Data protector Veeam has appointed a new CEO, Anand Eswaran, to take over from Bill Largent who continues as board chair. The company is showing all signs of contemplating an IPO.

Eswaran brings, Veeam said, extensive experience in developing new business models, executing on market expansion, and driving growth with an inclusive purpose-led and people-first culture. He was previously the president and COO of RingCentral, which supplies cloud-based communications and collaboration offerings for business. In its most recent results it reported ARR of $1.6 billion, a 39 per cent increase year-over-year — just what Veeam would like to do.

A Largent statement said: “To have someone with Anand’s experience on board will lead us into a new era of success, as we further accelerate into the cloud and evaluate the opportunity for Veeam to be a publicly traded company in the future.”

This is Eswaran’s first CEO gig, but he has a big company background. At RingCentral, he led Product, Engineering, Sales, Marketing, Services, Customer Care, Operations, IT, and Human Resources. Before that he looked after Microsoft’s Enterprise Commercial and Public Sector business globally, after having led Microsoft Services, Industry Solutions, Digital, Customer Care, and Customer Success — a global team of 24,000 professionals.

Prior to Microsoft he was a SAP EVP, head of its $5.4 billion Global Services business with 17,000 business process and technology professionals.

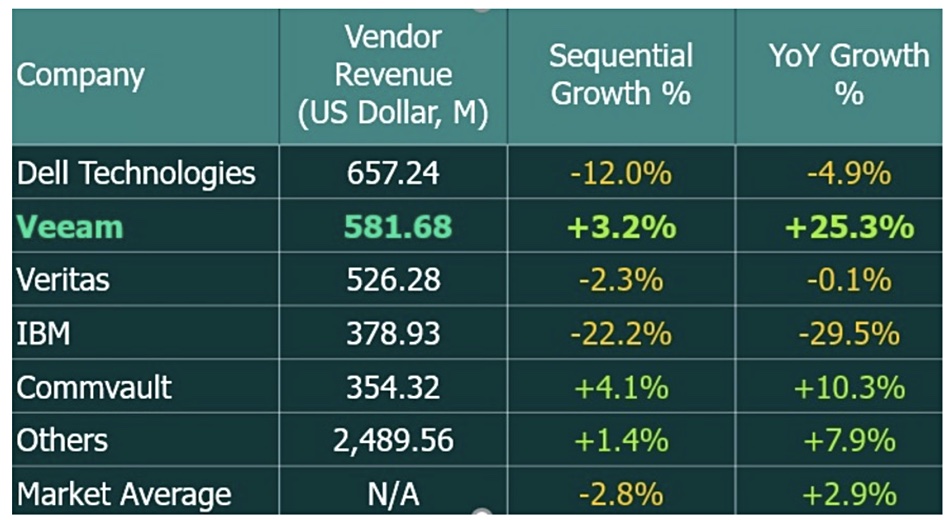

Veeam attained the number two position by revenue in IDC’s Data Replication and Protection Software Tracker for the first half of 2021, having overtaking Veritas and behind only Dell Technologies. It wants the top slot.

Eswaran commented: “Data is exploding and has become one of the most important assets for all organisations. As such, data management, security and protection are pivotal to the way organisations operate today, and failure to have a robust strategy can be catastrophic. Veeam has a unique opportunity to break away as we sit in the middle of the data ecosystem, with the most robust ransomware protection and ability to protect data wherever it may reside.”

A Veeam breakaway, meaning a jump in revenues, particularly ARR, would be a great prelude to an IPO. And an IPO would hopefully enable Insight Partners to get a decent payback for its $5 billion acquisition of Veeam in January 2020.