Infinidat has decided to use Arrow Electronics to manufacture its InfiniBox-based storage arrays.

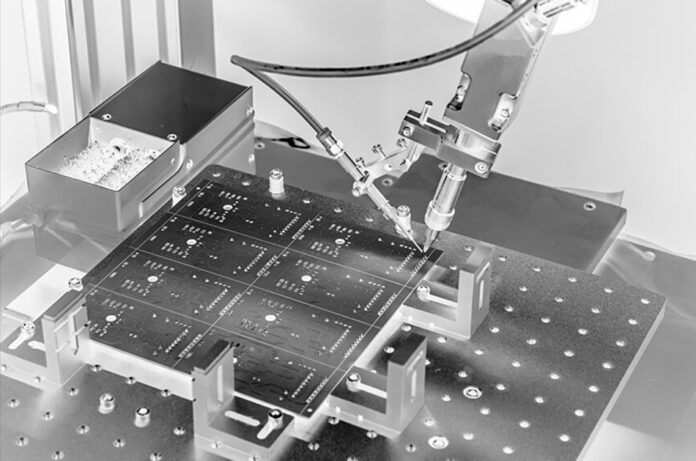

Arrow Electronics provides global product manufacturing services as well as being a value-added distributor. It says customers can invest their working capital elsewhere in their business with Arrow’s full product manufacturing support. Arrow supplies the components and subcontracts the manufacturing to an established network of qualified, global Electronics Manufacturing Services partners. Arrow is huge – it had sales of $37 billion in 2022.

Infinidat CEO Phil Bullinger explained in a statement: “Our collaboration with Arrow spans across our business from manufacturing and fulfillment services to global commercial distribution.”

This is: “accelerating our capabilities to deliver compelling business and technical value to enterprise customers globally with leading cyber storage resilience, storage consolidation, autonomous automation, and a powerful ROI.”

Prior to this arrangement, Infinidat operated with a local contract manufacturing partner in Israel. Bullinger told us “the global transition of these services to Arrow will expand our production operations with much greater purchasing power to multiple manufacturing sites in two different continents, including in the United States with closer proximity to our largest customer base. This will give us the ability to balance manufacturing activity and respond faster to global customer demand.”

It’s generally reckoned that manufacturing in-house entails significant working capital resources, management oversight, and supply chain overhead. A specialist contract manufacturer can combine sub-contracts into a large-scale manufacturing operating and gain efficiencies denied to a smaller-scale manufacturer.

The pandemic has caused severe supply chain difficulties across the IT industry and Arrow will be better placed to navigate them than Infinidat – particularly with global supply chains involved.

Salesh Rampersad, president of Arrow’s intelligent solutions business, provided his thoughts: “This collaboration is a testament to Infinidat’s commitment to providing reliable and innovative solutions to the industry and showcases Arrow’s integration services and global supply chain capabilities.”

Contract manufacturers can typically produce products in higher volume and lower cost than a business like Infinidat. We asked Bullinger: “What savings does Infinidat anticipate?”

He replied: “We expect to realize an overall positive business impact driven by more efficient upstream supply chain and global logistics, leveraging Arrow’s broader scale and capabilities. This significant expansion of our relationship with Arrow will help power our continued growth and expanding scale in the market.”

Generally a contract manufacturer does not reveal who their customers are, so Infinidat’s public deal with Arrow is unusual in that regard. Qumulo, Silk and VAST Data have each exited the hardware business recently, and Infinidat’s Arrow Electronics deal is not in line with a hardware exit.

Arrow will remain Infinidat’s primary commercial distributor globally, through its enterprise computing solutions business, and Infinidat will utilize Arrow’s intelligent solutions business for streamlined supply chain management, integration, and global logistics.