Fujitsu has embarked on an ambitious M&A programme to enable it to supply “transformational services [in a] very competitive” market. The Japanese tech giant has drawn up a list of 20 potential targets, according to the FT.

Nicholas Fraser, an acquisition consultant from McKinsey who joined the company in March 2020 to lead the investment programme, wrote in Fujitsu’s fiscal 2020 report: “To build the capability we need to deliver what our customers need, we must move fast to evolve what we do. Inorganic growth, encompassing both acquisitions and venture investments, is a powerful tool for accelerating this evolution. Inorganic growth is most effective when it is done programmatically. This means doing a number of deals each year and not just one or two every few years.”

He added: “DX (digital transformation) is about both digital (technologies) and transformation (capability). We are filling our investment pipeline with opportunities that help us on both of these fronts: gaining differentiation in digital technologies such as AI, advanced data/analytics, or cybersecurity, and gaining capability to engage customers in transformative discussions.”

Adoption of 5G phone services is also a focus area, with US sanctions on Huawei opening up more opportunities for Fujitsu. The coronavirus pandemic has also accelerated Fujitsu customers’ adoption of remote working and digital services.

The new acquisition programme is part of Fujitsu’s ¥600bn ($5.7bn) digital transformation drive.

Fujitsu president and CEO Takahito Tokita told a 2019 Fujitsu annual forum audience that the company needed to change to a global services focus because its current hardware-focus made it unbalanced.

In the fiscal 2020 annual report, he stated: “We have not yet turned the corner toward growth, and frankly, we recognise that rebuilding our global business is the most challenging of the four priority issues.”

He said: “We are also working to build an ecosystem that supports DX through M&As and investments in venture companies. For example, in light of the now widespread view that data will be the “new oil” of the global economy, we are collaborating with companies that have advanced software platforms for data analysis. By doing so, we are keen to create new markets that did not exist before and establish a competitive advantage in them.”

Background notes

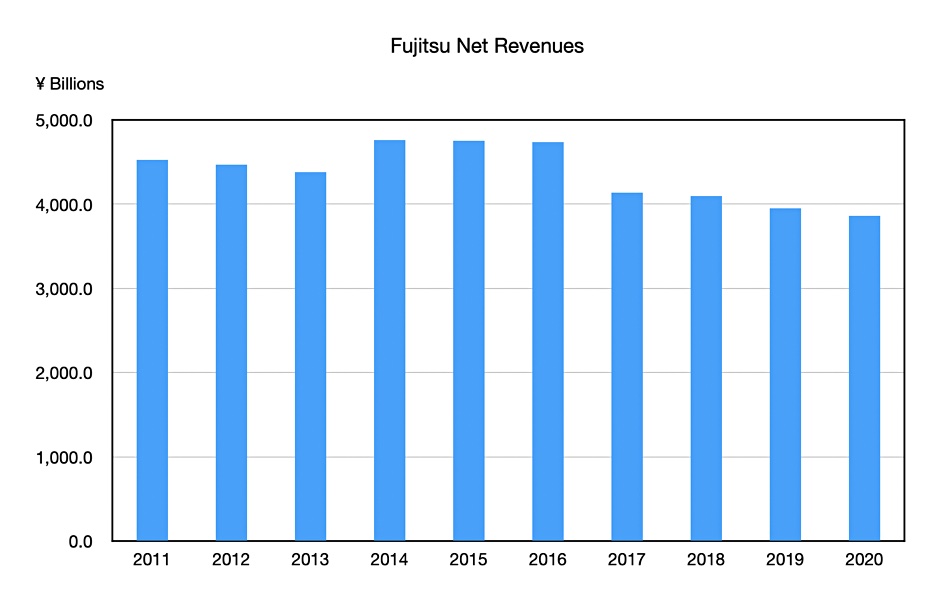

Fujitsu had sales of about ¥3.8 trillion in fiscal 2020 – about $35.5bn – and employs 130,000 people worldwide. It has a comprehensive server and storage hardware product line featuring, for example, supercomputers, Primergy servers and ETERNUS storage arrays. But it also has legacy hardware products such as mainframes and SPARC servers. It divested its PC business to Lenovo in 2017 and sold off its Arrow smartphone business in 2018.

Recently it has taken up OEM and reselling partnerships in the storage area, and supplies NetApp arrays, Commvault appliances, Datera enterprise storage software, Quantum tape libraries, Qumulo filers, and Veritas data protection products.

We might expect changes are coming to Fujitsu’s server and storage businesses, such as subscription-based business models and cloud-based management.