HPE grew revenues 4 percent in Q2 of its fiscal 2022 – albeit missing previous guidance – with stronger sales of edge networking and HPC helping to offset tumbling server shipments that dragged down total storage turnover.

Group revenues were $6.973 billion in the quarter ending April 30 with a profit of $418 million, up 67 percent annually, helped by previous efforts during the pandemic to trim operating expenses.

CEO and President Antonio Neri trilled: “Building on a great start to the fiscal year, HPE grew revenue, increased the contribution of recurring revenue through the HPE GreenLake edge-to-cloud platform, and delivered exceptional profitability to generate a strong second quarter performance.”

EVP and CFO Tarek Robbiati said: “These results demonstrate that our strategy to pivot our portfolio to higher-growth, higher-margin areas is working – and that we are operating with discipline.”

The company saw longer sales cycles due to the general economic situation but said AI-related sales were a big bright spot.

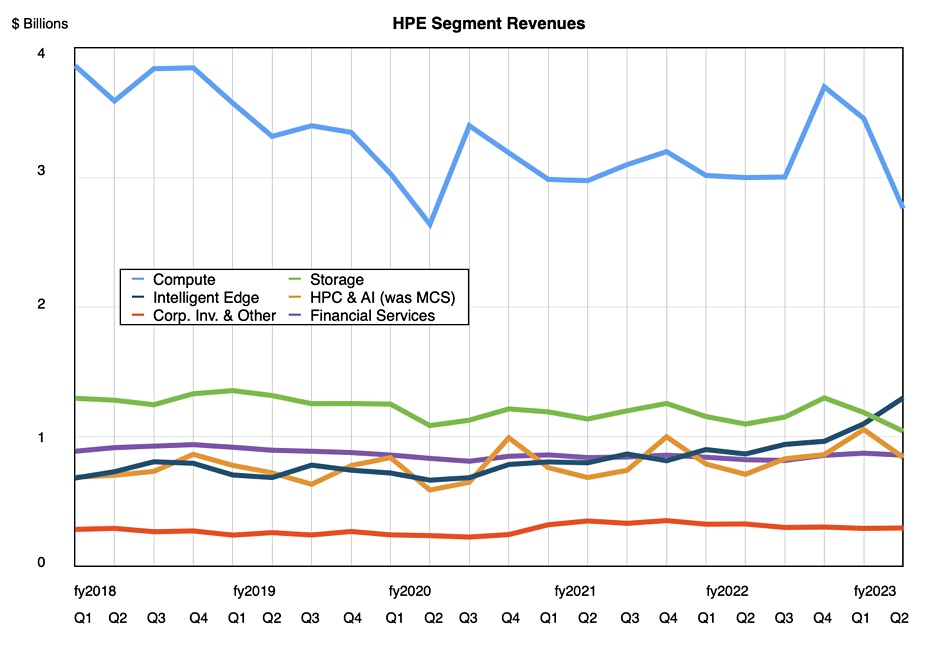

The largest business segment for HPE is servers, which brought in $2.761 billion, down eight percent year-on-year and the second consecutive quarter of declines. Wells Fargo analyst Aaron Rakers pointed out that profitability increased for the Compute division as average server prices grew in single digit percentages on the back of richer configurations sold.

The Intelligent Edge (Aruba) division reported revenues of $1.3 billion, up 50 percent year-on-year. This eclipsed storage divisional revenues of $1.043 billion which declined 3 percent annually. Storage was, however, a tale of two halves as external storage (Alletra) sales grew by triple digits – for the fourth consecutive quarter – but not quite high enough to counter the fall in storage based on HPEs servers, which declined at a greater rate than Alletra’s increase. All-flash array sales grew 20 percent annually.

Financial services recorded $858 million in revenues, up 4 percent, with HPC and AI reporting revenues of $840 million, 18 percent higher than a year ago. Tail runner Corporate Investments and Other had $296 million in revenues, down 9 percent.

GreenLake, HPE’s cloud-like subscription business, has now captured more than $10 billion in total contract value to date and the Annual Revenue Run-rate grew 35 percent year-on-year in HPE’s Q2 to $1.1 billion.

Financial Summary

- Gross margin: record 36 percent, up 3.6 percent Y/Y

- Operating cash flow: $889 million

- Free cash flow: £288 million

- Diluted EPS: $0.32, up 68 percent Y/Y

- Share repurchases and dividends in quarter: $261 million

Neri said during the earnings call that HPE saw “saw some decline in the health of microeconomic conditions, causing unevenness in customer demand, particularly in general purpose computing.”

He added: “European, Asian and mid-sized company deals are holding up better than expected while large enterprise businesses and customers in certain sectors, such as financial services and manufacturing in North America have been more conservative.”

Sale cycles are being stretched as some customers are becoming more hesitant to commit to new projects. Neri mentioned “some sluggishness from large accounts.”

The AI opportunity

The CEO said: “Our shift to a higher-margin portfolio mix led by the Intelligent Edge segment, and the strong demand for our AI offering, further strengthen the investment opportunity for our shareholders.”

Robbiati amplified this: “The emergence of large language models and generative AI has prompted many inquiries from our customer base during the past quarter, which are turning into pipeline and orders. In the past few months, we have multiple large enterprise AI wins totaling more than $800 million and counting. This includes large AI as a service deals under the Green Lake model.”

HP intends to invest organically and inorganically in AI.

Neri said what HPE had experienced in AI was “simply amazing, breathtaking. In some cases, I consider AI a massive inflection point no different than web 1.0 or mobile in different decades. But obviously the potential to disrupt every industry, to advance many of the challenges we all face every day through data insights, is just astonishing.“

He reckons HPE is well-positioned with a hybrid AI market opportunity because it can support AI inference at the edge as well as in the data center, in supercomputing and in the cloud.

Neri highlighted HPE’s “second exascale system called Aurora for Argonne National Laboratory, Aurora will develop a series of generative AI models to run on the HP Cray EX supercomputer”.

We can expect to hear more at the HPE Discover event in Las Vegas next month.

HPE is uprating its profitability and EPS guidance for the full year on the back of the latest financial numbers.

China

HPE expects to see more money coming in from China and its HC3 joint venture with China’s Unisplendour International Technology (UNIS). HPE owns 49 percent of H3C Technologies which sells HPE kit in China. It has entered an agreement, a Put Share Agreement, to sell its HPC shares for $3.5 billion in cash to UNIS. This transaction could take place in the next 6 to 12 months depending on regulatory approval, but may take longer.

HPE has negotiated a new Strategic Sales Agreement with H3C covering the sales of HPE gear in China, and said it “is firmly committed to serving customers and continuing to do business in China through both direct sales and our partner H3C.“

Outlook

The revenue forecast for Q3 is flat: $6.7 billion to $7.2 billion; $6.95 billion at the mid-point and the same as a year ago. This will be the first full quarter of GreenLake file services, the HPE-VAST Data deal, and we’ll see if that delivers a boost to HPE’s storage sales. If it does then the odds of HPE providing a VAST-based GreenLake object services offering should increase.