Korean memory fabber SK hynix reckons it has met the bottom of the DRAM market trough and the revenue way is up from here on, but the NAND market bottom is not here yet.

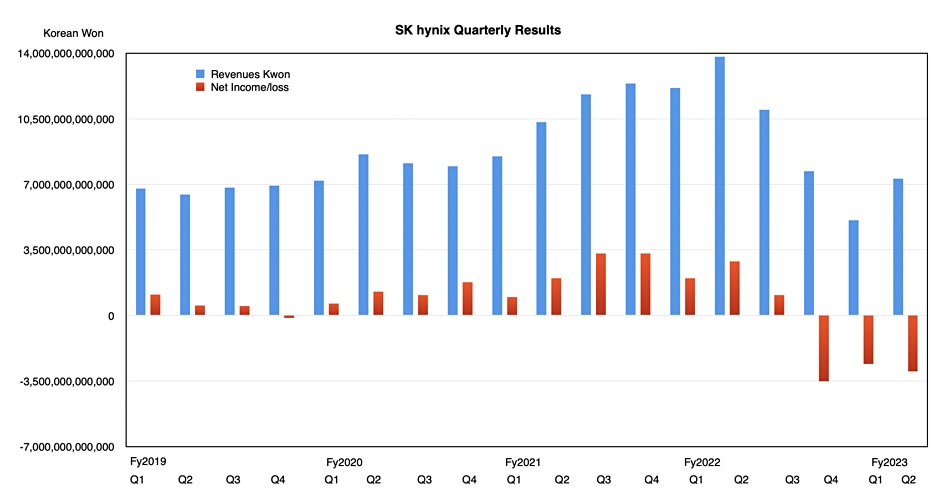

Revenues from its DRAM and NAND operations in the second 2023 quarter were 7.306 trillion won ($5.7 billion) with a loss of 2.988 trillion won (-$2.3 billion) compared to year-ago revenues of 13.8 trillion won ($10.8 billion), meaning a 47 percent drop, and a profit of 2.9 trillion won ($2.2 billion). Both DRAM and NAND product sales increased in the quarter, with a higher DRAM average selling price (ASP) contributing most to the revenue growth.

A company statement said: “Amid an expansion in [the] generative artificial intelligence (AI) market, which has largely been centered on ChatGPT, demand for AI server memory has increased rapidly. As a result, sales of premium products such as HBM3 and DDR5 increased, leading to a 44 percent sequential increase in revenue for the second quarter.”

A revenue history chart shows that there has been a substantial Q/Q rise in revenues from last quarter’s 5.1 trillion won ($4.0 billion). The company thinks that the demand for AI memory will stay robust, and also that DRAM prices are improving due to decreased production by memory companies in general.

Wells Fargo analyst Aaron Rakers said: “Hynix sees long-term AI server growth in mid-30 percent CAGR range looking forward; total server demand to grow in high-single digit percent CAGR range.”

Kim Woohyun, VP and CFO at SK hynix, said: “Having passed the trough in the first quarter, the memory semiconductor market is seen to have entered the recovery phase. SK hynix will strive to prop up earnings through its technological competitiveness in high-end products.”

It says the price for general DRAM products such as DDR4 continued to decline on sluggish demand for both PCs and smartphones. Rakers said: “Smartphone demand is expected to improve in 2H2023 via new product cycle and content growth via price elasticity.”

SK hynix’ overall ASP for DRAM rose due to increased high-end DRAM sales for AI servers. It intends to expand sales of high-end DRAM products, including HBM3, DDR5 and LPDDR5 memory products, as well as 176-layer SSDs, to help accelerate its earnings improvement.

It will expand HBM3 and DDR5 output in response to AI server demand. But NAND inventory levels are still too high and the company will cut its NAND output by 5 to 10 percent to help reduce them, and so bring NAND production and demand into a better balance.

SK hynix will also work to raise the quality and yields of its gen 5 10nm DRAM process technology, the 1b-nanometer class, to help raise production. It will do the same with its 238-layer NAND this year but only expand the scale of mass production once the NAND industry upturn is visible.

Separately, according to to a South China Morning Post report, SK hynix has rebuffed suggestions that it will sell it Dalian 3D NAND fab in China, which it acquired from Intel with Solidigm. Dalian output is needed for Solidigm SSDs. It notified the state of California that it has also laid off 98 people from the Sacramento County branch of its NAND Product Solutions Corp, aka Solidigm, likely as a way of cutting costs.