Despite the worldwide economy heading into recession due to COVID, Russian war on Ukraine and inflation, ExaGrid says it has increased its sales in the fourth 2022 quarter, recruited more customers than ever before, and claims to be having a record revenue year.

The company builds purpose-built and scale-out backup appliances, with backups stored in a fast ingress and restore landing zone until being deduplicated for longer-term retention. It said revenues for its fourth 2020 quarter had increased by more than 20 percent (though of course we don’t know the figure for the base sales amount) and there were 192 new customers in the quarter, recruited by its more than 200 salespeople. This takes the total customer count past 3,750.

President and CEO Bill Andrews said in a statement: “ExaGrid is continuing to expand its reach and now has sales teams in over 30 countries worldwide and has customer installations in over 80 countries. Outside of the United States, our business in Canada, Latin America, Europe, the Middle East, Africa, and Asia Pacific is rapidly growing.”

ExaGrid said it has a positive P&L, EBITDA, and free cash flow, which funds its operations and growth. Its large deal count is increasing, and there were 59 six-figure and three seven-figure new customer deals. Its new customer average selling price exceeded $100,000 in the quarter.

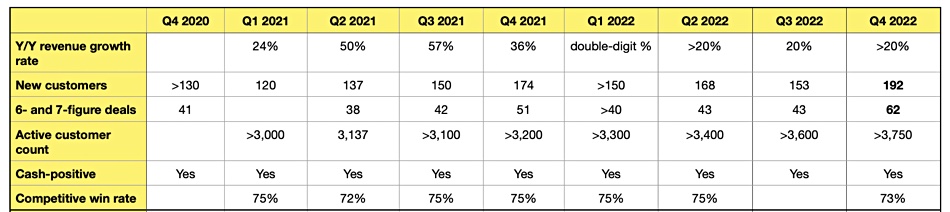

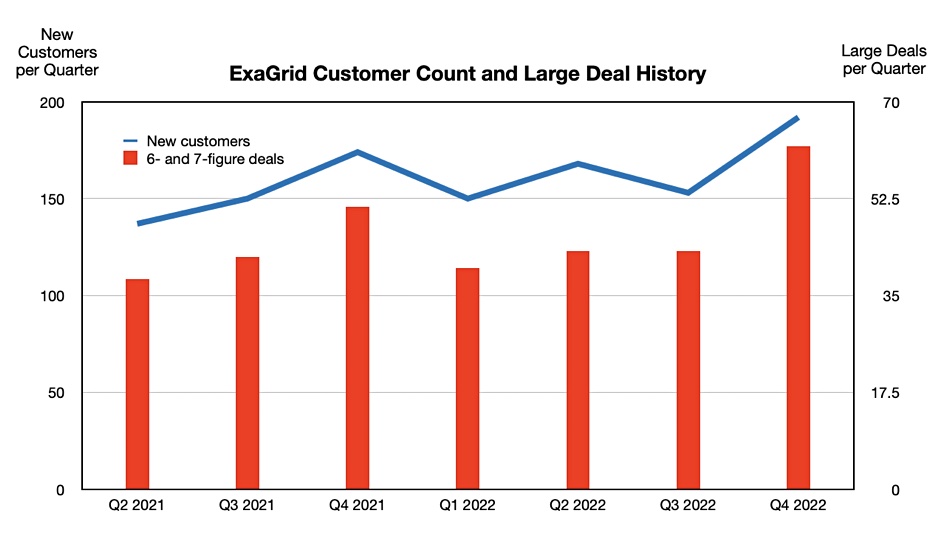

We keep a running tally of ExaGrid’s quarterly results and the latest version shows a seasonal fourth quarter uplift, which a chart brings out:

ExaGrid added that it maintained its customer recruitment rate above 150 per quarter in the year then jumped to 192 in the final quarter, with the large deal count (blue line) rising then as well.

Andrews told us: “ExaGrid business is growing behind Commvault as we further deduplicate Commvault deduplicated data and bring the deduplication ratio up by a factor of 3. We have won some very large Veritas NetBackup deals sitting behind NetBackup [and] we continue to grow very nicely behind Veeam. … We have a lot more tricks up our sleeve that will start to be announced in late Q2 and then every quarter thereafter.”

He says this about the PBBA market and ExaGrid’s prospects: “It is huge market and we see a path to building a $1 billion dollar company.” That’s possibly over a five-year time frame, maybe longer still.

None of the major analyst houses publicly publish PBBA market numbers showing supplier revenues and shares. We think Dell is the market leader with its PowerProtect (Data Domain as was) product line, with ExaGrid in second place, followed by HPE (StoreOnce), Quantum (DXi) and Veritas.