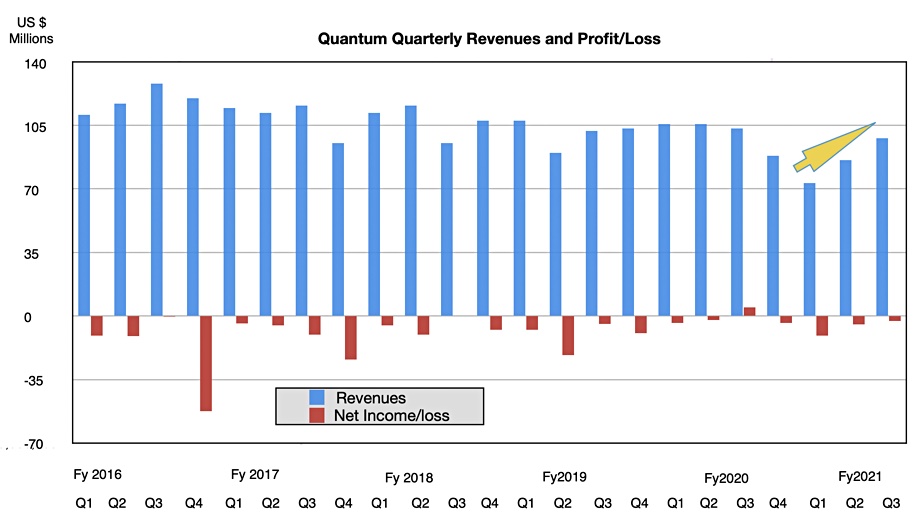

Quantum’s third fiscal 2021 quarter revenues ended December 31 were $98m, down 5.1 per cent and net income was -$2.7m, down from $4.7m. But Chairman and CEO Jamie Lerner was upbeat on the earnings call.

The veteran tape storage vendor said it became a self-sustaining business in the previous quarter and it has gone one better this time by achieving breakeven on an internal measure, according to Lerner.

“It was a great quarter… and we’ll keep everyone updated on our transformation as we move as quickly as we can to transform ourselves into a more profitable, more earnings rich company as we transition to software, services and subscriptions.”

Quantum’s revenues were “coming off the COVID related lows in the first fiscal quarter… Our average deal sizes have been increasing steadily over the past two years and increased 24 per cent year-over-year. … We closed a record number of six and seven figure deals in the quarter.“

CFO Mike Dodson said: “We are… encouraged by the early signs of a recovery in our media and entertainment business. Keeping in mind, the year-to-date revenue is running just over half of last year’s level for the same period. This reflects the significant impact COVID has had on this end market segment.”

However, the pandemic also fuelled online sales and that has caused increased data storage requirements which benefits Quantum; eg, in the tape archival storage area for webscale and hyperscale customers.

Dodson said: “We really saw an increase across all the products, all the verticals, everything was up with the exception of service was plus or minus flat.”

Hyperscale, webscale and product breadth

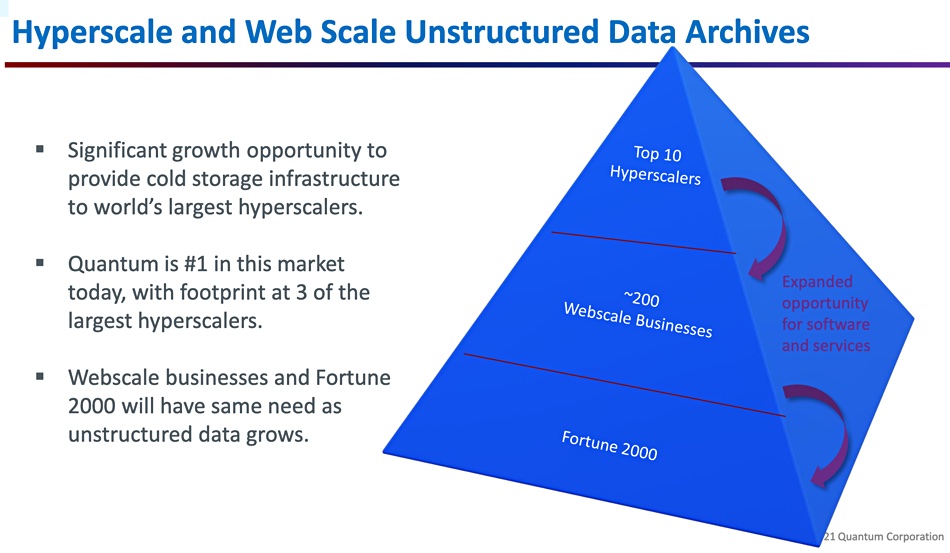

Lerner claimed Quantum is the biggest supplier of unstructured data archiving products to the hyperscale-webscale market.

“We put a lot of energy in our sales efforts with the top eight to 10 cloud and hyperscale customers just because of just how massive their buying power is. But we also put energy to the next 200 or so accounts beneath that in the web scale companies, maybe not at hyperscale, but they certainly are -certainly of scale and then the Global 2000, all of which have data they need to archive for decades, if not longer.”

“Obviously, we started at the top of the pyramid, but we’re pressing down. And the goal is, we need much more diversity in our install base. Having one or two very large customers is great. But that comes with all the issues of having just a handful of customers,” He pointed out.

He added: “We went from just selling tape hardware to now selling tape hardware, tape management software, storage software and now some of our primary software and hardware.”

The same is true for other customers: “So there were tiers of storage we didn’t use to have, right? We didn’t use to have flash storage. We gave up those sales to other people. Now we have that. We didn’t have mid-range storage. We would give that up to someone like Isilon at EMC. Now, we –with the ATFS, we actually have that midrange.”

“So the existing customers where we had gaps, we now can sell them the full range of storage they need instead of saying, you can buy some from Quantum, but you have to fill the gaps with other competitive vendors. We can now do end-to-end sales.”

What’s next

Quantum, once a $1bn/year tape-based data protection business, now sells three classes of product:

- Protection – ActiveScale object storage, Scalar tape libraries, DXI deduplicating backup appliances

- File Management – StorNext file system, ATFS NAS platform, and surveillance, IoT and Edge appliances – ATFS was added through acquisition

- Analysis – CatDV asset management platform – added through acquisition

As well as broadening its product base Quantum is transitioning to adding a subscription business models.

Lerner mentioned “future product offerings, such as an all in one media appliance that will run StorNext and CatDV in a single H-Series hyper converged storage server.” This will be aimed at video production segments such as corporate video, sports, government and education markets. He said Quantum has the “potential to eventually expand the software to other markets such as genomic research, autonomous vehicle design, geospatial exploration and any use case dealing with large unstructured data.”

Financial summary

Financial summary

- Gross margin – 43.1 per cent.

- Cash and cash equivalents – $17.4m.

- Product Sales – $63m compared to year-ago $66.4m.