Privately-owned ExaGrid claims to have notched up record bookings and revenue during the final three months of 2023.

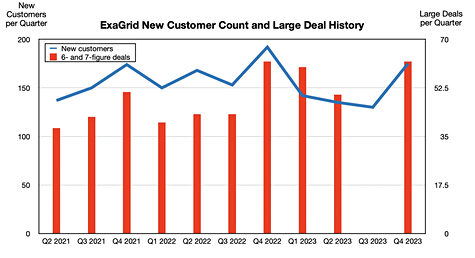

Exagrid supplies a two-tier appliance with incoming backups written as-is to a landing area, from which they can be restored. Once the ingest is finished, the data is deduplicated and sent to disk for longer-term storage. The business says it added 175 new customers in the quarter and completed 59 six-figure deals and three seven-figure deals.

The total customer count has now surpassed 4,100, we’re told, and the company has been free cash flow- and EBITDA-positive for 12 quarters in a row. ExaGrid has increased its reach beyond continental USA, a move that appears to be paying off.

President and CEO Bill Andrews said: “ExaGrid is continuing to expand its reach and now has sales teams in over 30 countries worldwide, with customer installations in over 80 countries. Outside of the United States, our business in Canada, Latin America, Europe, the Middle East, Africa, and Asia Pacific is rapidly growing. We now do 48 percent of our business outside of the United States.”

Andrews highlighted “our 95 percent net customer retention, NPS score of +81, the fact that 92 percent of our customers have our Retention Time-Lock for Ransomware Recovery feature turned on, and 99 percent of our customers are on an active yearly maintenance and support plan.”

We understand that ExaGrid’s customers are using standard primary storage disk behind the backup application about 65-70 percent of the time. With other customers, it meets most scale-up dedupe appliance competition from Dell PowerProtect (DataDomain as was) and HPE StoreOnce, with some Veritas customers using FlexScale appliances. It rarely competes with any other dedupe backup supplier.

ExaGrid customers retain their existing backup application in 85 percent of cases. When the backup software is being changed, ExaGrid finds that Veeam and Commvault are preferred with Rubrik and Cohesity also present.

According to our sources, ExaGrid has moved upmarket, deals are getting bigger, and around three-quarters of its bookings involved $100,000-plus purchase orders. The company has more than 30 open sales positions, and has just hired dedicated sales reps to go after global systems integrators such as Tata, Wipro, Tech Mahindra, HCL, Accenture, Capgemini, and more.