Open source data synchronizer Airbyte has a new API, complementing its existing cloud UI, that makes it possible to automate data movement and manage large deployments. Other suppliers can embed Airbyte Cloud’s data movement capabilities directly into their product offerings. Integrating Airbyte Cloud with orchestration tools like Airflow, Dagster, or Prefect makes it easier to manage and monitor data pipelines and ensure data is flowing smoothly between sources and destinations. A Terraform SDK is coming soon to define configurations and automate deployments as part of CI/CD pipelines. This will enable Airbyte resources and configurations to be version-controlled, reviewed, and tested.

…

Analyst house KuppingerCole says Arcserve is one of six market champions in its 2023 Leadership Compass for Cloud Backup for Ransomware Protection report. In alphabetical order the champions are Arcserve, Cohesity, Commvault, OpenText (MicroFocus), Veeam and Veritas. Read a blog and download the Arcserve-focused report extract here.

…

Backup supplier CrashPlan has a new Partner Program giving channel partners dedicated resources to make onboarding quick and painless, enhance sales opportunity identification, and shorten time-to-revenue. With incumbency protection and CrashPlan’s long lifetime value, it will continue to reliably produce revenue for partners in the program for years to come.

…

Data lakehouse supplier Dremio has achieved Microsoft Top Tier Partner status, Microsoft’s highest level of partner designation for Azure IP co-sell partners, driving strategic collaboration, solution differentiation and dynamic go-to-market momentum.

…

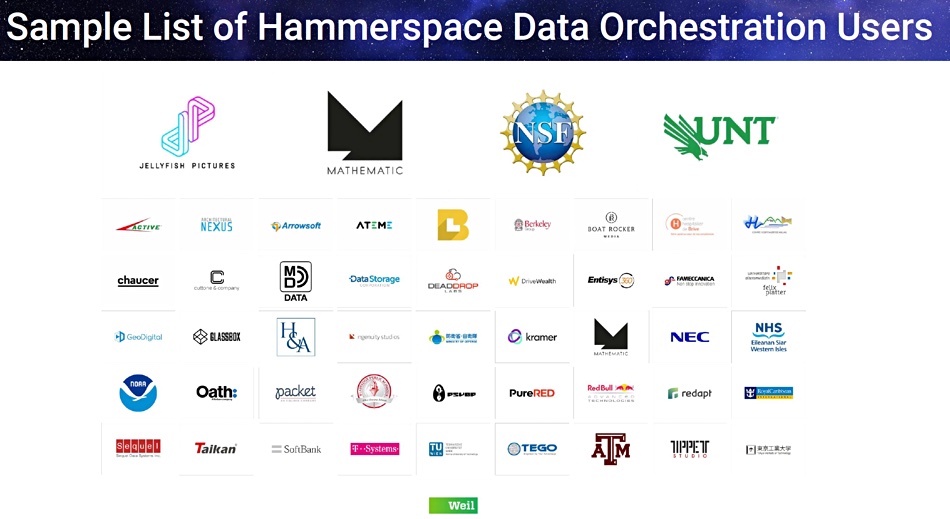

Data orchestrator Hammerspace said in a quarterly briefing that its business progress is accelerating. It showed a slide listing 50 users:

It says its channel partners are bringing in more opportunities and its pipeline is growing.

…

Infinidat has produced a datasheet describing its InfuzeOS’s capabilities. InfuzeOS runs on the InfiniBox, InfiniBox SSA and InfiniGuard systems. Download it here.

…

Infinidat is supporting Tech Tackles Cancer through the “Battle of the Tech Rockstars” charity competition in London on May 24 at the O’Meara Nightclub and in Boston on September 21 at The Sinclair (Cambridge). These fundraising events are part of a broad effort within the tech community to advance cancer research and help pediatric cancer patients and their families. Infinidat is actively involved as a Gold Sponsor of both Tech Tackles Cancer London and Tech Tackles Cancer Boston. Infinidat also has a seat on the volunteer-led team that oversees and plans the organization’s activities.

…

Semiconductor analyst Mark Webb of MKW Ventures asks “When Will SSD Cost be Lower than HDD Cost?” He says he updated all the numbers he had previously shown at FMS 2022 on April 26 and the answer is still 2034, possibly, as he has previously calculated! He reckons that HDD technology has a few tricks left to pull and NAND scaling will slow over time [see Pure note below].

…

Peer Software is partnering with Wasabi Technologies to provide a combination of built-in failover/failback and disaster recovery protection that reduces or eliminates snapshot or backup window limitations to keep critical data current and easily accessible on Wasabi cloud storage. Peer provides PeerGFS, a distributed file system that integrates existing storage systems across multi-site, on-premises and cloud storage. It has local access to data, high availability and redundancy across synchronized storage systems, and continuous data protection, and now supports Wasabi.

…

Proact has become a Rubrik Authorized Support Partner.

…

Shawn Rosemarin, VP, Product Management at Pure Storage, believes there will be no hard disks sold five years from now. He says NAND cost dynamics, density, energy efficiency, resiliency and innovative storage software are the game changers here and Pure Storage is leading this charge. Flash density will be a major factor in accelerating the move from HDD to Flash. We’re arranging a briefing to find out why he thinks this is true.

…

Analyst house TrendForce says SK hynix, Samsung and Micron had 50, 40 and 10 percent HBM market share respectively on 2022. As more customers adopt HBM3, SK hynix, the only mass producer of HBM3 chips, will get a 53 percent HBM market share in 2023 with Samsung and Micron having 38 and 9 percent, respectively. These two are expected to start HBM3 mass production towards the end of this year or in early 2024.

…

UK law firm Charles Russell Speechlys has selected a StorMagic SvSAN, running on two HPE DL380 servers in a hyperconverged configuration, for nine of its global offices. It says it found SvSAN was easy to deploy, showed better disk latency and offered the easiest storage usage visualization compared to Starwind and Linux Ceph. Speechlys previously used VMware vSAN to manage its business-level applications, including domain controller, Microsoft Exchange databases, and SQL.