Pure Storage’s second quarter revenues for its fiscal 2023 grew 30 percent year-on-year – outpacing the competition – and for the second time in its commercial existence it reported a profit.

Revenues generated during the quarter ended August 7 were $646.8 million with a $10.9 million profit comparing strongly to the loss of $45.3 million a year earlier.

Chairman and CEO Charles Giancarlo said: “Pure saw continued growth and solid market share gains as our expanding portfolio of industry leading products and services are recognized and embraced by more and more enterprises around the world.”

Summary;

- Subscription services revenue: $232.2 million, up 35 percent year-over-year

- Subscription Annual Recurring Revenue (ARR): $955.3 million, up 31 percent year-over-year

- Remaining Performance Obligations (RPO): $1.5 billion, up 25 percent year-over-year

- Gross margin: 68.6 percent

- Operating cash flow: $159.4 million

- Free cash flow: $134.2 million

- Total cash, cash equivalents, and marketable securities: $1.4 billion

- Returned approximately $61 million in Q2 to stockholders, repurchased 2.4 million shares

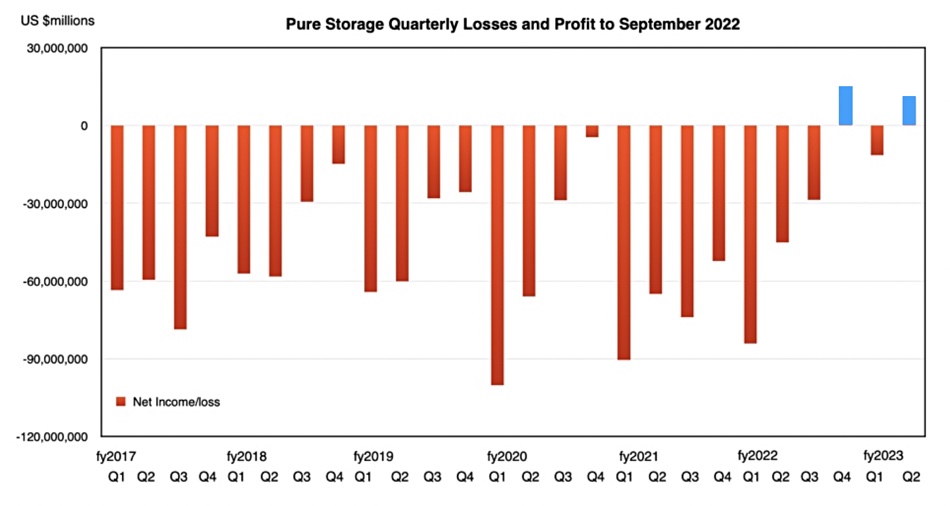

Pure Storage has started making profits, as a chart of its losses and profits since 2017 indicates;

Two sudden swallows don’t make a summer but the sea of red ink has started becoming a bit more blue as Pure turns the corner towards becoming a more sustainable organisation

Pure said it gained more than 350 new customers in the quarter with the total customer count greater than 10,500 and including about 56 percent of the Fortune 500. There was solid progress with Evergreen subscription offerings and Portworx, it added.

In the earnings call Giancarlo said: “For the first time, I increasingly hear from international customers that they actively consider Pure specifically for our ability to drive down energy usage and e-waste. The demand for solutions that reduce customers’ environmental footprint is now top of mind in a majority of international enterprises that we speak to.”

He also said that Pure delivered strong growth and increasing operating profit “while navigating the external inflationary and supply chain environments without raising list prices. Our customers are continuing to expand their data storage with Pure and we continue to expand our customer base.”

But there are indications of customer buying caution ahead: “We do however see signs of increased diligence of purchases by enterprise customers, resulting in some lengthening of sales cycle. Overall, I remain confident in our ability to take market share and to grow faster than the market.” Deal cycles are lengthening by one or two weeks but the deals are still closing, the CEO added.

William Blair Analyst Jason Ader said: “Despite the weaker macro backdrop, we continue to view Pure as the best story in storage, given in its industry-leading AFA (all-flash array) technology, strong channel partnerships, and high customer satisfaction.”

Pure’s headcount has increased to 4,600 and Giancarlo said: “Our attrition rates are below the rest of our industry peers.” Its hiring more sales people and Giancarlo said there was room for more productivity improvements in the sales department.

Competitor comparisons

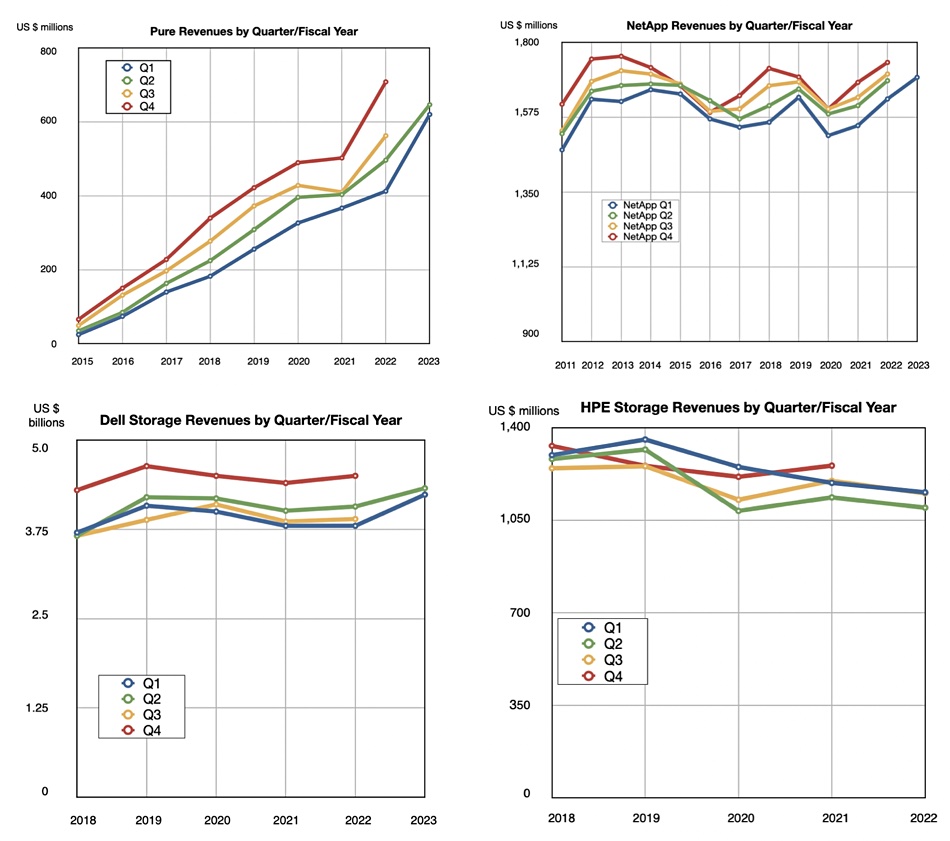

This double-digit revenue growth puts recent results from Dell (storage up 6.3 percent), NetApp (revenues up 9 percent) and HPE (storage revenues down 2 percent) in the shade.

Charts comparing the four suppliers’ quarterly revenues by fiscal year show this vividly;

Giancarlo said: “Our differentiation is only increasing right now. We are still the only player that can now take on hard disk at the secondary tier level, which continues to be a strong area of growth for us.” He is talking about FlashBlade and its ability to store backup data sets for fast restore.

Giancarlo has possibly overlooked VAST Data which has an all-flash backup and restore capability and a partnership with Commvault based on that. ObjectFirst, the Veeam founders’ startup, is also an all-flash backup and restore target system.

Outlook

Pure Storage CFO Kevan Krysler said: “Demand signals for our solutions are solid and our visibility of opportunities is healthy.” On this basis, Pure expects revenues of approximately 670 million next quarter, which will be a 19.1 percent increase on the year-ago Q3 and indicates a growth slow-down from the 30 percent achieved in the current quarter. That’s partly due to two largish deals that came in the first quarter which were initially expected to complete in the second half of the year.

Giancarlo said: “We are market share takers in what is a very large market [$50 billion]. Slight perturbations in the growth of this market shouldn’t affect dramatically our ability to transform pipeline into sales and continue to grow our pipeline. So we feel like we are very well-positioned.”

Pure has raised its fy2023 revenue outlook to $2.75 billion from the previous $2.6 billion, a 5.8 percent increase. This new full year outlook represents a 26.1 percent uplift from last year’s annual revenues of $2.18 billion.