IDC’s beancounters reported a small 1.7 per cent rise in enterprise external OEM storage systems revenues in 2021’s first quarter, to $6.7bn from $6.57bn the year before. But it was growth after a year of decline.

We also note that it still hasn’t gained enough ground to recover to sales levels seen in Q1 2019, which were $6.85bn.

This is rather lower than the 12 per cent rise in server revenues IDC has reported over the same period. Perhaps a heralded increase in server-based storage is taking place; we’ll have to wait for IDC’s hyperconverged infrastructure (HCI) revenue tracker to get more information.

According to the IDC Worldwide Quarterly Enterprise Storage Systems Tracker, total external storage capacity (external OEM + ODM direct + server-based storage) shipped was up vastly more, 20.6 per cent Y/Y to 118.8 EB. The $/TB cost must have fallen substantially Y/Y.

Storage revenues generated by original design manufacturers (ODMs) selling directly to hyperscale data centres grew at 14.1 per cent Y/Y to $5.6bn and involved 70.2EB of capacity. This means that public clouds and Facebook-like businesses accounted for 84.6 per cent of the storage revenues, leaving just 15.4 per cent for on-premises data centres.

Zsofia Madi-Szabo, IDC’s research manager, Infrastructure Platforms and Technologies, issued a statement saying: “After four quarters of market contraction, the first quarter of 2021 represented an important moment of recovery for the external storage systems market.”

The analyst noted that the total All Flash Array (AFA) market generated $2.7bn in the quarter, down 3.3 per cent Y/Y. The Hybrid Flash Array (HFA) market was worth nearly $2.5nn and increased 1.4 per cent from the year ago quarter.

It seems to Blocks & Files that disk drive and hybrid flash/disk storage revenues provided the growth in the market – and not flash. In other words, buyers prized capacity over access speed..

Madi-Szabo said: “Geographic results for the external enterprise storage market were mixed. Asia/Pacific and EMEA lead the recovery with 11.5 per cent and 4.9 per cent respective increase in spending, while sales within the Americas fell by 5.4 per cent during the quarter. Clearly it is going to take time for the global enterprise storage market to fully recover from the substantial negative impacts of COVID-19.”

The top five supplier rankings were:

- Dell – $2.16bn with 32.3 per cent of w-w revenues

- NetApp – $728.9m and 10.9 per cent of revenues

- HPE – $626.9m and 9.4 per cent

- Hitachi – $390.5m and 5.8 per cent

- Huawei – $365.1m and 5.4 per cent

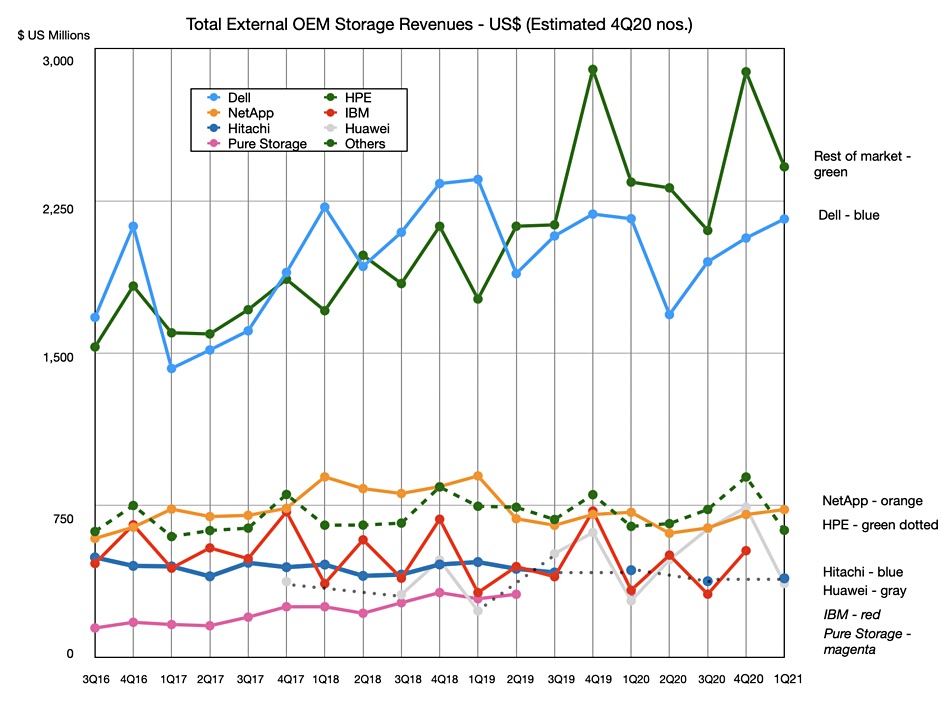

We have updated our historical chart of IDC external OEM storage revenues to add the 1Q21 numbers:

Dell still rules the supplier roost with NetApp in second place, having overtaken HPE and Huawei which were numbers 2 and 3 last quarter.

NetApp’s Q1 storage revenues seasonally exceed those of HPE and did so in 2020, 2019, 2018 and 2017. In each year HPE revenues subsequently climbed past NetApp’s (or equalled them in 2018) so we shouldn’t read anything significant into NetApp surpassing HPE storage revenues this quarter.

Huawei also exhibits a significant peak in Q4 and a drop to Q1 revenue historically so its revenues may well rebound as well.

Neither IBM storage nor Pure were included in IDC’s top 5 supplier list.