Cloud storage and backup supplier Backblaze recorded 25 per cent revenue growth in its third calendar 2021 quarter to $17.3 million.

This was the company’s first post-IPO set of results and there was a net loss of $6 million, which compares to a $1.9 million loss a year ago. Its recently-launched B2 Cloud storage business saw revenues grow to $6 million, while the established Computer Backup business earned $11.2 million in revenues.

CEO Gleb Budman’s results statement reads: “We delivered continued strong Q3 growth overall, led by rapid 59 per cent revenue growth in B2 Cloud Storage and consistent double-digit growth of 13 per cent in Computer Backup.”

He pointed out: “Our successful IPO in November was an important milestone for the company and a recognition by the markets of the mid-market public cloud storage opportunity. We believe the future is being built on independent clouds, and we plan to use our IPO proceeds to help accelerate future growth in this large and fast-growing market.”

Although the loss deepened, there was good news on the gross profits front. It saw $8.8 million — 51 per cent of revenue — compared to $6.7 million and 49 per cent of revenue in Q3 2020. Cash and cash equivalents were $4.7 million at the end of the quarter, and this sum does not include net cash proceeds of $103 million from the November 2021 IPO.

William Blair analyst Jason Ader summed up Backblaze like this: “As the B2 [Cloud Storage] mix rises over the next two years, and as the bootstrapped firm deploys its new growth capital toward sales and marketing, we expect revenue to accelerate (we model growth of 24 per cent, 26 per cent, and 31 per cent in fiscal 2021, 2022, and 2023, respectively). Our view is that Backblaze is a pure-play on SMB cloud adoption, with investors getting a high-growth, independent cloud storage platform supported by a cash-cow computer backup business that can also drive cross-selling opportunities.”

Backblaze expects revenues between $17.7 and $18.2 million for the fourth and final 2021 quarter. That would mean $67.1 million full 2021 year revenues at the mid-point.

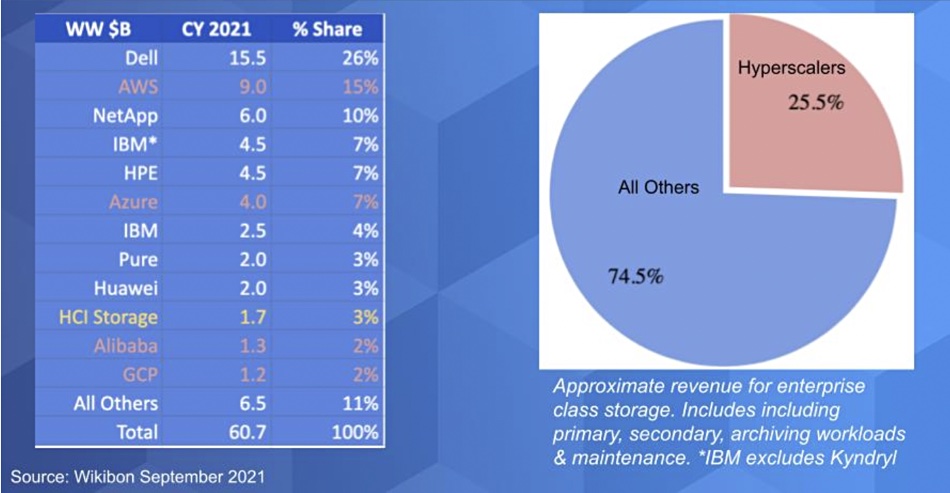

The company is minute in size compared to cloud service-providing hyperscalers, such as Amazon Web Services, which earned $16.11 billion in its third quarter — a figure which rose 39 per cent year-on-year. Analyst company Wikibon estimated that AWS storage revenues for all of 2021 will be $9 billion. He wrote: “We believe AWS storage revenue will surpass $11 billion in 2022 and continue to outpace on-prem storage growth by more than 1,000 basis points for the next three to four years.”

Backblaze may be sized like a pilot fish circling the Amazon shark, but its successful IPO and growth show that there is cloud storage life outside AWS and its hyperscaler competitors Azure, GCP and Alibaba. Competitors like Backblaze can thrive and prosper because AWS and its ilk price their storage services so high as to give Backblaze profitable pricing headroom — so to speak. For example, Ader points out that BackBlaze’s B2 Cloud Storage “is one-quarter the price of AWS’s S3 service.”