UniFabriX says its CXL memory expansion technology can double the number of servers in a CSP’s datacenter racks.

The Israeli startup has developed a Smart Memory Node with 32TB of DDR5 DRAM in a 2RU chassis. The pitch is that attached servers need less local DRAM, sharing the Smart Memory Node’s memory. That way they don’t have local stranded DRAM that’s not being used efficiently.

CEO and co-founder Ronen Hyatt told an IT Press Tour: “For Cloud Service Providers we can 2x servers on a rack, up from 12 to 24. We take some memory from existing 12 servers and put it in Smart Memory Node. CSPs can then improve their server/DRAM granularity. We do it when the CSP builds new server racks. You don’t physically move DRAM DIMMS from the existing servers; you populate the rack with servers with smaller DRAM capacity than before.”

The reason is that by using the Smart Memory Node each server needs half as much electrical power as before, and the benefit is that the CSPs get twice as much revenue from a rack; more servers means more compute instances available to the CSP’s customers.

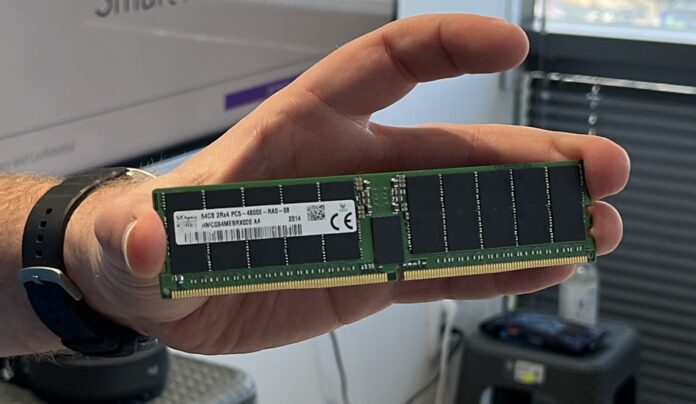

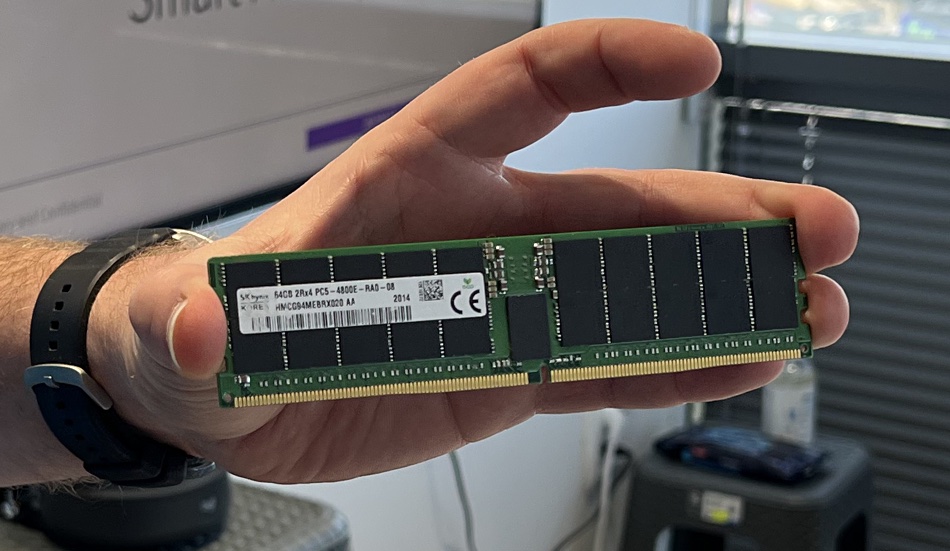

The UniFabriX node uses standard DDR5 DIMMs on a main printed circuit board with FPGAs running the controlling software which provisions and deprovisions memory. Hyatt said the DIMMs are denser than a CXL memory expander card such as one from Samsung. Thermal considerations were also important in the DIMM choice, he added..

UniFabriX had to develop special cables to link the Smart Memory Node to the servers in a rack. The node has 10 x PCIe gen 5 ports in its rear face and each port can be bifurcated. It developed a 16-lane PCIe gen 5 cable with each lane carrying 32Gbps full duplex.

UniFabriX’s software provides CXL 1.1. (memory expansion) and 2.0 (switching and memory pooling) functions and most of CXL 3.0 but not the multi-level switching and some security features. Hyatt said: “We can abstract 90 percent of CXL 3.0 features and make them usable in CXL 1.1 and 2.0 environments.”

The node provides memory checkpointing, useful during long application runs as a way of recovering from any failures. Hyatt said that UniFabriX provides software primitives and a mediation layer for hyperscalers to compose Smart Memory with servers, providing memory as a service.

The company has paying customers – the HPC market was mentioned – and is looking for OEM deals. There has also been interest from a composability company, but UniFabriX did not want to follow up that opportunity, preferring to focus on the CSP and HSP server memory expansion market.

It believes the CXL memory market could have a $20 billion total addressable market (TAM) by 2030, with the specific memory pooling TAM being in the $14 billion to $17 billion range. If UniFabriX can capture a decent percentage of that, its backers will be very happy with CXL memory expansion and pooling driving their own revenues.