Commvault is looking to grow both its software and SaaS businesses with a focus on data management as well as security, with the CEO saying there’s an ongoing respectful relationship with activist investor Starboard Management.

We had the opportunity to discuss Commvault matters with CEO Sanjay Mirchandani after the latest earnings report disclosing its 10th consecutive growth quarter, and approached the session with questions about its vision for the next few years.

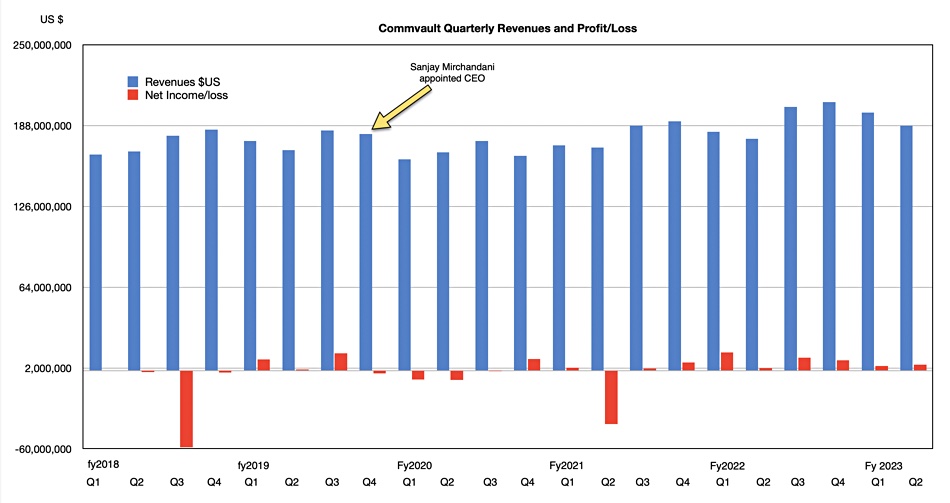

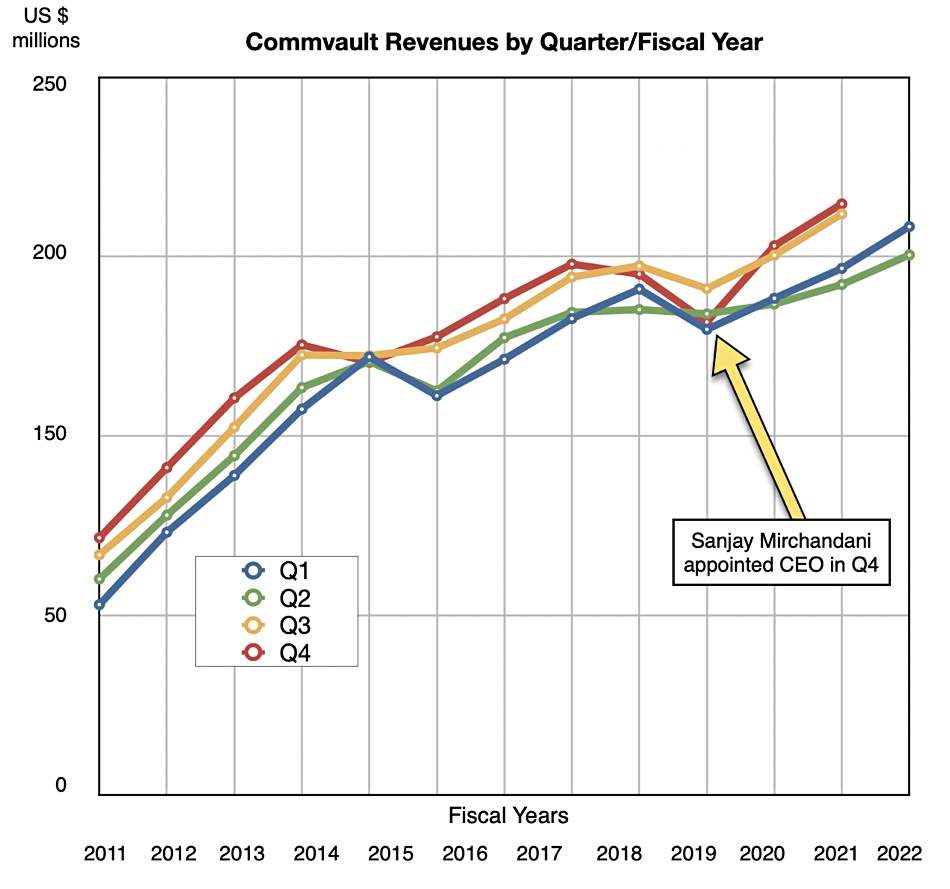

Mirchandani joined Commvault as CEO in February 2019. His appointment was at least partly due to activist investor Elliott Management agitating for change after perceived poor performance. Revenues in that fourth fiscal 2019 quarter were $181.4 million with a loss of $2.2 million.

In its latest quarter, Q2 FY 2023, revenues were $188.1 million, with a profit of $4.5 million. To take account of seasonality, Q4 FY 2022 revenues, three years after he joined, were $205.9 million, with an $8 million profit. That’s 13.5 percent over the three years, and a profits turnaround.

If we cut these numbers another way, and highlight Commvault’s revenues per quarter per fiscal year, we see a clearer picture: 10 consecutive growth quarters, preceded by a year of decline before the new CEO took the reins.

In the following interview we have edited Mirchandani’s statements for brevity.

Blocks & Files: Could you describe how you see your time at Commvault?

Sanjay Mirchandani: When we met, almost three years ago, I had just been on board for a few months. And it was really quite simple to bring back a very strong tech company to responsible growth. That’s what we said, that’s what we were focused on and that’s what we’ve been driving pretty hard with. And we also announced that we were launching a SaaS product Metallic.

We had an investor day, just shy of two years ago, and said we were going to track ourselves on software revenue, overall revenue margins and ARR. What we didn’t know at the time was what Metallic would do. I’m really pleased that we’re tracking ahead of all the metrics except margin, only because Metallic’s taken off, and it has a different margin profile.

If I had to sort of take the first part of that statement, which is responsible growth as a public company, it was not only bringing us back to growth on the top line, but also making sure we were doing right by the bottom line. Today, our growth on a constant currency basis, because that is now the norm, is 17 percent year on year; that’s just to the first half of the year. And total revenue is exceeding 12 percent year on year. So if you look at just the top line, it’s respectable.

ARR is in excess of $600 million. That was two years ago in the $400-470 million range. So it’s moved at a nice healthy clip. If you double click that number and you just look at subscription software subscription and SaaS as a component of that total number, it’s an excess of 4 million. And that grew last quarter a healthy 40 percent year on year.

When you look at the growth numbers, when you look at ARR, total revenue, or software revenue, we’re back to growing, I think, in a very respectable way.

And we’ve incubated and now grown a pretty good SaaS business [Metallic], a real SaaS business for data management, or backup-as-a-service; pick your term. And it took us about six quarters to get to $50 million in ARR, and then we went from $50 million to $75 million in two quarters.

Blocks & Files: I was wondering whether, having bought Hedvig, you had a taste for another acquisition? [although Commvault had bought TrapX in January]

Sanjay Mirchandani: We’ve actually bought two companies under my watch. I bought recently an Israeli company called TrapX, which subsequently the product has been renamed ThreatWise. And those are the only two companies we ever bought. Our tech stack is pretty rich, and I’ve got my eyes open, but I’m not looking. Were something relevant to come along, I’d obviously look at it.

Blocks & Files: You’re not perhaps looking at all the data you’re taking care of for your customers and thinking that you could do some more data management for our customers? And perhaps you need some technology for that?

Sanjay Mirchandani: We do look at data management, and we have some capabilities because of our distributed indexing engine. We have incredible metadata that is available to our customers to use. And we have technology that’s built-in that does very focused things like sensitive file management or sensitive data matching; looking for credit cards, social security numbers, ID cards, and we also do eDiscovery.

Then there’s the policy engine on how you retain that data, who has access to that data, how long is that data active and valid, all of that. It’s all done in a way that doesn’t touch you and the sanctity of your data, your backup. That’s the kind of stuff we do today and I think it’s what customers like.

Blocks & Files: What might you be doing in five years time?

Sanjay Mirchandani: I want to keep going deeper and deeper in the data management, data protection space. Because as customers move workloads from on-premises, and live in coexistence with a hybrid world, it opens up a plethora of new issues, and fragmentation and siloing and generational systems, inflight security and security at rest and new protocols. It creates a whole new set of challenges for customers, and we want to go deep with that.

Data management is a natural adjacency that that we can avail off and give our customers. But giving them secure data sets and giving them a high degree of confidence and the restorability of that data is what we’re going to focus on as they move in the cloud journey.

Blocks & Files: Would you consider providing some kind of complete data protection platform for smaller enterprises than the ones you typically focus on at the moment?

Sanjay Mirchandani: We learned a lot in that space from Metallic because a lot of our customers are now mid-market, and you know, MSP delivery customers. And so we’re learning a lot. Never say never.

Blocks & Files: Are you finding your customers are buying more than one Commvault product?

Sanjay Mirchandani: In the second quarter, nearly 40 percent of our transactions involve multiple products. It’s partly the Metallic effect. Metallic’s interesting because roughly 50 percent of the customers are new to Commvault. The whole vision that we have – that it’s not software or SaaS, it’s software and SaaS – is playing out in these numbers. Smaller customers are now taking more services inside of SaaS, and bigger customers are attaching SaaS to software.

Blocks & Files: Would it be realistic to hope that as more Metallic customers come on board, and the cross selling and upselling increases, that you might see an increase in Commvault’s growth rate?

Sanjay Mirchandani: I think we have to look at them separately because when you blend them at this stage, I don’t know if it’s apples to apples.

If you look at software, which is a mature business, which we continue to do well, it’s growing by any stretch in a healthy number of digits and in and of itself, it has a different profile, and a different margin and everything looks a little different.

So who knows what the future holds? We’re still putting everything we have into this and learning and growing, and it’s doing well for us. But I think on both sides, it’d be safe to say we’re back to being a growth company.

Blocks & Files: How is the relationship with the activist investors [Starboard Management] that were on board a year or so ago?

Sanjay Mirchandani: They’re a big shareholder. It’s a very mutually respectful relationship. We talk often and make sure we communicate with them as as we do with others. It’s I think a perfectly open and respected relationship. It’s a good relationship I’d go as far as saying.

Comment

We look forward to Commvault doing more in the data management area and its customer base expanding with new Metallic users. Will this keep Commvault growing sufficiently for Mirchandani and his team? We have a lingering thought that he may look for an extra growth boost in the next few years.