Western Digital revenues grew strongly in its latest quarter but disk drive supply chain issues held it back from much stronger growth.

WD revenues for its second fiscal 2022 quarter, ended December 31, 2021, were $4.83 billion – a rise of 23 per cent which exceeded its own guidance, even with the supply chain problems. There was a profit of $564 million, which compares exceedingly well with the year-ago quarter’s $62 million.

CEO David Goeckeler’s results statement expressed pleasure. “I’m proud of the Western Digital team for delivering another quarter of strong results that exceeded guidance, even in the midst of ongoing supply chain disruptions and COVID-related challenges. While we continue to experience strong demand across our end markets, these challenges continue to present a headwind to near-term results.”

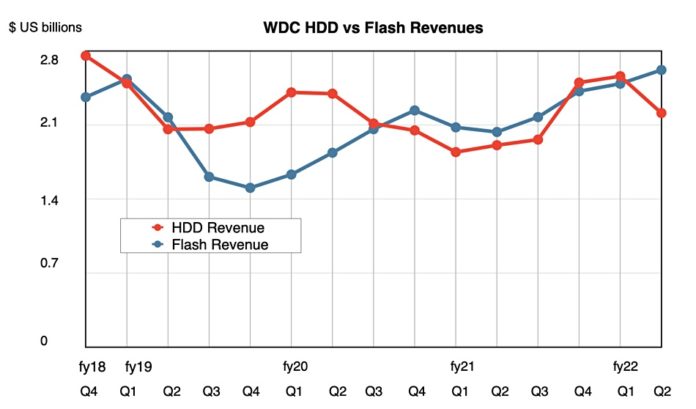

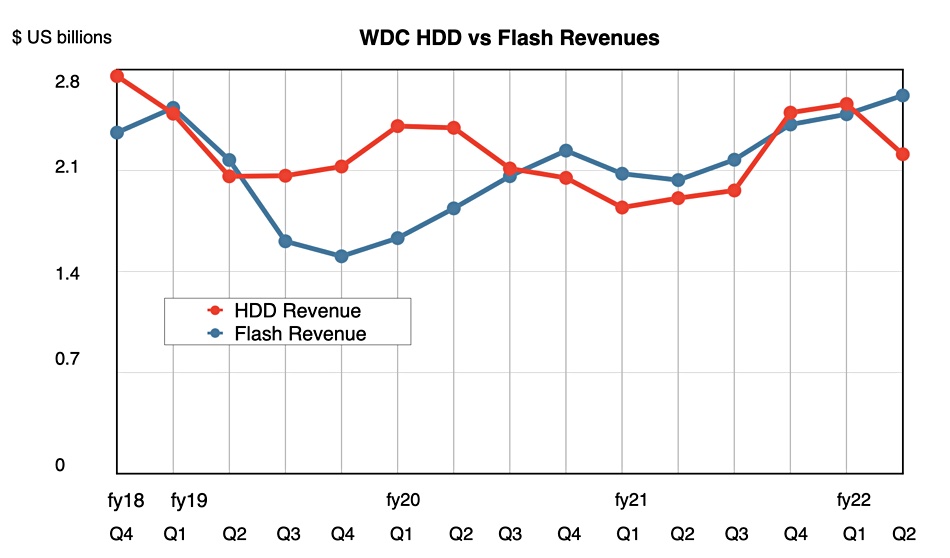

Disk drive revenues were $2.2 billion, up 15. 9 per cent annually but down 13.6 per cent sequentially (see chart), while flash revenues were $2.6 billion, a rise of 28.8 per cent year-on-year. HHD units shipped in the quarter were 21.6 million, compared to 24.1 million in the prior quarter and 25.7 million a year ago. WD estimated the COVID impact on its HDD business this quarter at $60 million.

WD said supply chain disruptions impacted cloud hard drive deployments at certain customers, which led to a sequential decline in exabyte shipments in the quarter. Goeckler attributed a lot of this to “one very, very large customer that’s going through some challenges of their own.” Even with the sequential HDD decline there was >50 per cent year-over-year increase in exabyte shipments.

In the earnings call Goeckeler said “We are seeing an increase in customer interest in adopting SMR (Shingled Magnetic recording) technology and expect multiple cloud titans to deploy SMR drives in high volume later in this calendar year.”

WD said its Enterprise SSD products are qualified at three cloud titans and two major storage OEMs. That’s compared to one cloud titan a year ago.

Client SSD revenue declined sequentially due to supply chain disruptions at some of its PC customers and pricing pressure in the more transactional markets. Once again we see supply chain problems lowering revenues.

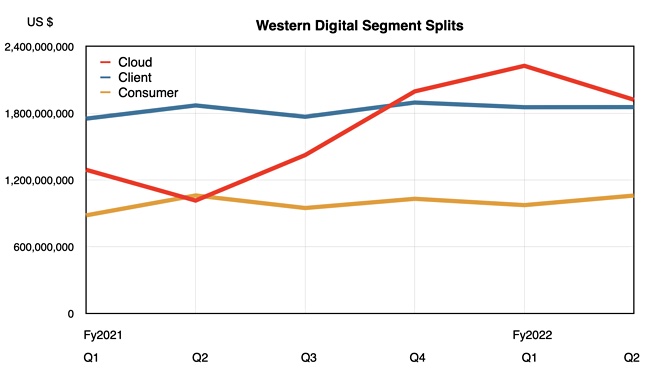

Cloud revenue of $1.9 billion increased by 89 per cent year-on-year but declined 13.7 per cent quarter on quarter, due to the HDD supply chain issues. Client revenue declined by one per cent to $1.85 billion, and WD said the continued ramp of 5G phones helped offset declines in both client SSD and client hard drive revenue. Consumer revenue remained flat at $1.06 billion with retail flash leading the sequential growth in a strong holiday season.

Financial summary:

- Gross margin – 32.8 per cent (it was 33 per cent in Q1);

- Operating cash flow – $666 million;

- Free cash flow – $407 million;

- Total cash and cash equivalents – $2.53 billion.

WD is replacing its CFO Robert Eula with Wissam Jabre on February 7. No reason was given for Eulau’s departure but he was publicly and sincerely thanked for his service and contribution to WD.

WD’s outlook for the next quarter is revenue between $4.45 billion and $4.65 billion. At the mid-point that will be an 8.5 per cent increase on the year ago third quarter. Goeckeler said “We are optimistic about our outlook for calendar year 2022 as our customers continue to indicate solid demand across the end markets we serve.” However supply chain challenges are increasing, although they are expected to be transitory.