Server and PC manufacturer Lenovo says it has secured the second-place ranking in worldwide mainstream storage supply. Has it really?

The claim was made during the company’s first fiscal 2022 quarter earnings release, in which it reported revenues of $16.93 billion, up 27 per cent year-on-year, and its profits of $466 million rose 119 per cent over the year-ago $213 million.

The company is split into three divisions:

- Solutions and Services Group (SSG) — revenues of $1.18B, up 38 per cent year-on-year with an operating profit of $264M, up 51 per cent.

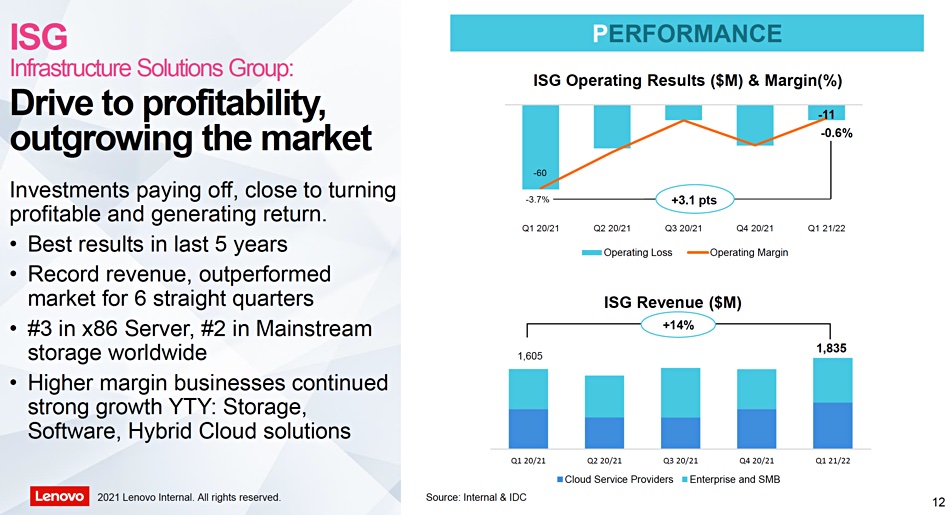

- Infrastructure Solutions Group (ISG) — revenues of $1.84B, up 14 per cent, and slightly improved operating loss of $11M compared to last year’s $60M loss.

- Intelligent Devices Group (IDG) — revenues of $14.666B, up 28 per cent, and $1.1B operating profit, up 43 per cent.

IDG is a PC and smartphone business while SSG is the services business. ISG is Lenovo’s old datacentre group, which sells ThinkAgile and ThinkSystem server and storage products, with some storage products being OEM from NetApp. Its markets include supercomputing/HPC, enterprises, small and medium business.

Lenovo says that ISG recorded its best overall results for five years and investments it has made are paying off. ISG has outperformed the market for six consecutive quarters, and is now close to turning profitable.

There was record revenue from cloud service providers (CSPs) who bought servers and storage. Lenovo recorded its highest revenue for five years from its enterprise, small and medium business (ESMB) customers. Its high-margin storage, HPC and Hybrid Cloud segments grew faster than the market with record revenues.

ISG, Lenovo says, is number three on X86 server sales, following leader Dell Technologies and second-placed HPE. It also claimed to be number two in mainstream storage worldwide, and backed it up with this slide:

What does “mainstream storage” mean? Lenovo doesn’t say. Nor does it quote any research analyst numbers to back up its claim.

Gartner and IDC views

In Gartner’s November 2020 Magic Quadrant for Primary arrays Lenovo was classed as a Challenger, behind DDN. It was behind all the suppliers in the Leaders quadrant — meaning Pure Storage, NetApp, Dell, HPE, IBM, Huawei, Hitachi Vantara and Infinidat.

Lenovo did not appear at all in Gartner’s October 2020 distributed file systems and objects MQ.

An IDC Worldwide Quarterly Enterprise Storage Systems Tracker in June this year did not include Lenovo in its top five list of storage suppliers — Dell, NetApp, HPE, Hitachi and Huawei.

It’s possible Lenovo is counting its acting as an ODM (Original Design Manufacturer) for cloud service providers (CSP) and hyperscaler customers as its storage business. That business would not be visible in the Gartner and IDC enterprise storage systems reports. Lenovo’s ODM business is, in fact, substantial.

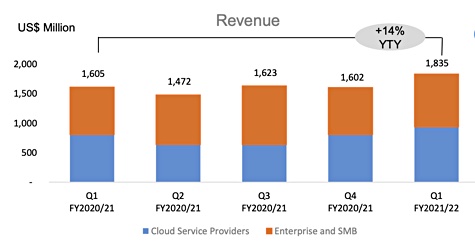

A Lenovo ISG earnings presentation slide shows the split between CSP and enterprise and SMB customers:

It looks to be about a rough average 60:40 split in favour of enterprise and SMB customers with the Q1fy2022 CSP revenues being above $800 million. We do not know what proportion of this is storage.

Dell’s latest quarterly storage revenues were $3.8 billion, NetApp’s $1.56 billion and HP’s $1.14 billion. A $1.835 billion quarterly ISG revenue number for Lenovo is split between servers and storage — implying that storage would be less than $1.835 billion.

For Lenovo to claim the number-two storage sales slot by revenue implies its quarterly storage revenue was below Dell’s $3.8 billion and above NetApp’s $1.56 billion. Therefore, by our crude comparative math, and if Lenovo’s claim is real, Lenovo’s Q1 fy2022 storage revenues were between $1.56 billion and $1.835 billion. That is impressive, if true.

We have asked Lenovo’s investor relations and public relations people what the “mainstream storage” term means and who it is supplying. So far it has been unable to reply. We are really looking forward to finding out.