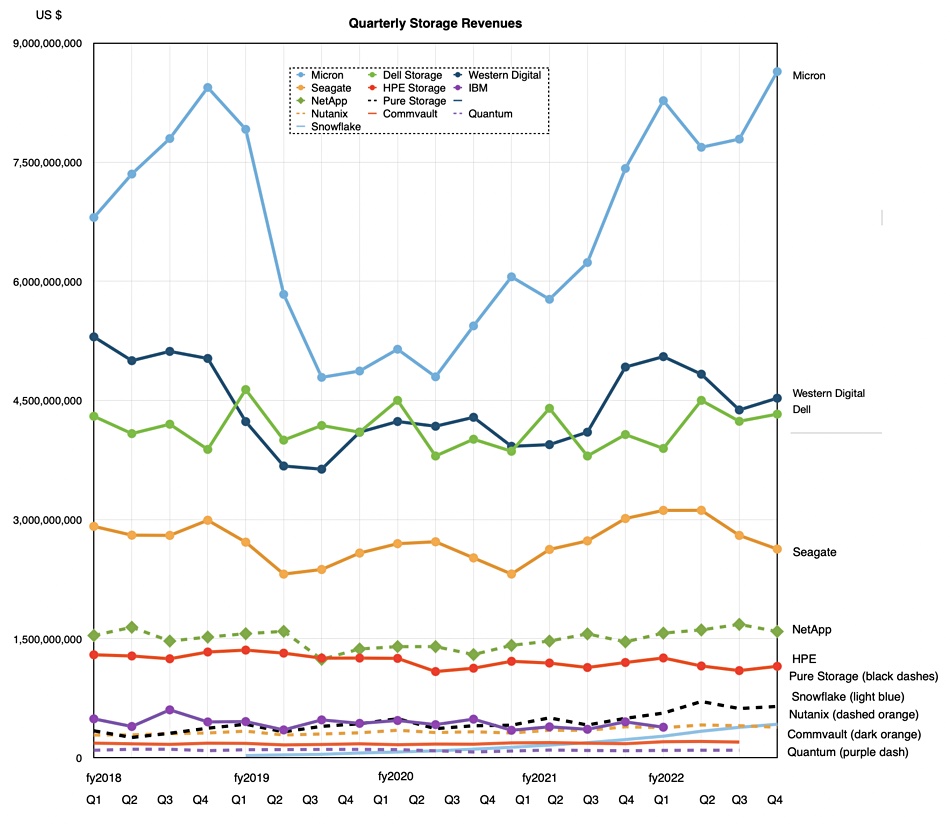

The storage market is mature and rigid, according to the revenue picture for publicly owned storage companies, which shows five stratified revenue layers, with a bit more movement among the smaller companies on the bottom rung.

We compared the past five years of publicly owned supplier storage revenues in a chart normalized to HPE’s financial quarters. It shows Micron ruling the roost with its DRAM and NAND chip products augmented by SSDs:

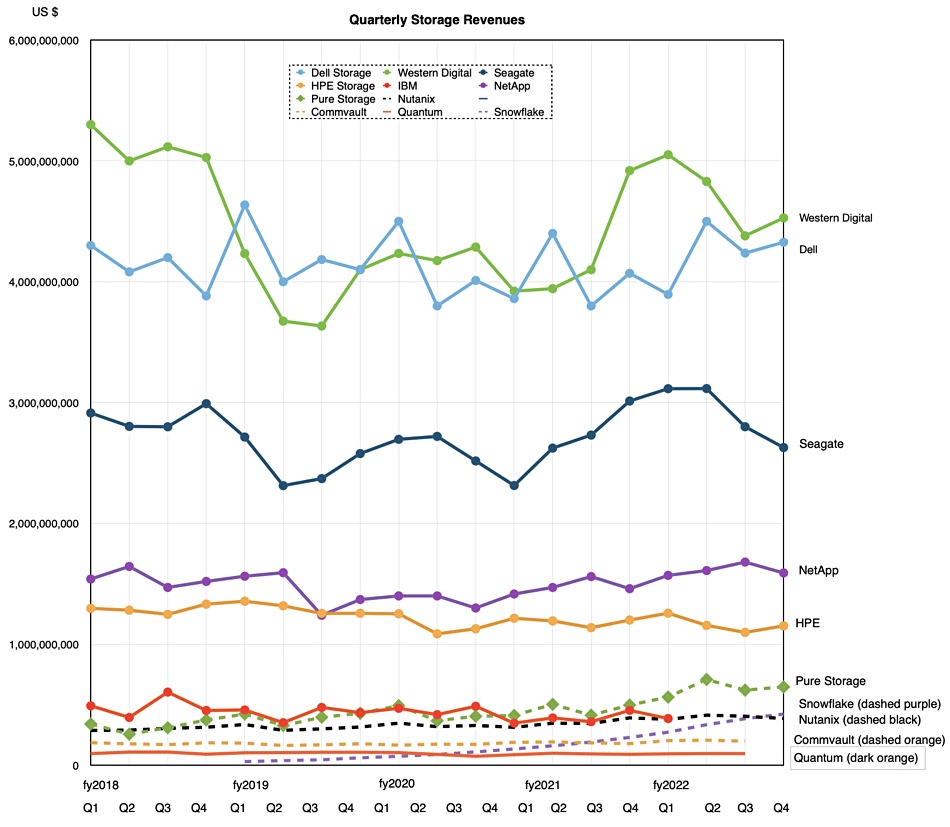

Micron’s revenues are so far above the other suppliers that we can remove them from the chart to get a clearer picture of the rest:

It now shows four tiers, with Western Digital and Dell, both above the $4 billion/quarter level, outstripping a second tier of just one vendor – disk drive manufacturer Seagate at the $2.5 billion level. WD, Dell and Seagate far outstrip a third tier of two suppliers; NetApp at the $1.6 billion level and HPE at the $1.1 billion point. The NetApp-HPE gap is widening as NetApp sales have outgrown those of HPE storage since 2020.

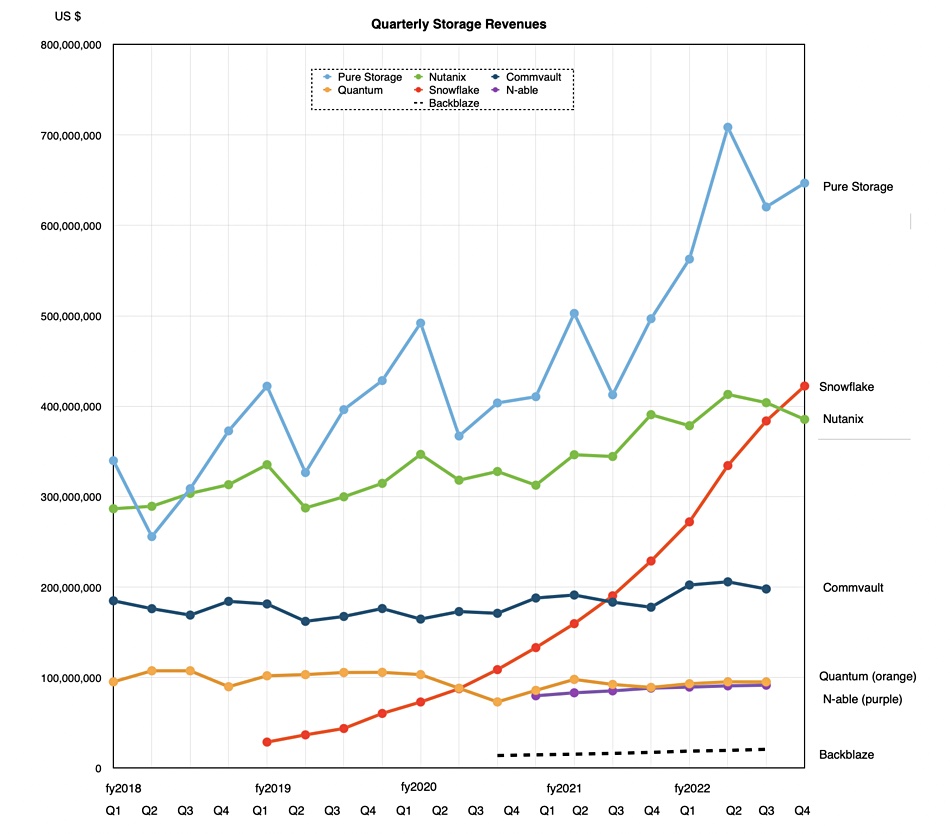

Below these three suppliers is a fourth tier, with Pure Storage and Snowflake appearing to move up. We’ve isolated the fourth tier vendors in a separate chart:

All-flash array supplier Pure Storage is growing fast, at 30 percent year-on-year on its latest results, and so is cloud data warehouser Snowflake.

Snowflake is now the top vendor in the fourth tier. Nutanix is next, some way ahead of Commvault, Quantum, N-able, and then Backblaze.

IBM (red line) was a member of this fourth tier group but has stopped publishing its declining storage revenue numbers so has no recent data points in the chart.

Overall Micron, then WD and Dell, reign supreme in the storage market and will continue to do so unless something catastrophic happens. Micron banks on its DRAM, NAND, and SSDs being widely used. WD is bolstered by supplying both disk drives and SSDs. Dell, the leading storage systems vendor, is present in many storage sub-markets and leads in virtually all of them. Neither NetApp nor HPE has a hope of catching it, nor the two media vendors Micron and WD, or Seagate for that matter.

It is hard to predict that current revenue trends will continue – particularly in light of the current economic outlook.

Nutanix‘s last two quarters show a slowing growth rate and Nutanix could need some accelerative measures.

Overall the charts show us, with the exception of Pure Storage and Snowflake, a fairly static and mature storage market. We are anxious to see Acronis, Cohesity, Rubrik, Veeam, and Veritas all IPO because then we could place them on this chart as well, and directly compare them with the current crop of publicly owned storage vendors. Longer term, VAST Data, WekaIO, and Komprise look to be possible IPO candidates as well.