon struggling to sell DPU products in a server OEM market reluctant to adopt, and to enterprises unclear about the benefit of adopting a proprietary infrastructure technology with no big and credible name behind it. How could tiny Nebulon compete with Intel, AMD, and Nvidia against this background?

Its pivot to Nvidia’s BlueField hardware was a consequence of this; it’s cheaper to operate when the hardware’s designed for you. But Nebulon’s development of edge server cards, which could provide sales volume, came, with hindsight as an attempt to try and enter an edge server system market that was also dominated by OEMs including Dell, Lenovo, and Supermicro, and hyperconverged vendors such as Scale Computing.

All-in-all, the general DPU market is yet to appear and, without that, Nebulon, three years after its last funding round, looks vulnerable. Nvidia might well enjoy the idea of acquiring Nebulon IP that includes BlueField fleet management. Nv may well have acquired it. We await further explanation.