A New York hedge fund spoiled Intel’s Christmas with calls for the company to get its act together. Dan Loeb, CEO of Third Point, said in a letter published Dec 29 that the semiconductor giant was going through a”rough patch”.

Third Point has amassed a near-billion dollar stake in Intel and you can read Loeb’s letter, addressed to Intel chairman Dr. Omar Ishrak, in full here, but here is the nub of his comments:

- Intel has declined, market cap is down, staff morale is low and the board is neglecting its duty.

- Intel must correct process lag with Asian competitors TSMC and Samsung.

- Nvidia and ARM are using Asian competitors and eating Intel’s lunch

- This has US national security implications – US needs access to leading edge semiconductor supply (presumably by retaining semiconductor manufacturing capacity in the US).

Loeb’s recommendations

- Should Intel remain an integrated device manufacturer?

- Intel needs to figure out how to serve its competitors as customers – e.g. making chips designed by Apple, Microsoft and Amazon that are currently built in East Asia.

- Potential divestment of “certain failed acquisitions”.

For the sake of argument, let’s assume that Intel takes on board Third Point’s suggestions. It is unclear at time of writing if Loeb wants Intel to split itself into two separate corporate entities – a fabless chip designer and a US fab business – or if he wants the company to pursue the Amazon-AWS route. We suspect he has the the first option in mind, as an independent foundry could potentially open to its doors to AMD and Nvidia.

That said, it is highly unlikely that the maker arm of Intel could quickly retool its fabs to, say, make ARM chips for the likes of AWS and Apple. Any move into contract manufacturing would require substantial and sustained investment. We have no insight into which “failed” acquisitions Loeb is referring to, but note that Altera ($16.7bn) and MobileEye ($15.3bn) are the big recent acquisitions.

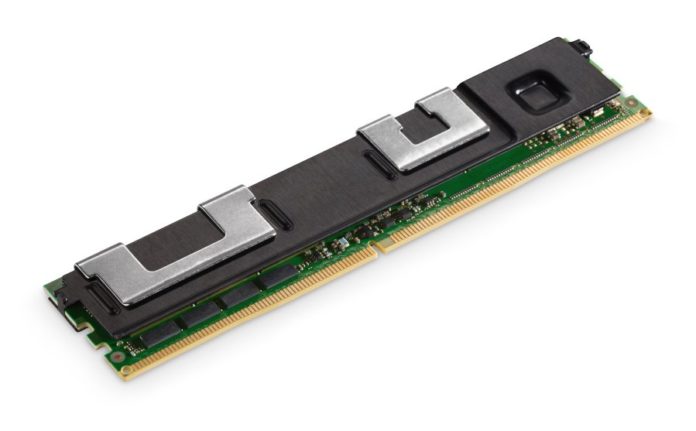

Optane stuff

But what about Intel’s Optane-branded 3D XPoint SSD and Persistent Memory business? The company is estimated to have “lost well over one billion dollars per year in 2017-2019 to bring 3D XPoint to the break-even point,” according to the tech analyst Jim Handy.

Today, it buys in chips from Micron and plans to manufacture gen 3 and gen 4 Optane chips. But why? The company is doubling down on its commitment to Optane -and may even have moved into operating breakeven point.

Intel is using Optane as a defensive moat for its x86 server chip business against AMD. This logic relies on customers agreeing it is worthwhile spending extra money on servers with Xeon CPUs and DRAM to buy Optane persistent memory. And Optane is building up steam in AI, machine learning and financial trading applications. But is this a big enough market?

The hyperscalers, who are the biggest purchasers of server chips, have displayed little interest. AWS, for example, one of Intel’s largest customers for its Xeon CPUs, has developed Graviton server instances that use its own Arm-based CPUs.

If AWS is adding Arm-powered server instances because they are better for microservices-based apps. We think it likely other public cloud and hyperscale cloud services suppliers will follow the same route.

Because of this and because of Loeb’s input, Blocks & Files thinks that it is possible we will see Intel rowing back on Optane persistent memory and SSDs in 2021, and possibly even sell the business to Micron. Intel is now selling its NAND memory business to SK hynix, which would make an Optane spin-off suggestion even more likely.

As Handy says: “The economies of scale have allowed Intel to finally reach the break-even point, and from now on Optane is likely to either continue to break even or to make a profit. This is enormously important if the company ever wants to spin off the Optane business. A spin-off seems very likely since Intel has exited nearly every memory business it has participated in since its founding: SRAM, DRAM, EPROM, EEPROM, NOR flash, Bubble Memories, and PCM. The only two left are NAND flash and 3D XPoint.”