Western Digital could have HAMR disk drives in volume production in 12 to 18 months, according to the company’s CFO. He also denied that SSDs will make HDDs obsolete.

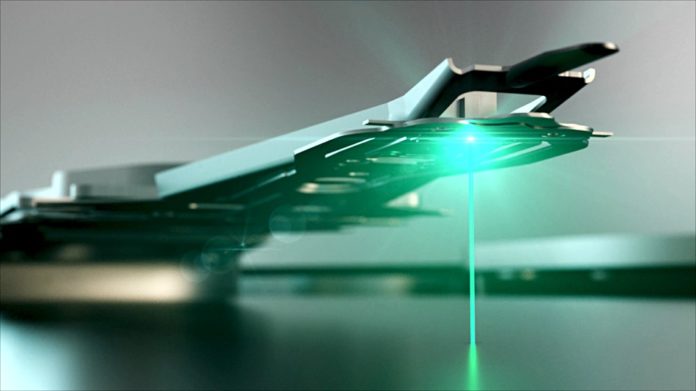

This is unexpected as Western Digital has been prioritizing its MAMR (microwave-assisted magnetic recording) technology over HAMR (heat-assisted magnetic recording), saying HAMR will likely follow MAMR. Now it’s suggesting MAMR is a relatively short-term stopgap technology. Competitor Seagate has a 30TB HAMR drive coming this quarter and will be volume shipping HAMR drives in three to four quarters.

Wissam Jabre told a Bank of America analysts meeting: “On the HAMR side, we’re probably a year to 1.5 years plus before we get sort of volume production.” That’s a fairly wide time span and could actually be 12 to 24 months.

Western Digital is currently shipping 22TB conventional disk drives and 26TB shingled drives. A 30TB Seagate HAMR drive gives it an 8TB advantage over the 22TM WD product. Western Digital must be bringing out a >22TB conventional drive using its MAMR/Optinand tech but is unlikely, in our estimation, to be able to manage a leap to 30TB. It has to move to HAMR, it appears, because MAMR has a limited technology runway in capacity terms.

Jabre also answered questions about SSDs killing hard disk drives, prompted by Pure Storage’s marketing points around its QLC (4 bits/cell) flash arrays. He said: “I think hard drives will still be shipping in five years plus. Look, there’s this whole discussion around where the flash prices are today, [whether] there’s cannibalization of hard drive or not. We don’t see it. And we do sell both.”

“In fact, over the last quarter or two, probably the enterprise SSD business was a little bit more impacted than the hard drive business,” meaning sales were lowered more.

What about HDD and SSD cost declines over the next three to five years? He said: “I think the cost declines on the HDD side would still be there. They won’t be as high as the cost declines we would experience necessarily on the flash side as an industry, but they’ll still be there. And they will still be there in a meaningful way to allow for that TCO to continue decline and make it economic for our customers to adopt them.”