Commvault’s earnings were hit in the last quarter by a degree of large deal buyer reluctance, as revenues flattened.

Update: Financial analysts and earnings call-related information added 3 May, 2023.

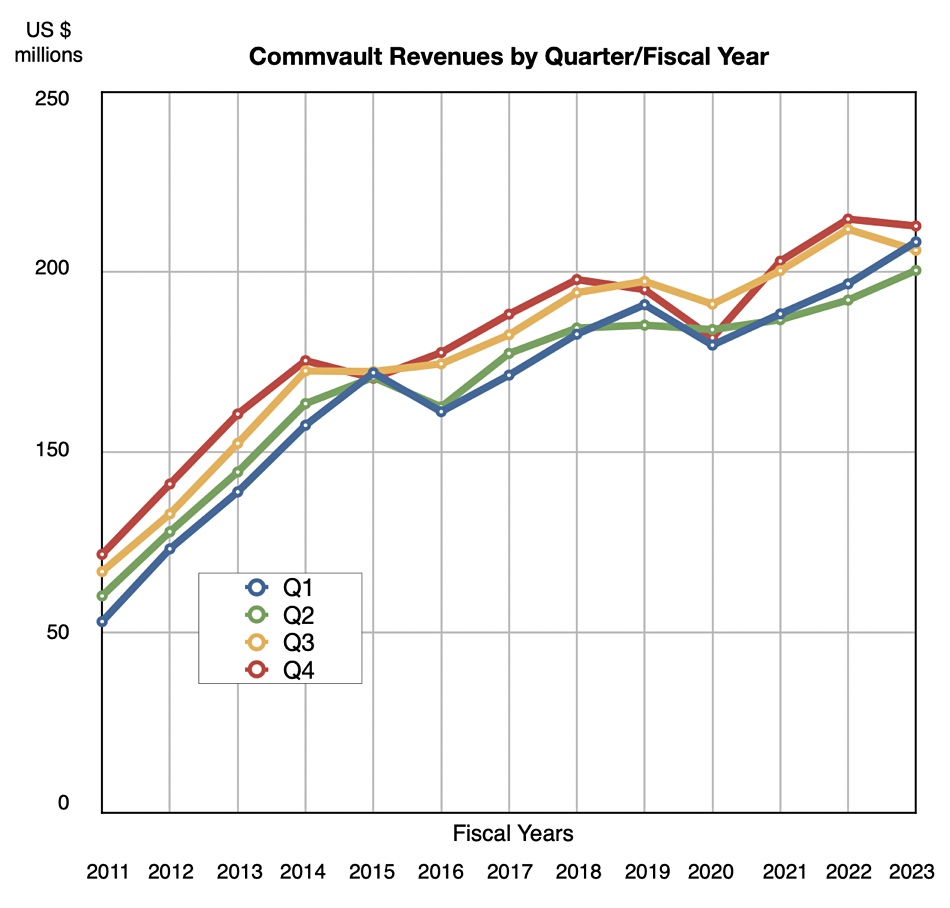

Revenues in the fourth FY2023 quarter, ended March 3, were $203.5 million – 1 percent lower than a year ago, but exceeding Commvault’s guidance of $197 million. There was a loss of $43.5 million, dramatically down on the year-ago profit of $8.0 million. Full FY2023 revenues were $784.6 million, 2 percent higher than a year ago, with a loss of $35.8 million – pretty much all due to the loss-making fourth quarter.

Sanjay Mirchandani, Commvault president and CEO, accentuated the positive, saying: “Commvault closed out the year strong, highlighted by Metallic eclipsing the $100 million ARR mark, 15 percent year over year total ARR growth, and strong cash flow. We enter the new fiscal year with momentum and confidence that Commvault customers are future proofed for the road ahead.”

The loss is partly attributable to an operating expenditure increase. Total Q4 opex rose from $162.5 million a year ago to $206.3 million, and within that there was a non-cash headquarters impairment of $53.5 million. Commvault is selling its 278,000 square foot Tinton Falls HQ to Ashling Development LLC for $40 million, leasing back just 10 percent of it. Remote work is the new normal for everyone, it seems.

Financial summary

- Operating cash flow: $67.8 million compared to year-ago $87.1 million

- Free cash flow: $66.8 million.

- Diluted loss/share: $0.98 vs $0.17 diluted earnings/share a year ago

- Total cash: $287.8 million vs $267.5 million a year ago

Software and products brought in $90.2 million, 10 percent lower year on year. There were 187 large deals – transactions with greater than $100,000 of software and products revenue – in the quarter, down from 206 in the prior quarter and 226 a year ago. These large deals represented 72 percent of Commvault’s software and products revenue, so hiccups there directly affect the bottom line.

Services revenue rose 7 percent annually to $113.2 million.

Total recurring revenue in the quarter was flat year on year at $173.9 million, while annual recurring revenue (ARR) was up strongly with a 15 percent jump to $668.4 million. Subscription ARR rose 38 percent year on year to $477 million. The subscription business is 71 percent of Commvault’s ARR and subscription revenue – up 9 percent year on year to $95 million – is 46 percent of Commvault’s total revenue.

Commvault said deferred revenue growth related to Metallic as-a-service offerings continues to be a driver of cash flow. About 70 percent of Metallic customers are new to Commvault and there is a 125 percent net dollar retention rate; customers are spending more.

Its board has increased its share repurchase program funding to $250 million. Commvault notes that free cash flow supports share repurchases and it wants to use around 75 percent of FY2024 free cash flow for repurchasing shares.

Update

Wells Fargo analyst Aaron Rakers notes that Commvault’s perpetual license revenue at $17.561 million was -25 percent y/y and -11 percent q/q, contrasting strongly with the subscription revenue rises. Commvault disclosed that it has ~7,300 subscription customers; about half of its customer base. This compares to 6,600 and 5,000 in the prior and year ago quarters respectively.

William Blair Analyst Jason Ader noted: “While subscription revenue boosted growth, the weaker macro environment continued to challenge large deals. Management noted that while macro did not deteriorate from the prior quarter, budget scrutiny and elongated deal cycles persisted,” primarily in the enterprise market.

Ader is cautious about Commvault’s prospects because of competitive pressures; “As noted in our recent VAR tracker note, the data protection market remains highly fragmented and competitive, with newer vendors like Cohesity, Rubrik, Druva, Veeam, HYCU, and OwnBackup all seeing good traction. While VARs continued to see Commvault as the most feature-rich and robust data protection platform on the market, we worry that the company remains at risk of donating market share to newer, innovative, more brand-forward vendors.”

Commvault’s revenue guidance for the next quarter – Q1 fy2024 – is for revenues between $195 million and $199 million; $197 million at the mid-point. This compares with $198 million a year ago (Q1 fy2023). It provided a full fy2024 revenue guide of $805 million to $815 million compared to fy 2023’s $784.6 million, a 3.2 percent rise at the mid-point.

Rakers told subscribers: “We are Overweight CVLT shares, and believe the company’s positioning as a data management play for hybrid cloud, improving competitive positioning with HyperScale, Metallic, and Activate, as well as increasing subscription renewal cycle opportunity should be viewed as positives. We believe Commvault can return to a sustainable mid single-digit revenue growth story.”