The whole area of IT storage is buzzing with innovation, as startups and incumbents race to provide the capacity needed in a world exploding with unstructured data. Chatbot technology, the I/O speed to get data into memory, the memory capacity needed, and the software to provide, manage, and analyze vast lakes of data all create massive opportunities.

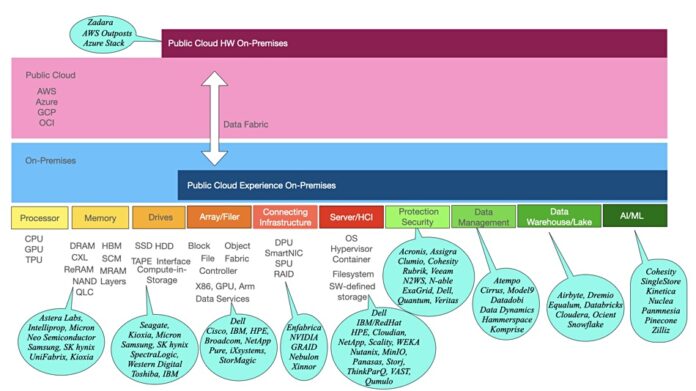

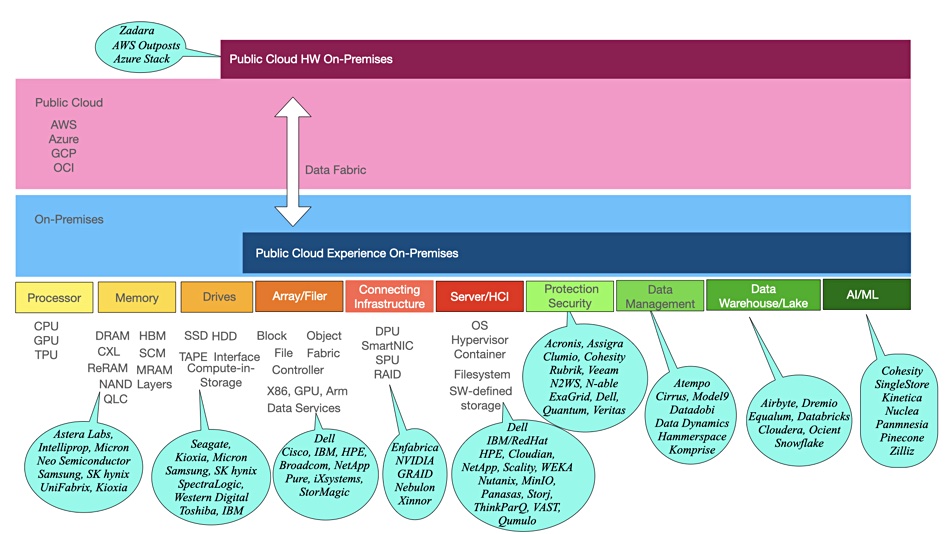

Growing amounts of data need storing, managing, and analyzing, and that is driving technology developments at all levels of the IT storage stack. We’ve tried to put this idea in a diagram, looking at the storage stack as a spectrum running from semiconductor technology at the left (yellow boxes) to data analytics technology at the right (green boxes):

Talk about a busy slide! It starts with big blue and pink on-premises and public cloud rectangles. Below this is a string of ten boxes, stretching from the smallest hardware to the largest software. The first six have sample technology types below them. A set of nine blue bubbles contain example suppliers who are constantly bringing out new technology. A tenth such bubble can be found to the top left – building public cloud structures on-premises.

This diagram is not meant to be an authoritative and comprehensive view of the storage scene – think of it as a representative sample. There isn’t an exhaustive list of innovating suppliers either, just examples. Exclusion does not mean a supplier isn’t busy developing new technology – they all are. You can’t survive in the IT storage world unless you are constantly innovating – both incrementally with existing technology and through new means.

Although innovation is ongoing, the amount of money and number of funding events for storage startups has slowed this year. So far this year we have recorded:

- Cloudian – $60 million

- Impossible Cloud – $7 million

- Intrinsic Semiconductor – $9.73 million

- Komprise – $37 million

- Pinecone – $100 million

- Volumez – $20 million

- Weebit Nano – $40 million share placement

That’s a total of $273.7 million – not a lot compared to 2022, when we saw $3.1 billion in total funding events for storage startups.

Near the midpoint this year there have been just five acquisitions, and no IPOs:

- Iguaz.io bought by McKinsey & Co.

- Model9 bought by BMC

- Ondat acquired by Akamai

- Databricks bought Okera

- Serene bought crashed Storcentric and its Nexsan products

In 2022 Backblaze IPO’d, Datto was bought for $1.6 billion, Fungible was acquired by Microsoft, MariaDB had a SPAC exit, AMD bought Pensando, Rakuten bought Robin, Hammerspace acquired Rozo, and Nasuni bought Storage Made Easy – it was a much busier year.

There could be more this year as DRAM and NAND foundries buy CXL technology, and data warehouse and lakehouse suppliers acquire AI technologies.

We have, we think, at least three IPOs pending: Cohesity, Rubrik and VAST Data. Possibly MinIO as well, and we might see private equity takeouts for other companies.

The world is bristling with new technology developments. Think increased layer counts in the NAND area, memory pooling and sharing with CXL, large language model interfaces to analytical data stores, disk drive recording (HAMR/MAMR), cloud file services, tier-2 CSP changes, incumbent supplier public cloud-like services for on-premises products, SaaS application backup, and Web3 storage advances.

Keeping up with all this is getting to be a full-time job.