NetApp had a knock-out second fiscal 2022 quarter, selling more flash arrays and object storage, and with a good pipeline for further sales. Its public cloud business is growing strongly and it’s uprated its guidance for the full year, despite looming supply chain issues.

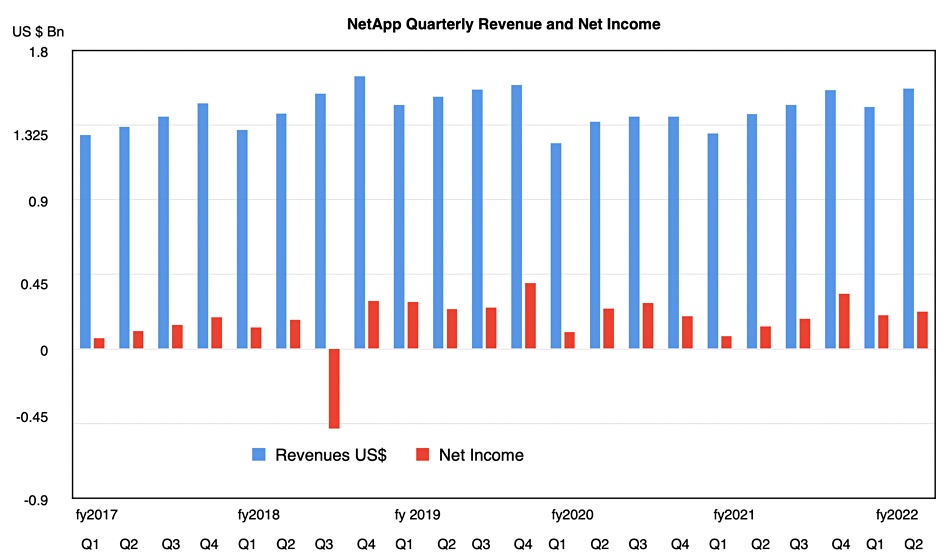

Revenues were $1.57 billion — 10.9 per cent more than a year ago — with a profit of $224 million, up 63.5 per cent. Profit as a percentage of revenue was 14.27 per cent versus 9.68 per cent a year ago. NetApp really is doing well. (Although Pure Storage is growing faster, it is still not making a profit.)

CEO George Kurian’s statement said: “We delivered another strong quarter, with results all at the high end or above our guidance. Our performance reflects a strong demand environment, a clear vision, and exceptional execution by the NetApp team and gives the confidence to raise our full year guidance for revenue, EPS and Public Cloud ARR. We are gaining share in the key markets of all-flash and object storage, while rapidly scaling our public cloud business.”

Hybrid cloud (meaning not public cloud) revenues increased eight per cent, to $1.48 billion, but that was the bulk of NetApp’s revenues. This growth was driven by StorageGRID object storage and all-flash arrays, predominantly ONTAP. The all-flash array annualised net revenue run rate increased 22 per cent year-over-year to $3.1 billion — a record — and product revenue overall grew nine per cent year-over-year to $814 million. Thirty per cent of NetApp’s installed base use its all-flash arrays, leaving lots of adoption ahead still.

Kurian said: “We once again gained share in the enterprise storage and all-flash array markets,” without identifying competitors who lost share.

Public cloud-based revenues were $87 million — up 85 per cent annually — meaning an 80 per cent increase in annualised revenue run rate (ARR) to $388 million. The public cloud business, 17 per cent of that, has a lot of growth ahead of it to reach this heady level. Kurian said: “We remain confident in our ability to achieve our goal of reaching $1 billion ARR in FY25” — meaning $250 million/quarter in public cloud revenues.

He also pointed out: “Our public cloud services not only allow us to participate in the rapidly growing cloud market, but they also make us a more strategic datacentre partner to our enterprise customers, driving share gains in our hybrid cCloud business.”

Kurian was especially pleased about NetApp’s relationships with AWS, Azure and GCP. “These partnerships create a new and massive go-to-market growth engine, as three of the largest and most innovative companies in the world are reselling our technology. … We are now the first and only storage environment that is natively integrated into each of the major public cloud providers.”

He also said NetApp was coping with the supply chain challenges — but more challenges are coming.

Billings increased seven per cent year-over-year to $1.55 billion. There was a 14 per cent increase in software product revenues.

Financial summary:

- Gross margin — 68 per cent;

- Public cloud gross margin — 71 per cent;

- Operating cash flow — $298 million;

- Free cash flow — $252 million;

- EPS — $0.98 compared to $0.61 a year ago;

- Cash, cash equivalents and investments — $4.55 billion at quarter-end.

This was NetApp’s fifth growth quarter in a row.

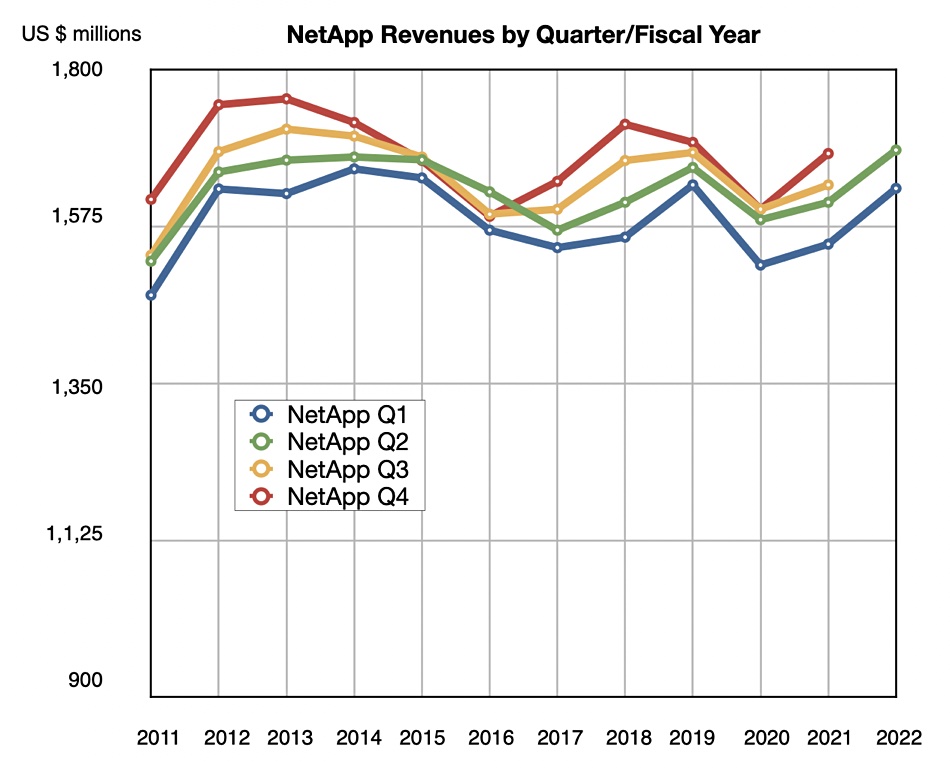

But it still has away to go to get back to fiscal 2018 revenue heights, and an even bigger hill to climb to claw back ground from fiscal years 2012 and 2013 — the glory years, in retrospect.

In the earnings call NetApp said that it had a strong deal pipeline relating to on-premises datacentre modernisation. William Blair analyst Jason Ader argues: “This is mainly motivated by lower costs for storing large, production data sets (where cloud storage costs can be prohibitive), but can also be due to improved control (for compliance and regulatory reasons) and security.”

The outlook for the next quarter is for revenues between $1.525 billion and $1.675 billion — $1.6 billion at the mid-point — which would be an 8.8 per cent increase year-on-year. Full FY2022 revenues are being guided to being 9 to 10 per cent more than last year — $6.29 billion at the mid-point. This revenue increase is depressed by anticipated supply chain issues in the second half of FY2022.