Western Digital’s fiscal Q1 ended 30 September show a pandemic-induced decline. But the company is optimistic that hyperscalers will drive growth from next year onwards.

Revenues fell 3 per cent on the back of a strong performance of flash memory, which mostly covered a big drop in disk drive revenues. WD sold $3.9bn of disk and flash products in this first fiscal 2021 quarter, with $1.84bn coming from disk drives, down 23.4 per cent Y/Y, and $2.1bn from flash SSDs, up 27.3 per cent. There was a $60m loss, much better than the year-ago $276m loss.

Commenting on the Q1 earnings, CEO David Goeckler said: “While we are still managing through macro uncertainty, during the quarter we benefitted from strength particularly in the retail sector, driven by favourable macro and market dynamics, as well as the brand recognition of our products.”

Summary:

- Gross margin of 23 per cent, up 4.2 per cent Y/Y,

- Operating cash flow of $363m,

- Free cash flow of $196m,

- Cash and cash equivalents were $3bn,

- HDD units – 23.1 million, down 21.5 per cent,

- HDD ASP – $79, down 2.5 per cent.

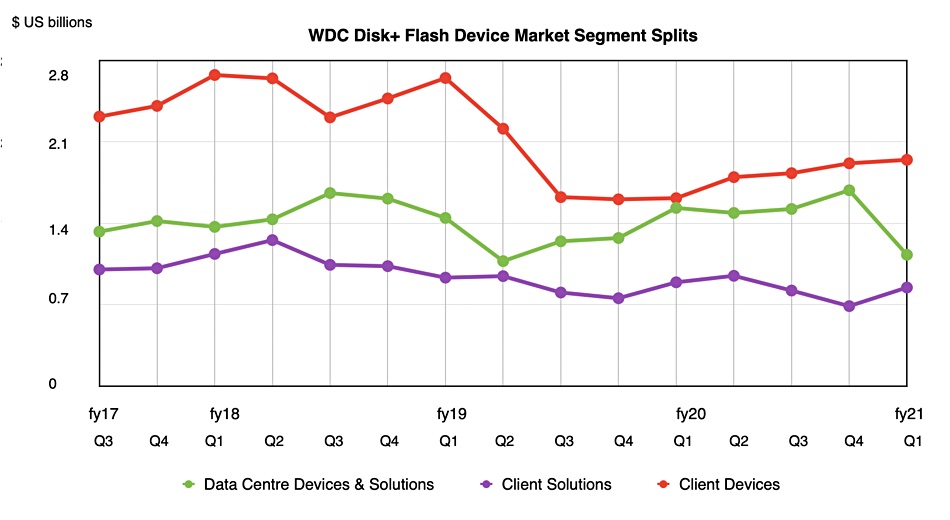

WD sells SSD and disk drives into three markets, which experienced markedly different effects from Covid-19 dynamics.

- Data centre devices and solutions – $1.13bn revenues, down 26 per cent, with both HDD and SSD impacted,

- Client solutions – $847m, down 5 per cent, as work-from-home helped sales recover,

- Client devices – $1.95bn, up 20 per cent as work-from-home drove up end-point storage needs.

A chart shows the big drop in data centre revenues (green line) this quarter;

Wells Fargo senior analyst Aaron Rakers wrote in an email: “WD’s nearline HDD capacity ship declined by ~20 per cent Y/Y [which] compares to Seagate reporting nearline capacity ship at +36% y/y.”

WD needs to gets its 16TB and 18TB into mass production fast to recover. The company said it made a million of these drives in the quarter but not has old all of them.

The transition of gaming devices storage from HDD to SSD also helped client devices revenue.

Earnings call

In the earnings call, Goeckler said WD’s re-organisation into separate HDD and SSD businesses was now complete at the exec level. Dell’s former servers and infrastructure business unit boss, Ashley Gorakhpurwalla, has been hired as EVP and GM of the HDD business. He was passed over in a Dell reorg in October last year, when Jeff Boudreau was promoted from storage boss to run the Infrastructure Systems Group (ISG). He then resigned from Dell.

Goeckler also made this intriguing comment about a second-generation NVMe SSD; “Over the next two quarters, we expect to start qualifications at additional Cloud Titans in one of our largest OEMs, which will further expand our addressable market.”

He is optimistic about the enterprise SSD market: “The enterprise SSD market has immense untapped potential and remains a key area of focus for us.” The cloud disk market looks rosy too: “Capacity enterprise is going to be a growth business for the foreseeable future. We have, essentially, anybody that’s building a public cloud is going to be using HDDs and there’s not going to be a substitute for a long time.”

Energy-assisted 18TB and 20TB HDD products look promising: “We have completed nearly 100 qualifications, including with one Cloud Titan and have an additional 125 qualifications in process, including with two more Cloud Titans.”

He really does like talking about Cloud Titans. Let’s hope they don’t turn into Cloud Titanics!

The outlook for the next quarter is for revenues between $3.75bn and $3.95bn, implying a nine per cent drop at the mid-point; the economic conditions that WD sees are getting worse. It expects hard drive revenue will be up and flash revenue will decline.

WD also anticipates zero sales to Huawei next quarter, as it had pulled purchases forward in anticipation of US trade restrictions. However, CFO Bob Eulau said: “We are optimistic that conditions will improve next calendar year. … overall, 2021 is shaping up to be a good year”