Seagate has benefitted from an extraordinary secular change in the disk drive market as cloud-scale datacentre demand sends its quarterly revenues up 35 per cent year-on-year — its fourth consecutive growth quarter.

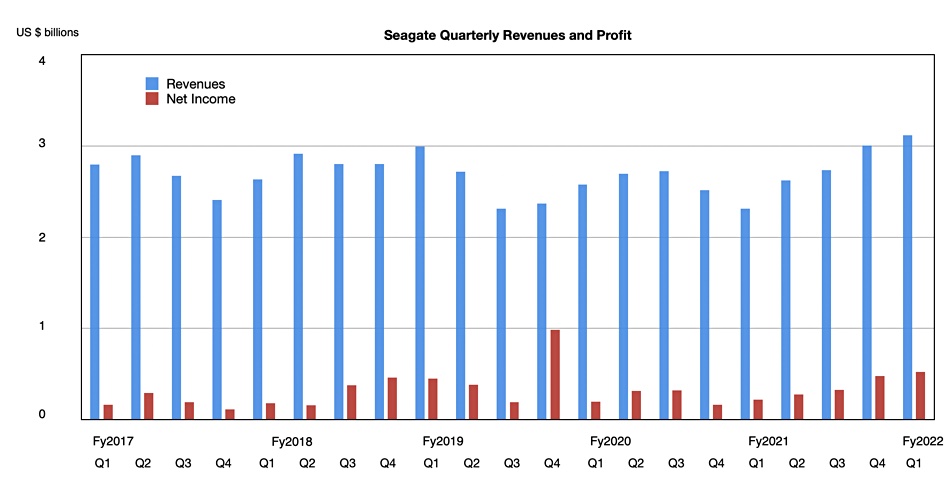

Revenues in the quarter ended October 1 were $3.12 billion, compared to $2.3 billion a year ago, with profits of $526 million — a 135.9 per cent increase year-on-year. Seagate is a cash-generating machine.

CEO Dave Mosley was enthused in the earnings call: “Seagate had an outstanding start to fiscal 2022, underscored by our September quarter results. … Overall, our results reflect record demand for our industry-leading mass capacity products and solid execution on cost reduction plans and our ongoing focus of balancing supply with demand. We are confident in our ability to deliver excellent results for the fiscal year.”

Demand growth is set to continue for the rest of the year and its raised its outlook to greater than ten per cent full year growth from around eight per cent. The company also raised its dividend, confirming its confidence in the future.

Mosley said: “Without question, the HDD industry is being driven by long-term secular demand for mass capacity storage, a market that we expect to more than double by calendar 2026 to $26 billion, and Seagate is well equipped to answer the call. “

Total capacity shipped was 159.1EB — a 39 per cent rise on the year.

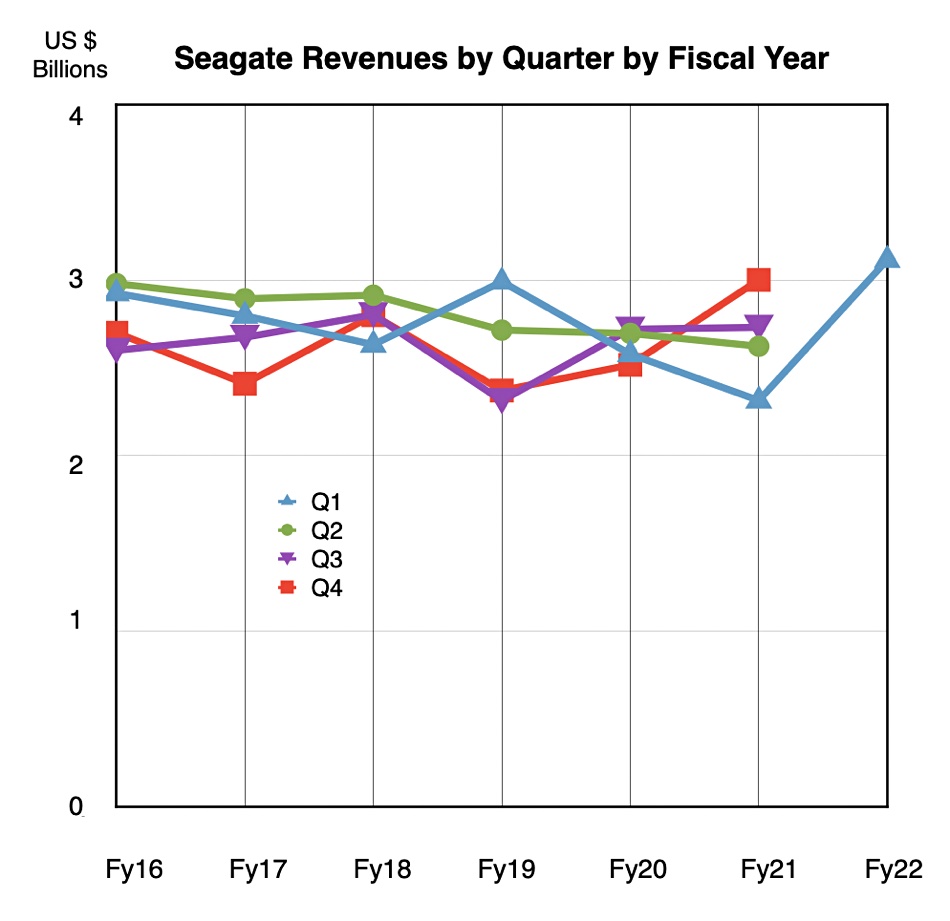

The year-on-year revenue growth was spectacular, as two charts show:

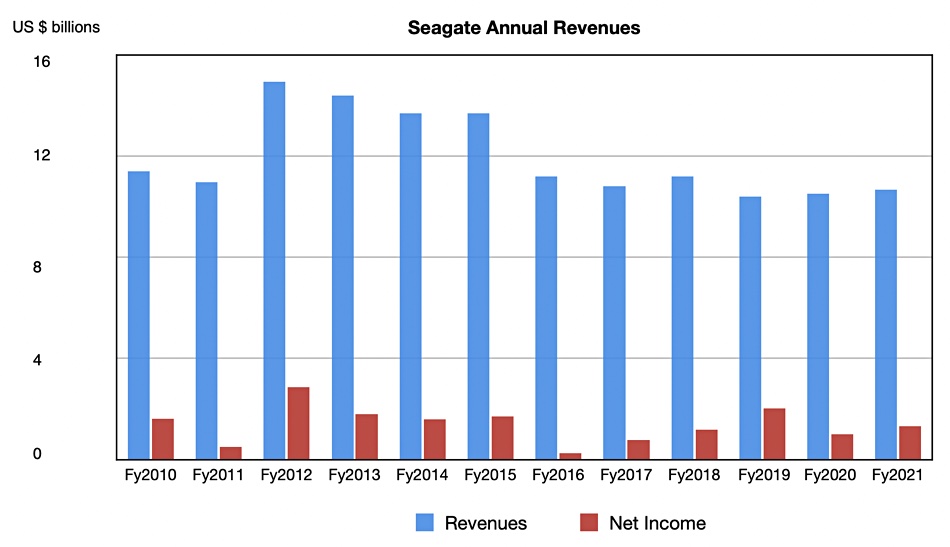

Seagate revenues have been in a trough since the glory years of FY2012 to FY2015:

If its growth expectations for the 2022 financial year come true then we could see $12 billion full year revenues, ending a six-year slump since the glory days. If Seagate maintains its share (~43 per cent) of the HDD market, and it does double to $26 billion in 2026, then annual revenues should grow larger still.

Business segments

Seagate has two main business segments: its HDD business that covers mass-capacity disk drives, legacy drives, and the rest; and non-HDD business referred to as Enterprise Data Solutions, SSD & Other. There are three mass capacity HDD product groups — Nearline, VIA (Video and Image Apps) and NAS — and the three account for 71 per cent of its revenues with 132.3EB of shipped capacity ( up 53 per cent year-on-year).

Mosley said: “Revenue from the mass capacity markets exceeded $2 billion for the first time, reflecting broad-based growth across each of the end markets.” These are cloud, enterprise and OEM customers.

Mosley again: “The cloud is the strongest contributor to the mass capacity markets and Seagate’s revenue growth. Ongoing investments to build and equip new datacentres have translated into stable healthy demand for multiple quarters now and we expect this trend to continue. Over the past five years, the number of hyperscale datacentres has more than doubled to nearly 600 worldwide, with approximately 200 more on the way.”

The enterprise and OEM business grew for the fourth time in a row, though not as much as cloud. VIA demand grew significantly driven by higher-definition cameras and more use of analytics. That’s expected to continue this quarter.

The Lyve Mobile and Lyve Cloud business numbers were not called out, although Mosley said there was progress in the customer qualifications and a video comms provider partnership. He said: “We will continue to be deliberate in scaling infrastructure and developing an ecosystem.” No drama here.

Seagate shipped 106EB of nearline capacity, up 65 per cent annually.

Mosley said dual actuator (MACH.2) drives were shipping at large scale and that technology could become mainstream once capacities reach 30TB and beyond. He said HAMR drives were shipping with good recent test results, confirmed it was the gateway to 30TB and beyond, but didn’t say there would be a fixed cross-over date from current perpendicular recording (PMER) to HAMR drives.

We see a gradual increase in the proportion of HAMR drives shipping vs PMR drives, as capacities climb the staircase from 20TB to 24TB, 26TB, and on to 30TB. Mosley said he was very confident about the HAMR pathway to 30TB and beyond.

The legacy business — 29 per cent of Seagate’s revenue at $831 million and up five per cent year-on-year — is divided between consumer drives (mostly PC and branded) and mission-critical (2.5-inch) drives. Mission-critical drive sales rose, offsetting a consumer drive fall. Wells Fargo analyst Aaron Rakers told subscribers legacy HDDs dipped below 30 per cent of Seagate’s revenues for the first time.

The non-HDD business grew from $177 million a year ago to $251 million and Mosley commented: ”The non-HDD business has been a little choppy. I mean, there are certain places where we can use our brand for continued strength. But there are opportunities and we take advantage of them and sometimes those opportunities wax and wane a little bit.” It’s small potatoes compared to the HDD business.

Seagate generated $496 million in cash flow from operations and $379 million in free cash flow in the quarter. It estimates it will make $3.1 billion revenues in the second FY2022 quarter, plus/minus $150 million, which would be 18.2 per cent annual growth at the mid-point.