Seagate has consolidated its place at the top of the global HDD supplier rankings against a backdrop of stagnating disk drive areal density.

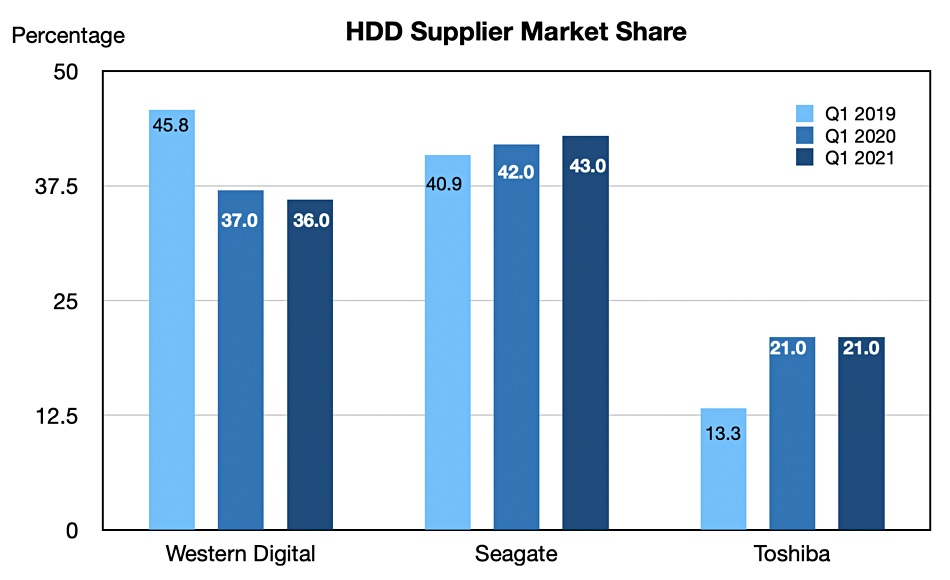

Data from TrendForce and Tom Coughlin’s Digital Storage Technology Newsletter enabled us to chart a 3-year picture of disk drive revenue market share. It shows a transfer of market leadership from Western Digital to Seagate, and Toshiba gaining and holding a 21 per cent share of all sales.

More of the disk drive market is switching to mass capacity drives, particularly with nearline storage applications. Capacity is becoming the most important aspect of disk drive technology as SSDs are favoured by customers in the speed stakes.

Areal density stagnation

High capacity disk drives provide 2TB/platter in capacity. Increasing that equates to storing more bits on the platters, meaning an areal density increase. Coughlin’s newsletter said: “There was no growth in HDD areal density in C1Q 2021 and the growth of capacity-oriented Nearline drives for enterprise and hyperscale applications will result in more components per drive out to 2026.”

That’s because the only way to get capacity increases, if the areal density (capacity per platter) is static, is to add more platters and heads.

Coughlin’s newsletter added: “The industry is in a period of extended product and laboratory areal density stagnation, exceeding the length of prior stagnations.”

The problem is that a technology transition from perpendicular magnetic recording (PMR), which has reached a limit in terms of decreasing bit area, to energy-assisted technologies – which support smaller bit areas – has stalled.

The two alternatives, HAMR (Heat-Assisted Magnetic Recording) and MAMR (Microwave-Assisted Magnetic Recording) both require new recording medium formulations and additional components on the read-write heads to generate the heat or microwave energy required. That means extra cost. So far none of the three suppliers: Seagate (HAMR), Toshiba and Western Digital (MAMR), have been confident enough in the characteristics of their technologies to make the switch from PMR across their product ranges.

Indeed Western Digital appears to be sitting on the fence: It introduced 18TB and 20TB partial MAMR drives in September 2019; and in July 2020 it launched an 18TB Gold brand PMR drive and a 20TB Ultrastar DC HC650 drive using shingling (overlapped write tracks) to reach 20TB without using MAMR at all.

Wikibon analyst David Floyer said: “HDD vendors of HAMR and MAMR are unlikely to drive down the costs below those of the current PMR HDD technology.”

Due to this: “Investments in HAMR and MAMR are not the HDD vendors’ main focus. Executives are placing significant emphasis on production efficiency, lower sales and distribution costs, and are extracting good profits in a declining market. Wikibon would expect further consolidation of vendors and production facilities as part of this focus on cost reduction.”