DRAM suppliers saw revenue increase by 26 per cent in 2Q21, according to market research firm TrendForce, continuing the trend seen during 1Q21. The firm attributes this to buyers expanding their DRAM procurement in anticipation of further price hikes and supply shortages, and said it expects the next quarter will see a smaller increase in pricing as a shortage of other components starts to dampen demand.

TrendForce said that demand was “robust” from clients in the laptop sector as a continued factor of remote working during the pandemic. However, it said that demand also remained strong for relatively niche products such as graphics DRAM and consumer DRAM, helping suppliers to deliver greater than expected quarter-on-quarter increases in their DRAM shipments for 2Q21.

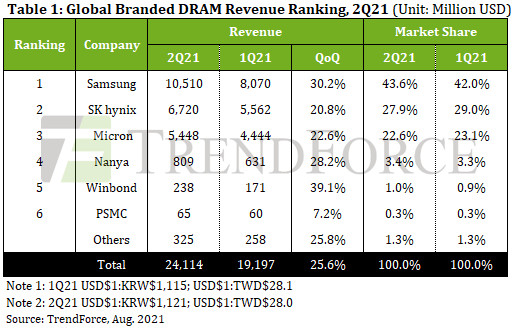

DRAM quotes grew by a higher magnitude compared to the first quarter, and with both shipments and quotes growing, DRAM suppliers saw their total DRAM revenue for 2Q21 reach US$24.1 billion.

But according to TrendForce, some ODMs such as laptop manufacturers are now starting to experience a mismatch in component availability, and are scaling back DRAM procurement because of a relatively high level of DRAM inventory in comparison with other components.

This means that the growth in demand from some product segments is soon likely to slow, since DRAM buyers still have ample inventory in stock. Coupled with higher quotes for DRAM, TrendForce therefore expects the average selling price of DRAM products during 3Q21 to see another quarter-on-quarter increase, but at a lesser three to eight per cent.

Each of the three dominant suppliers (Samsung, SK hynix, and Micron) increased their revenue by more than 20 per cent quarter-on-quarter in 2Q21 (see table). This is thanks to buyers being willing to expand DRAM procurement because they anticipated that prices would rise even further, but also because the suppliers were able to surpass their own expectations when it came to shipment volumes.

TrendForce said it expects these suppliers will continue to hike up quotes for 3Q21 and also increase their quarterly shipments by a similar magnitude. Because of these two trends, the firm said it is “bullish” on the profitability of DRAM suppliers for the next quarter, and even expects market leader Samsung to reach a 50 per cent operating profit margin for the first time in nearly three years.