SK hynix grew its DRAM and NAND business substantially in 2021 and expects to double NAND revenues this year with Solidigm, its Intel SSD business acquisition.

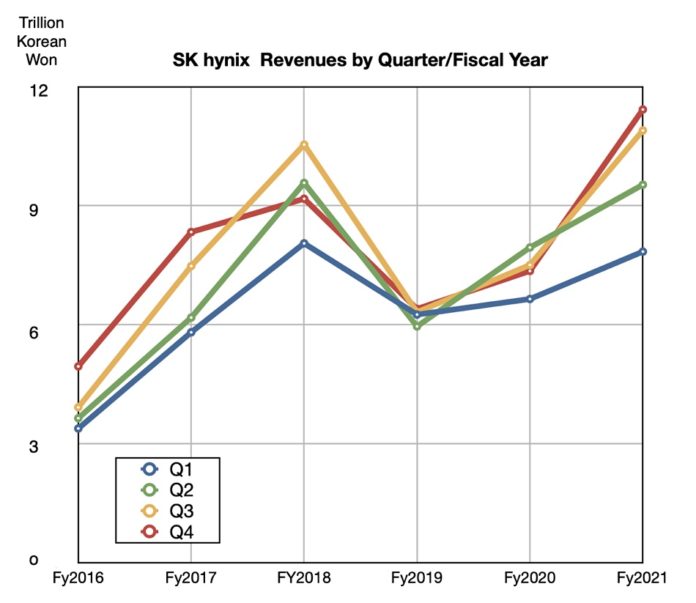

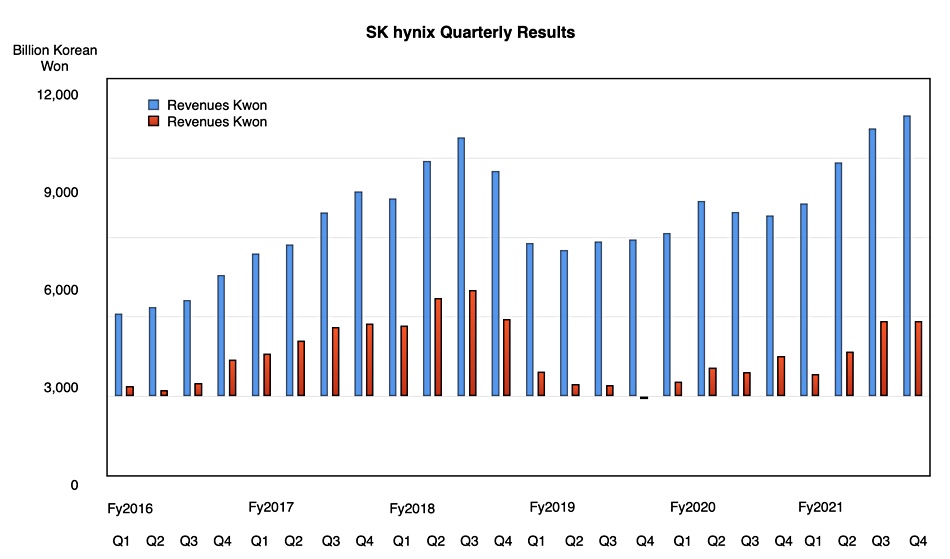

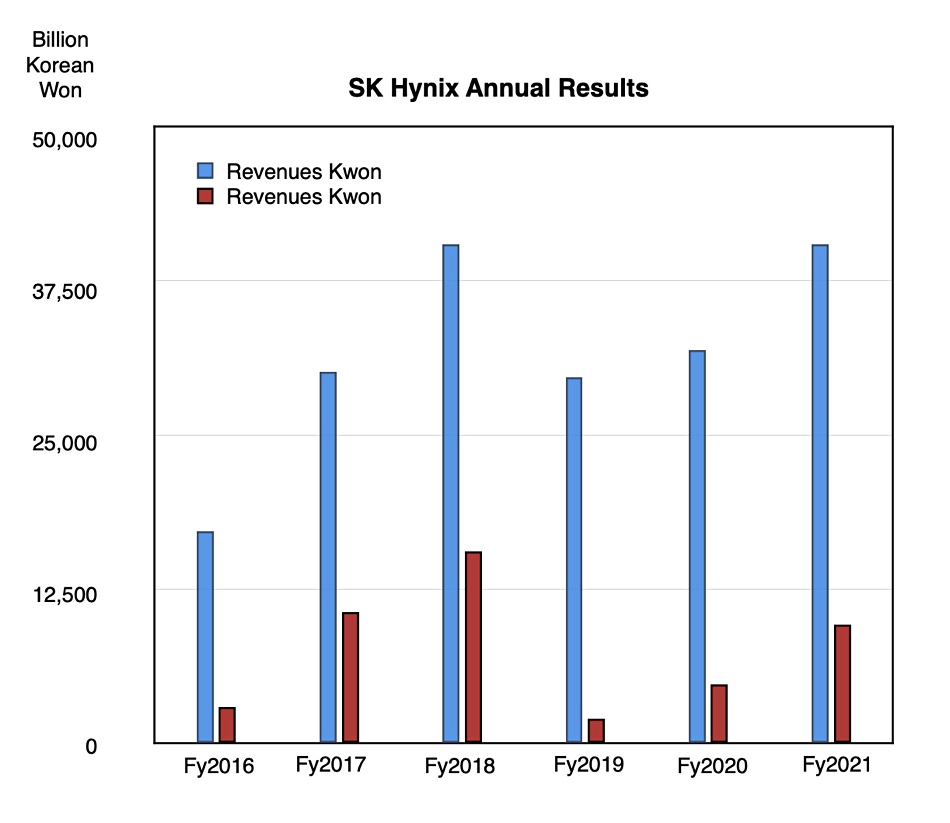

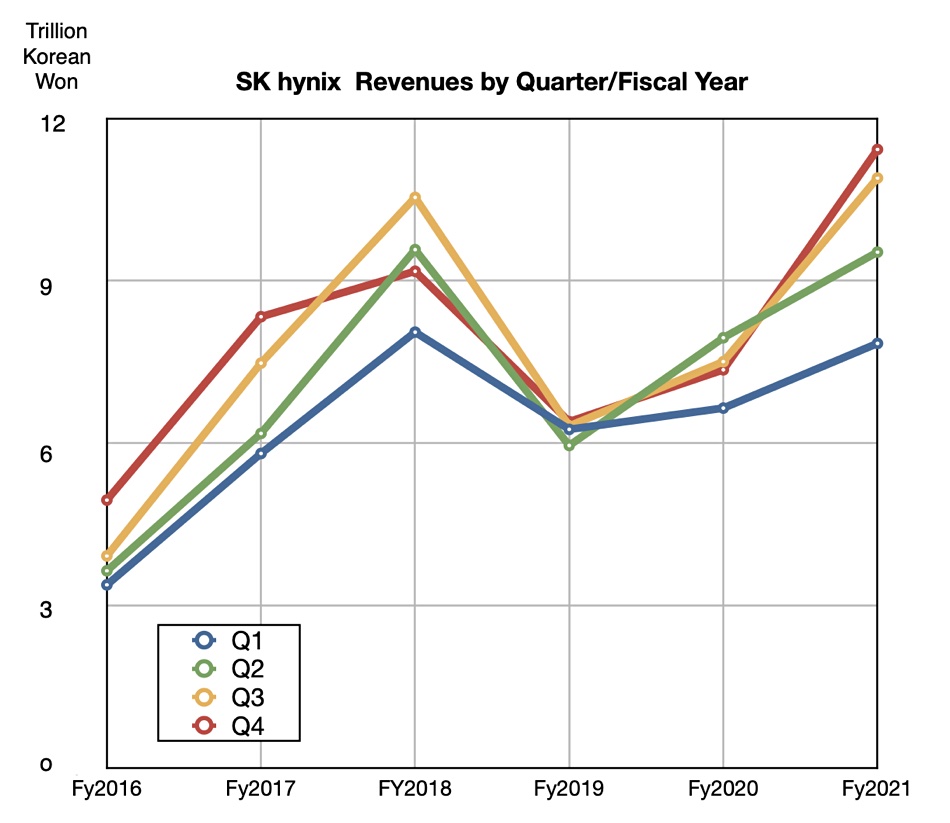

Revenues in the final 2021 calendar quarter were a record ₩12.38 trillion ($10.22 billion), up 55.4 per cent on the year, with profits of ₩3.32 trillion ($2.7 billion), a higher increase of 87.8 per cent.

Full 2021 revenues were ₩40.45 trillion ($33.4 billion), another record and 26.8 per cent higher than 2020 revenues, and the profit was 102.1 per cent higher at ₩9.62 trillion ($7.9 billion).

It said its NAND business recorded a sales growth rate that far exceeded the market average level. Overall demand for its memory products increased but its business was affected by COVID-related supply chain issues. Its technological prowess helped push sales higher, singling out DDR5 and HBM3 DRAM and 128-layer 3D NAND.

The company expects supply chain issues will gradually improve, beginning in the second half of this year, and market demand for memory products will increase. But, according to Wells Fargo analyst Aaron Rakers, it is forecasting both DRAM and NAND bit shipment declines for Q1 2022 with rises thereafter so that bit shipments for both in 2022 will be higher than in 2021. DRAM bit shipments should rise in the high teens percentage area but NAND bit shipments should rise around 30 per cent.

It aims to scale up its NAND business and Solidigm is part of that. It is recruiting more staff this quarter, including process, device, design, test, packaging, SoC, software, data science, product planning & strategy people.