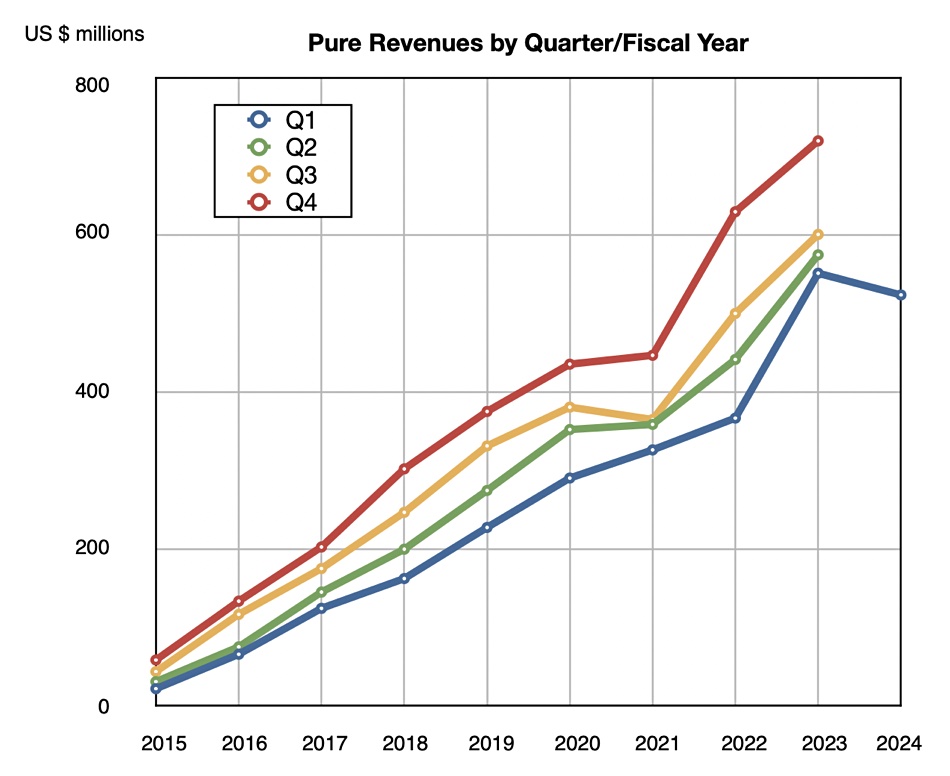

Pure Storage revenues declined in its first quarter of fiscal 2024 as enterprise and cloud customers slowed buying activity due to the uncertain economic situation.

The $598 million brought in for the quarter ended May 7 was down 5 percent on a year ago, with a loss of $67.4 million, compared to the $11.5 million loss the prior year. It was Pure’s first decline after eight consecutive growth quarters and in keeping with quarterly results from HPE storage, down 3 percent, and NetApp, down 6 percent. The previous year’s Q1 revenues were enlarged with a $60 million Meta deal and there would have been 5 percent revenue growth this year ignoring that. Pure gained 276 new customers in the quarter, the lowest number for 10 quarters.

CEO and chairman Charlie Giancarlo said: “We are the clear leader in data storage, now delivering a portfolio that can address the vast majority of storage needs for all enterprises. The superior economics, performance, and operational and environmental efficiencies of Pure’s product portfolio over both hard disk and SSD-based, all-flash competitive offerings are now undeniable.”

This ”clear leader” statement is one that other suppliers, with larger storage sales, would find difficult to reconcile with their reality. HPE, for example, just reported $1 billion in storage sales and NetApp recorded $1.6 billion. In March Dell reported $5 billion in storage revenues, 8.5x higher than Pure’s $598 million. Pure looks to be fifth in the storage revenue rankings, behind Dell, HPE, Huawei and NetApp – an odd sort of leadership in data storage.

Financial summary

- Gross margin: 70.1 percent

- Operating cash flow: $173.2 million

- Free cash flow: $121.8 million

- Total cash, equivalents & securities: $1.2 billion

Pure said it had a record pipeline for its latest FlashBlade//E product, it’s QLC flash-using wannabe nearline disk array killer. Giancarlo re-emphasized this aspect of the product, saying: “As I have stated in the past, the days of hard disks are coming to an end – we predict that there will be no new hard disks sold in 5 years.”

He said: “FlashBlade//E is the second in a series of products that can compete for the secondary tier, and soon lower tiers, of the storage market entirely dominated today by hard disks.” That “lower tiers” remark is a nod, we understand, to even higher capacity flash drives that Pure will announce in the next few months.

In his view: “With the introduction of our //E product line, Pure can now compete for customers’ entire storage estate, enabling Pure to become their complete storage partner for the first time.” We’d gently remind him that some potential customers, such as the three top cloud service providers and other large enterprises, use tape storage for archival reasons, and Pure has no offering in the tape market. Charlie Giancarlo is not one to undersell the company he both leads and chairs.

The Evergreen One Pure-as-a-Service subscription business doubled revenue year-on-year. That drove up subscription services revenue by 28 percent to $280.3 million. Subscription ARR rose 29 percent to $1.2 billion. Pure closed a near $10 million deal for its Cloud Block Store in the quarter.

Pure claimed it is the chosen vendor for AI environments across a broad range of industries, notably media, entertainment, pharma, healthcare, aerospace, transportation, and financial services. GIancarlo said: “We expect our leading role in AI to continue to expand, but we are equally excited that the requirements for big data will drive even more use of high performance flash for traditional bulk data.” He is confident Pure will increase its storage market share, outgrowing its competitors.

Revenue guidance for the next quarter is $680 million, which would be 5 percent higher than the year-ago Q2. Full 2024 guidance is for 5-9 percent growth over 2023’s $2.8 billion.