NetApp has bought eight companies in two years as Anthony Lye, EVP and GM of the Cloud DataServices Business Unit, builds up a cloud data operations facility.

The aim is to provide customers with the means of using various cloud resources optimally and cost-efficiently. They don’t have to get down and dirty in the weeds of evaluating, for example, which of 475 AWS compute instances to use, how to reserve instances, or optimize Spark.

None of this has much to do with NetApp’s traditional core focus on on-premises storage, and adjacent focus on providing its storage facilities in the AWS, Azure, and Google clouds.

The Cloud Business Unit was initially incubated and run by Jonathan Kissane, SVP and general manager. Lye came on board in March 2017 to make NetApp’s Cloud Business Unit profitable. When Lye was hired, Kissane became NetApp’s Chief Strategy Officer but left eight months later. Who was Lye and where did he come from?

It’s no Lye

Lye was a product marketing manager at Tivoli in the early ’90s and then became a senior director/ major accounts sales rep at Remedy Corp for four years from 1994. Then came a big move to president and CEO of SaaS company ePeople from March 1999.

In late 2005 he became Group VP and GM at Siebel Systems, which was acquired by Oracle, with Lye moving onto SVP and GM of Customer Relationship Management. He managed a unit of 3,000 people and acquired 10 companies for more than $2.5 billion.

In 2012 he joined Publicis as Global President for Digital Platforms and Product, but spent just nine months at the French multinational advertising and public relations company. He moved to become Chief Product Officer at HotSchedules, a provider of workforce and inventory management services for the restaurant industry, and became its President and CEO, leaving in late 2016 to be EVP and Chief Cloud Officer at Guidewire Software.

Guidewire supplies an industry platform-as-a-service for property and casualty insurance carriers. Lye quit after six months, jumping ship to NetApp. With hindsight, it looks like he was asked to replicate the things he did for Siebel/Oracle at NetApp in the cloud area.

This is a seasoned SaaS business executive, with experience building SaaS business units and acquiring companies to help with that.

Buying time

In January 2018 NetApp’s Cloud BU became the Cloud Data Services BU and Lye set out on the acquisition trail.

The first was Talon Software, which provided its FAST software-defined storage enabling global enterprises to centralize and consolidate IT storage infrastructure to the public clouds. NetApp said at the time that the combination of its Cloud Volumes technology and Talon FAST software meant enterprises could centralize data in the cloud while still maintaining a consistent branch office experience.

Lye said at the time: “As we grow our cloud data services offerings with solutions like Cloud Volumes ONTAP, Cloud Volumes Service, Azure NetApp Files and Cloud Insights, we are excited about the potential that lies in front of this new combined team to deliver complete solutions for primary workloads. We share the same vision as the team did at Talon – a unified footprint of unstructured data that all users access seamlessly, regardless of where in the world they are, as if all users and data were in the same physical location.”

This acquisition was a cloud product-as-a-service deal, not a cloud service operations deal. That came the next month with CloudJumper, a cloud VDI player and the first of eight such acquisitions.

NetApp has bought rapidly growing companies in what is still a fast-expanding market. These companies had great prospects and NetApp will have paid a good price for them, as the $450 million reported for Spot indicates, a 6.6x increase on Spot’s $52.6 million funding total.

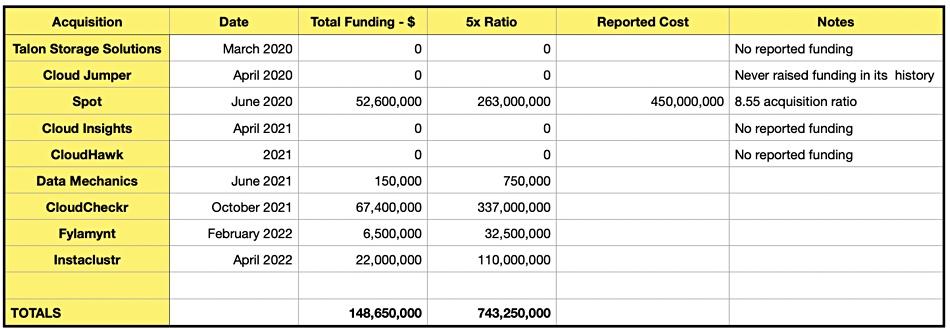

We have collated, in the table below, information on the nine acquired companies, the total funding (where it’s known), as well as the reported acquisition cost.

We must emphasize that this is highly speculative, but we also applied what we felt was a more conservative 5X increase to the total funding of these eight companies, $148.65 million, to arrive at a guess of $743.25 million for the vendor’s spending. There was no funding amount for four of the acquisitions, so this table assumes NetApp spent $10 million to buy each of them, giving a total potential cost of around $783 million.

Even if the number turns out to be smaller, a nine-firm buy is a huge bet by NetApp, and is notable because the acquisitions are in a completely new enterprise market that is quite a long way from its traditional and core storage on-premises market and growing adjacent public cloud storage market. Signalling this separation, Lye’s CloudOps software products were kept out of Chief Product Officer Harvinder Bhela’s control when he was hired by NetApp in December 2021.

Lye’s BU is doing well. In March we wrote NetApp’s “Cloud Operations (CloudOps) business looks so good for NetApp that the company has increased its overall revenue targets.”

These were the numbers behind that: “NetApp thinks its public cloud annual recurring revenue (ARR) will be $2 billion by its fiscal year 2026, up from $1 billion in 2025. NetApp should now reach its $1 billion public cloud target by 2024 – a year sooner than predicted.”

These numbers show why NetApp thinks it’s worthwhile to spend hundreds of millions in its rush to build a cloud data services business before anybody else. Public CloudOps is going to become, NetApp hopes, its second goldmine after storage.