This week’s digest includes acquisitions, a new small form factor removable flash standard from JEDEC, plus 2Q21 NAND flash revenues from TrendForce.

Arcserve’s StorageCraft backup service gets more affordable

Arcserve has enhanced its StorageCraft Cloud Services Basic offering so that managed service providers (MSPs) can offer improved cloud backup and disaster recovery services to a broader range of customers.

StorageCraft Cloud Services Basic now includes 500GB backup per machine, annual retention points, and cloud portal management for £18 per machine. This also includes an on-premises data protection licence for either ShadowXafe or ShadowProtect.

According to Arcserve, MSPs can now service a wider range of customer use cases such as small businesses and data protection for physical or virtual workstations, which are now economically viable with StorageCraft Cloud Services Basic.

Arcserve said that operations such as moving customer data in and out of the cloud or recovering files in the event of failure are standard in StorageCraft Cloud Services, rather than being subject to extra fees.

Arcserve and StorageCraft merged earlier this year, with StorageCraft becoming an Arcserve subsidiary brand.

JEDEC pushes out small, thin removable flash standard

The JEDEC Solid State Technology Association has published specifications for a new Crossover Flash Memory (XFM) format that is intended to target everything from IoT devices, to automotive applications and laptops.

The JESD233: XFM Embedded and Removable Memory Device (XFMD) standard is designed to bring removable storage to devices that would typically feature memory soldered in because of their small physical size or because they are used in an embedded application.

XFMD is a universal data storage media in a small, thin form factor. It specifies a PCIe interface for fundamental bus connectivity, while NVMe serves as the higher-level protocol for accessing the non-volatile media as a low-latency logical storage device.

This makes XFMD sound very similar to the XFMEXPRESS format (pictured) that Toshiba announced back in 2019, but it isn’t clear if the JEDEC standard is based on this.

The use of PCIe and NVMe means that XFMD support should be easy to integrate into laptops and other systems that already use PCIe. MediaTek and Kioxia are two flash chipmakers that are already backing the standard.

“Platform developers and device makers can easily adopt XFMD with minimal effort to enable new, expandable storage options for end users,” said Harrison Hsieh, senior general manager for Silicon Product Development at MediaTek.

“We are convinced that the XFM Embedded and Removable Memory Device (XFMD) standard will be used as a game changer for semi-removable storage in many electronic and IOT devices, taking advantage of its balanced performance, small size, and easy maintenance,” said Kioxia’s Atsushi Inoue, Senior Director for Memory Division.

Cloudian HyperStore object storage melds with Tanzu Greenplum

Cloudian has achieved certification for its HyperStore object storage with VMware’s Tanzu Greenplum data warehouse platform. According to Cloudian, it can provide the scalability, robust security and cost efficiency needed to support modern enterprise analytics applications in VMware Tanzu Greenplum environments.

HyperStore is an S3-compatible object store available in a hardware appliance or as software for deployment on bare-metal servers or virtual machines. Tanzu Greenplum is a massively parallel database that supports next generation data warehousing and large-scale analytics processing.

Combining HyperStore with Tanzu Greenplum enables the creation and deployment of analytics models for complex applications in cybersecurity, predictive maintenance, risk management and others, Cloudian said.

OpsRamp offers free trial of cloud monitoring services

Cloud monitoring provider OpsRamp is offering a free trial of its platform to lure potential customers. The trial version is free for 14 days and combines discovery, monitoring, alerting, and dashboards for cloud infrastructure services.

The trial is targeting cloud operators in mid-to-large enterprises (500+ employees) who have a need for a modern IT infrastructure monitoring solution for cloud and cloud native environments.

OpsRamp claims that users will be able to link up their cloud resources, access their first metrics and alerts, and track the performance of their cloud resources within 20 minutes of registering for the trial.

Cloud operators can use OpsRamp to track the health and performance of more than 160 cloud services across AWS, Azure, and Google Cloud Platform. The free trial also can monitor performance of on-prem Kubernetes clusters as well as managed Kubernetes environments in the cloud.

However, after the trial period, users will be prompted to upgrade to the paid version, which will allow them to transition their existing resources without any friction, according to OpsRamp.

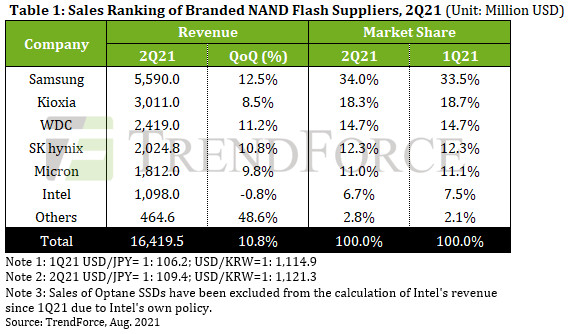

NAND flash revenues rise again in second quarter

Market research firm TrendForce reports that NAND flash revenues for 2Q21 rose by 10.8 per cent quarter-on-quarter, which it attributes to clients in the data centre market gradually stepping up enterprise SSD procurement after previous inventory adjustments. The overall average selling price (ASP) also rose by nearly seven per cent in response to the growing demand for NAND flash products.

The adoption rate of 4TB and 8TB products in the enterprise SSD market increased substantially, which TrendForce puts down to the introduction and adoption of new server processor platforms from Intel and AMD.

Quarterly total NAND Flash bit shipments rose by nearly nine per cent, thanks to PC manufacturers issuing plenty of component orders in 2Q21 due to robust laptop demand during the period.

TrendForce expects that the quarterly total NAND Flash revenue will hit a record high in the next quarter, 3Q21.

The suppliers performed as follows:

- Samsung’s NAND flash revenue went up by 12 per cent QoQ to $5.59B;

- SK hynix’s NAND flash revenue went up by 10.8 per cent to $2.025B;

- Kioxia’s revenue saw an 8.5 per cent increase to $3.011B;

- Western Digital’s NAND flash revenue rose by 11.2 per cent to $2.419B;

- Micron’s revenue was $1.812B, a 9.8 per cent increase;

- Intel’s revenue from its NAND flash business was $1.098B, a 0.8 per cent quarter-on-quarter decline. TrendForce attributes this to a shortage of key components such as controller ICs, which Intel mainly procures from a single source.

Quantum to absorb HCI startup

Quantum is set to acquire EnCloudEn, a startup based in India developing a hyperconverged infrastructure (HCI) software platform. The move follows Quantum’s acquisition of the assets of Pivot3, an early pioneer of hyperconverged infrastructure used for video surveillance workloads.

According to Quantum, The EnCloudEn buy-up will enable it to expand the addressable market for the company’s video surveillance portfolio, offering customers a solution using their server hardware of choice with a flexible subscription-based software model.

Quantum chief executive Jamie Lerner said that EnCloudEn’s technology brings an open and flexible HCI software stack that strengthens Quantum’s position in the video surveillance market.

“We can now extend HCI solutions to a broader set of customers, accelerate our development roadmap for HCI-based solutions and employ a subscription-based software purchasing model which is fast becoming the way businesses want to procure and manage their software investments.”

The acquisition is expected to close later this quarter, subject to the usual closing conditions.

StorCentric picks up Coughlan as new CFO

Growing storage newcomer StorCentric has a new Chief Financial Officer, John P. Coughlan, replacing current CFO Rob Eggers, who has stepped down for personal reasons.

Coughlan joins StorCentric having served as CFO of CoreBTS, a value-added reseller of “Cisco- and Microsoft-centric software, technology, security services and related IT infrastructure”. He also previously held the position of CFO at Penthera Partners, a SaaS venture focused on addressing the challenges of moving large data files between wireless devices and the cloud.

StorCentric emerged in 208 through the acquisition of the Nexsan array and Drobo storage businesses, and has continued to grow through acquisitions, picking up all-flash array pioneer Violin Systems in 2020.